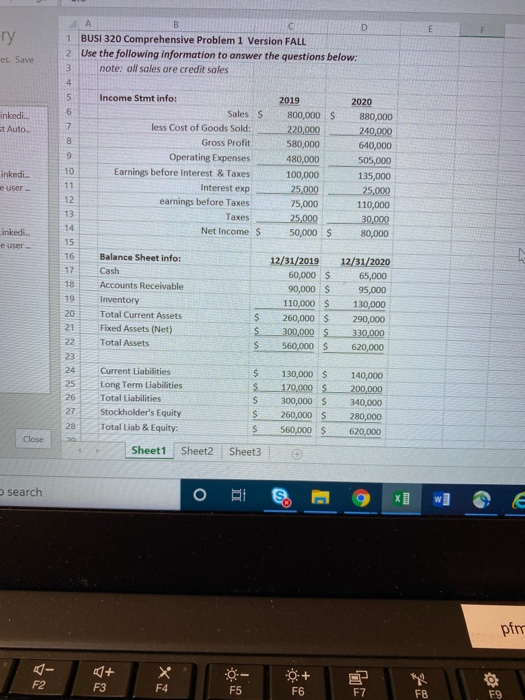

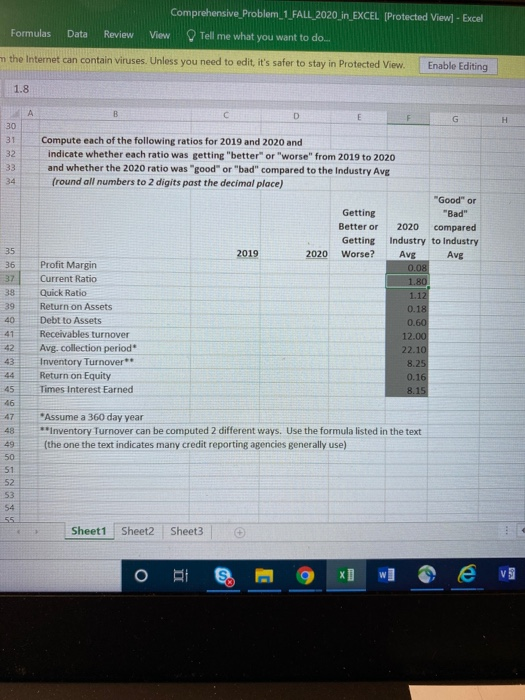

E ry es. Save inkedi. St Auto inkedi. inkedi A B D 1 BUSI 320 Comprehensive Problem 1 Version FALL 2 Use the following information to answer the questions below: 3 note: all sales are credit sales 4 5 Income Stmt info: 2019 2020 6 Sales S 800,000 $ 880,000 7 less Cost of Goods Sold: 220,000 240,000 8 Gross Profit 580,000 640,000 9 Operating Expenses 480,000 505,000 10 Earnings before Interest & Taxes 100,000 135,000 11 Interest exp 25,000 25,000 12 earnings before Taxes 75,000 110,000 13 Taxes 25,000 30,000 14 Net Income $ 50,000 $ 80,000 15 16 Balance Sheet info: 12/31/2019 12/31/2020 17 Cash 60,000 $ 65,000 18 Accounts Receivable 90,000 $ 95,000 19 Inventory 110,000 $ 130,000 20 Total Current Assets S 260,000 $ 290,000 21 Fixed Assets (Net) $ 300,000 $ 330,000 22 Total Assets $ 560,000 $ 620,000 23 24 Current Liabilities S 130,000 $ 140,000 25 Long Term Liabilities $ 170,000 $ 200,000 26 Total Liabilities S 300,000 $ 340,000 27 Stockholder's Equity $ 260,000 $ 280,000 28 Total Liab & Equity $ 560,000 $ 620,000 10 Sheet1 Sheet2 Sheet3 e user Close search O E E pfor - F2 X F4 0 + F6 F3 F5 F7 F8 F9 Comprehensive_Problem_1_FALL_2020_in_EXCEL (Protected View] - Excel Formulas Data Review View Tell me what you want to do... m the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing 1.8 A D F G H 30 31 32 33 34 35 36 37 38 139 40 41 42 43 Compute each of the following ratios for 2019 and 2020 and indicate whether each ratio was getting better" or "worse" from 2019 to 2020 and whether the 2020 ratio was "good" or "bad" compared to the Industry Avg (round all numbers to 2 digits past the decimal place) "Good" or Getting "Bad" Better or 2020 compared Getting Industry to Industry 2019 2020 Worse? Avg Avg Profit Margin 0.08 Current Ratio 1.80 Quick Ratio 1.12 Return on Assets 0.18 Debt to Assets 0.60 Receivables turnover 12.00 Avg.collection period 22.10 Inventory Turnover** 8.25 Return on Equity 0.16 Times Interest Earned 8.15 *Assume a 360 day year **Inventory Turnover can be computed 2 different ways. Use the formula listed in the text (the one the text indicates many credit reporting agencies generally use) 45 46 47 48 49 50 51 52 53 54 55 Sheet1 Sheet2 Sheet3 O RI va