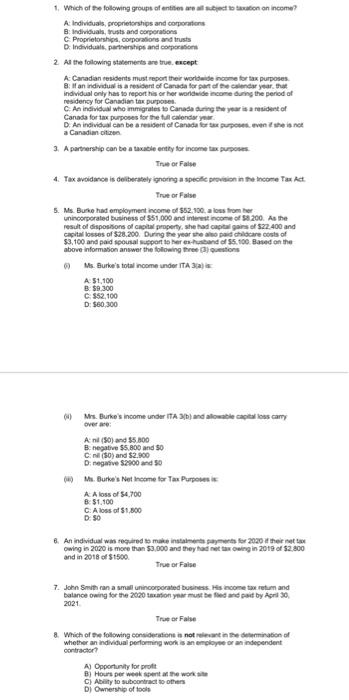

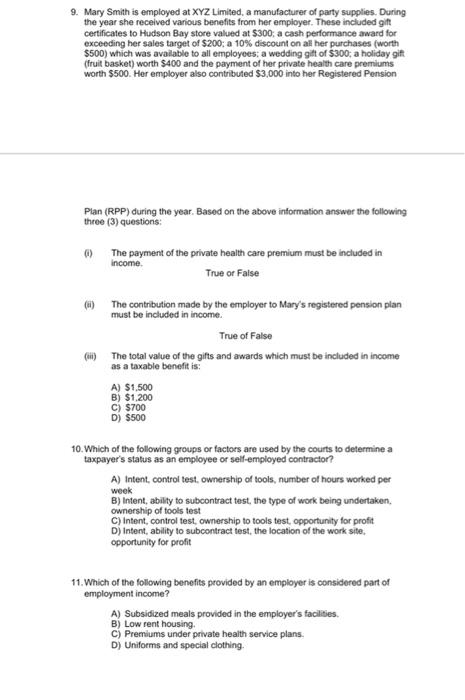

e period of We of $28 1. Which of the following groups of entities and to taxation an income? A Individuals, proprietorships and corporations B Individuals, trusts and corporations C Proprietorships, corporations and trusts D. Individual partnerships and corporation 2 As the following statements are true encept A Canadian residents must report their worldwidencome for tax purposes residency for Canadian tax purposes An individual who mmigrates to Canade during the year is a resident of Canads for tax purposes for the Monday D. An individual can be a resident of Canada for purpos even when a Canadian 3. A partnership can be a taxable entity for income tax purposes True or False 4 Tax avoidance is deliberately ignoring a specie provision in the Income Tax kt True or False 5. Ms Bute had employment income of 62.100.a oss from her unincorporated business of 551,000 and income of 58200. As the 53.100 and paid spousal support to her ex-husband of 56.100. Based on the above information answer the following the questions Ms. Burke's total income under ITA 31) A 51.100 B. $9 300 C$52,100 D: 560.300 00 Mrs. Burke's income under ITA 3band allowable a los cam over are: Anil (50) and $5.300 B. negative 55.800 and 50 C.nl (50) and $2.900 Dnegative S2000 and 50 M. Burko's Not come for Tax Purpotensi A A loss of 54.700 B: 51.100 C. A loss of 1.800 D. 50 8. An individual was required to make instaliments payments for 2020 at their natt owing 2020 is more than $3,000 and they had retthoning in 2019 of 52,800 and in 2018 of $1500. True or False 7. John Smith an a small unincorporated business income tax retum and balance owing for the 2020 tation you must be filed and paid by April 30 2021 True False 8. Which of the following consideration is not intermination of whether an individual performing work is an employee or an independent contractor A) Opportunity for profit B) Hours per week spent at the work C) Ability to subcontract to others D) Ownership of tools 9. Mary Smith is employed at XYZ Limited, a manufacturer of party supplies. During the year she received various benefits from her employer. These included gift certificates to Hudson Bay store valued at $300; a cash performance award for exceeding her sales target of $200 a 10% discount on all her purchases (worth $500) which was available to all employees: a wedding gift of $300, a holiday gift (fruit basket) worth $400 and the payment of her private health care premiums worth $500. Her employer also contributed $3,000 into her Registered Pension Plan (RPP) during the year. Based on the above information answer the following three (3) questions: 6) The payment of the private health care premium must be included in income True or False () The contribution made by the employer to Mary's registered pension plan must be included in income. True of False (1) The total value of the gifts and awards which must be included in income as a taxable benefit is: A) $1.500 B) $1,200 C) $700 D) $500 10. Which of the following groups or factors are used by the courts to determine a taxpayer's status as an employee or self-employed contractor? A) Intent, control test, ownership of tools, number of hours worked per week B) Intent, ability to subcontract test, the type of work being undertaken. C) Intent control test, ownership to tools test, opportunity for profit D) Intent, ability to subcontract test, the location of the work site. opportunity for profit 11. Which of the following benefits provided by an employer is considered part of employment income? A) Subsidized meals provided in the employer's facilities. B) Low rent housing C) Premiums under private health service plans D) Uniforms and special clothing