Answered step by step

Verified Expert Solution

Question

1 Approved Answer

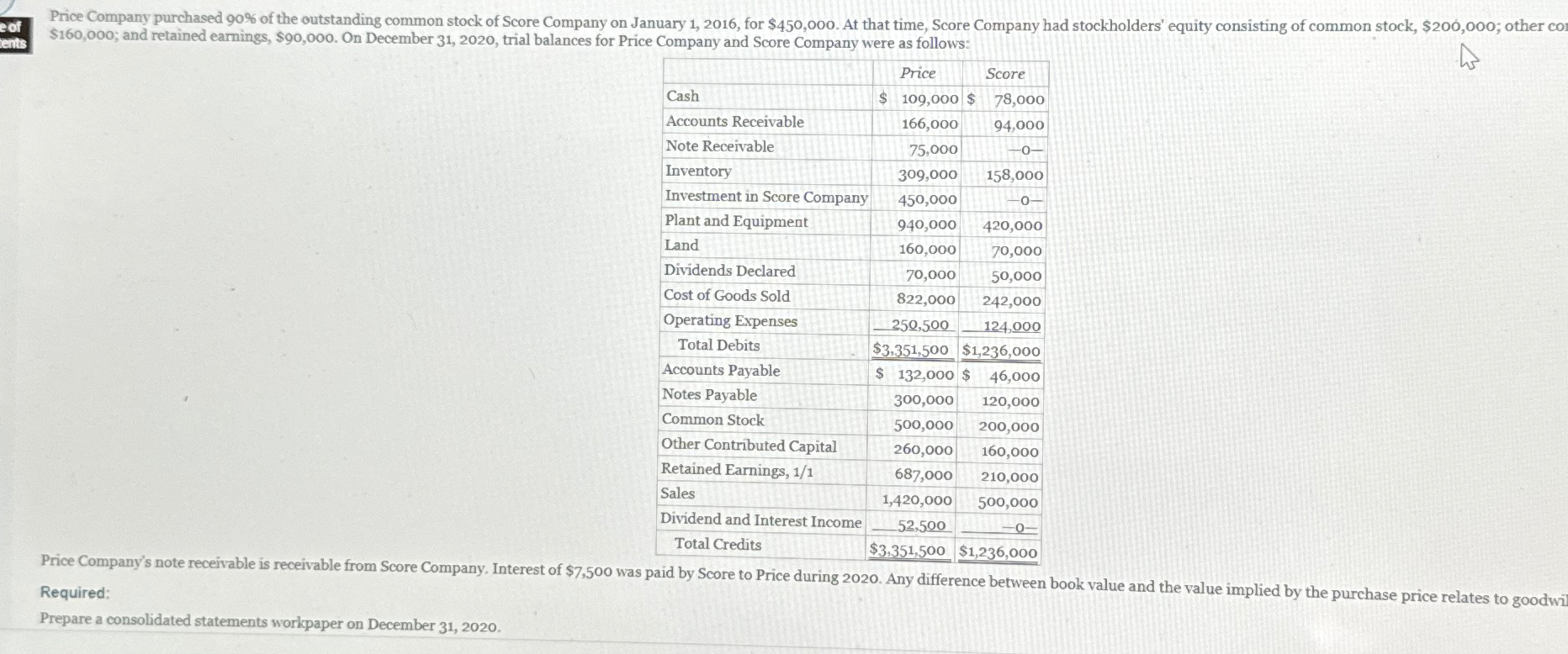

e of ents Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2016, for $450,000. At that time,

e of ents Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2016, for $450,000. At that time, Score Company had stockholders' equity consisting of common stock, $200,000; other co $160,000; and retained earnings, $90,000. On December 31, 2020, trial balances for Price Company and Score Company were as follows: Price Score Cash $ 109,000 $ 78,000 Accounts Receivable 166,000 Note Receivable 75,000 94,000 0- Inventory 309,000 158,000 Investment in Score Company 450,000 0- Plant and Equipment 940,000 420,000 Land 160,000 Dividends Declared 70,000 70,000 50,000 822,000 242,000 250,500 124,000 Cost of Goods Sold Operating Expenses Total Debits Accounts Payable Notes Payable Common Stock Other Contributed Capital Retained Earnings, 1/1 Sales Dividend and Interest Income Total Credits $3,351,500 $1,236,000 $ 132,000 $ 46,000 300,000 120,000 500,000 200,000 260,000 160,000 687,000 210,000 1,420,000 500,000 52,500 $3,351,500 $1,236,000 Price Company's note receivable is receivable from Score Company. Interest of $7,500 was paid by Score to Price during 2020. Any difference between book value and the value implied by the purchase price relates to goodwi Required: Prepare a consolidated statements workpaper on December 31, 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started