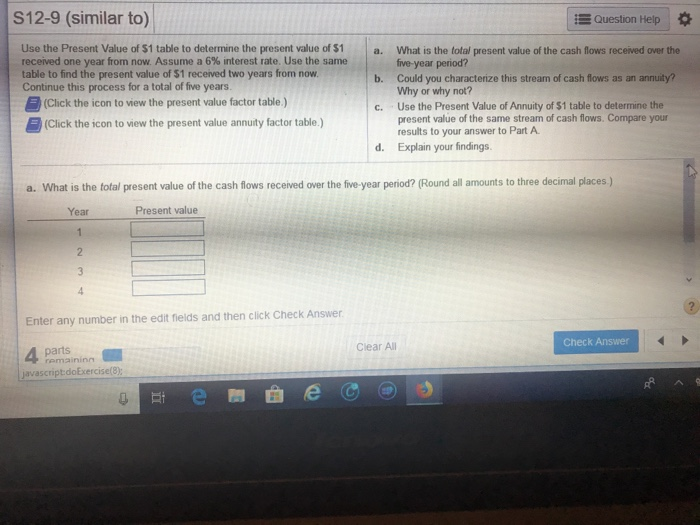

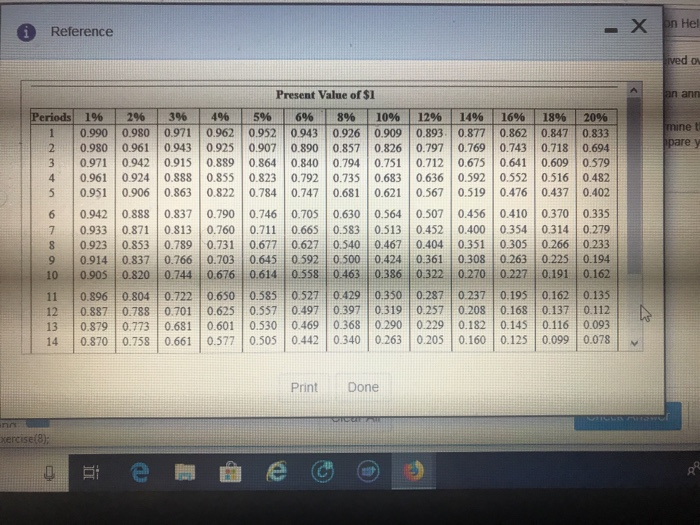

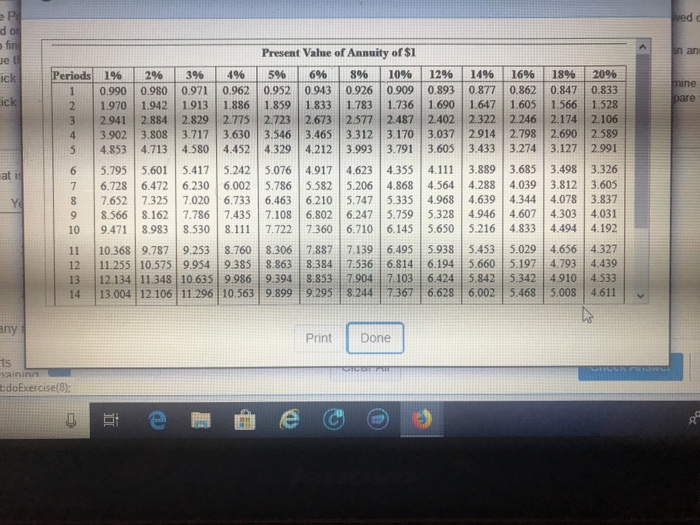

E Question Help S12-9 (similar to) Use the Present Value of $1 table to determine the present value of $1 a. What is the total present value of the cash flows received over the received one year from now. Assume a 6% interest rate, use the same table to find the present value of $1 received two years from now Continue this process for a total of five years five-year period? Could you characterize this stream of cash flows as an annuity? Why or why not? Use the Present Value of Annuity of $1 table to determine the present value of the same stream of cash flows. Compare your results to your answer to Part A Explain your findings. b. (Click the icon to view the present value factor table) (Click the icon to view the present value annuity factor table.) c. d. a. What is the total present value of the cash flows received over the five-year period? (Round all amounts to three decimal places) Present value Year Enter any number in the edit fields and then click Check Answer Check Answer Clear All 4 javascriptdoExercise(8); parts Reference Present Value of $1 ann Periods| 196 | 296 | 396 | 496 | 596 | 696 | 896 | 1096 | 12% | 1496 | 1696 | 1896 | 2096 mine t are y 1 0.990 0.980 0.971 0.962 0952 0943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 2 0.980 0.961 0.943 0925 0.907 0.890 0.857 0.826 0.797 0.769 0.743 0.718 0.694 3 0.971 0.942 0.915 0.8890.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 4 0.961 0.9240.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.5520.516 0.482 5 0.951 09060863 0.822 0.784 0.747 .68 0.621 0.567 0519 0.476 0.437 0.402 6 0.942 0.888 0.837 0.790 0.746 0.705 0.630 05640.507 0.456 0.410 0.370 0.335 7 0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 8 0.923 0853 0.789 0.731 0.677 0.627 0.540 0.467 0.4040.351 0.305 0.266 0.233 9 0.914 0837 0.766 0.703 0.645 0.592 0.500 0.424 0.361 0.308 0263 0.225 0.194 10 0.905 0.820 0.744 0.676 0614 0.558 0463 0.386 0.322 0.270 0.227 0.191 0.162 11 0.896 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 12 0.887 0.788 0.701 0.625 0.557 0.4970.397 0.319 0.257 0.208 0.168 0.137 0.112 13 0.879 0.773 0.681 0.601 0.530 0469 0.368 0290 0.229 0.182 0.145 0.116 0093 14 | 0.870 | 0.758 | 0.661 | 0.577 | 0.505 | 0.442 | 0.340 | 0.263 | 0.205 | 0.160 | 0.125 | 0.099 | 0.078 . 2 Print Done xercise(8) 1 Present Value of Annuity of $1 n an eriods 196 12%,- 3% 4%-L %1.6%-, 8% 10% 12% 14% 16% 18% 20% 0.990 0.980 0.971 0.962 0.9520943 0.926 0909 0.893 0.877 0.862 0.847 0.833 2 1.970 1.942 1.913 1886 1859 1833 1.783 1.736 1.690 1.647 1605 1.566 1.528 3 | 2.941 | 2.884 | 2.829 | 2.775 | 2.723 | 2.673 | 2.577 | 2.487 2.402 | 2.322 | 2.246 | 2.174 | 2.106 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 5 4853 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 6 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.113.889 3.685 3.498 3.326 7 6.728 6.4726.230 6.002 5.786 5.582 5.206 4.868 4.564 4.288 4.0393.812 3.605 8 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 9 8 566 8.162 7.786 7.435 7.108 680 6.247 5.759 5.32 4.946 4.607 4.303 4.031 10 9.471 8.983 8530 8.111 7.722 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 are IC 2 11 10368 9.787 9.253 8.760 8306 7.887 7.139 6.495 5.938 5.453 5.029 4656 4.327 12 11.255 10.575 9954 9385 8863 8384 7.536 6814 6.194 5.660 5197 4.793 4439 13 12134 11.348 10.635 9.986 9.394 8.833 7904 71036.424 5.842 5342 4910 4.533 14 13.004 12.106 11296 10.563 9899 9.295 8.244 7.367 6.628 6.002 5.468 5.008 4.611 any Print Done ts aininn doExercise(8)