Answered step by step

Verified Expert Solution

Question

1 Approved Answer

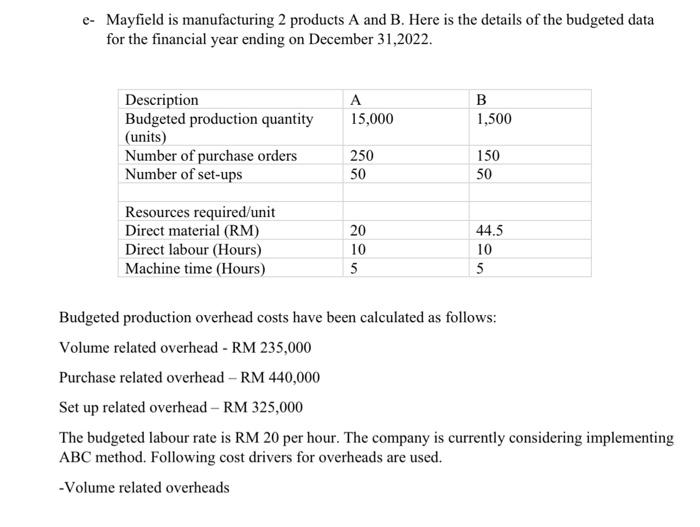

e- Mayfield is manufacturing 2 products A and B. Here is the details of the budgeted data for the financial year ending on December

e- Mayfield is manufacturing 2 products A and B. Here is the details of the budgeted data for the financial year ending on December 31,2022. Description Budgeted production quantity (units) Number of purchase orders Number of set-ups Resources required/unit Direct material (RM) Direct labour (Hours) Machine time (Hours) A 15,000 250 50 20 10 5 B 1,500 150 50 44.5 10 5 Budgeted production overhead costs have been calculated as follows: Volume related overhead - RM 235,000 Purchase related overhead - RM 440,000 Set up related overhead - RM 325,000 The budgeted labour rate is RM 20 per hour. The company is currently considering implementing ABC method. Following cost drivers for overheads are used. -Volume related overheads -Purchase related overhead -Number of purchase orders -Machine hours Calculate the unit costs for product A and B using: (15m) 1- The traditional costing method 2- The proposed ABC method

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started