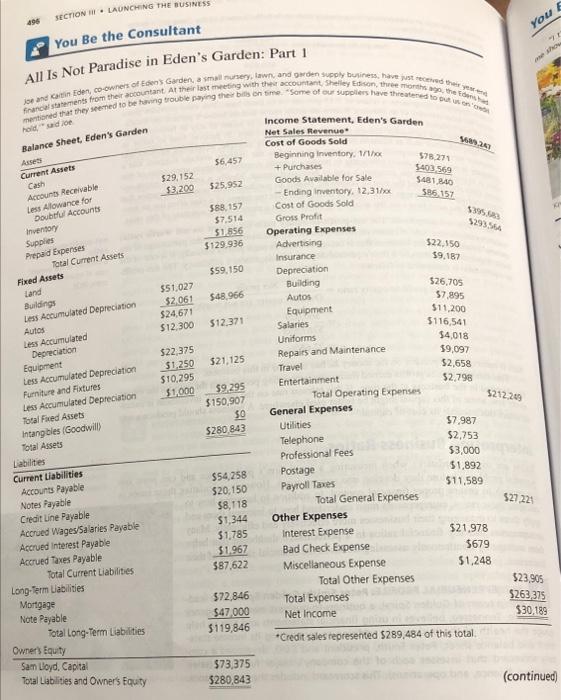

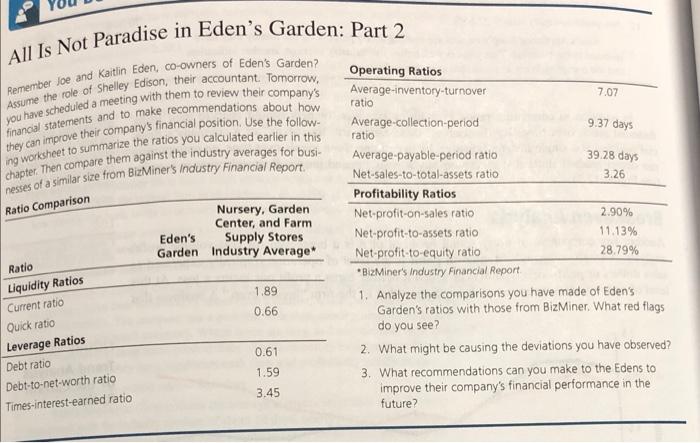

E SECTION LAUNCHING THE BUSINESS You - You Be the Consultant wa 241 $78.271 5403.569 $481 840 586,157 525.952 53953 $293.56 $59.150 hordado Balance Sheet, Eden's Garden Asses Current Assets Cash Accounts Receivable $29,152 Less Allowance for $3.200 Doubtful Accounts Inventory 588.157 Supplies $7,514 Prepad Expenses 51,856 Total Current Assets $129.936 Fixed Assets Land Buildings $51,027 Less Accumulated Depreciation $2061 Autos $24.671 Less Accumulated $12.300 $12.371 Depreciation Equipment $22 375 Less Accumulated Depreciation $1,250 Furniture and Fixtures $10,295 Less Accumulated Depreciation 51.000 Total Fixed Assets Intangbles (Goodwill $48.966 All Is Not Paradise in Eden's Garden: Part 1 Frances from their accountant At their last mong with the accountant Shelley Edison, the month the and Eder co-owner of Garden new and supply bure, have try mend that they seemed to be hang trouble paying the bone"Some of our suppliers Have Theatre Income Statement, Eden's Garden Net Sales Revenue Cost of Goods Sold 56 457 Beginning inventory. 1/1) + Purchases Goods Available for Sale - Ending Inventory, 12,31/% Cost of Goods Sold Gross Profit Operating Expenses Advertising 522,150 Insurance 59.187 Depreciation Building $26.705 Autos 57.895 Equipment $11.200 Salaries $116.541 Uniforms $4.018 Repairs and Maintenance 59,097 Travel 52.658 Entertainment $2,798 Total Operating Expenses General Expenses Utilities $7.987 Telephone $2,753 Professional Fees $3,000 Postage 51,892 Payroll Taxes $11,589 Total General Expenses Other Expenses Interest Expense $21.978 Bad Check Expense $679 Miscellaneous Expense $1,248 Total Other Expenses 572,846 Mortgage Total Expenses Note Payable $47.000 Net Income Total Long-Term Liabilities 5119,846 *Credit sales represented $289,484 of this total Owners Equity Sam Lloyd, Capital $73,375 Total Liabilities and Owner's Equity $280,843 $21,125 5212,249 59.295 $150,907 $0 $280 843 $27.221 Total Assets Labilities Current Liabilities Accounts Payable Notes Payable Credit Line Payable Acored Wages/Salaries Payable Accrued interest Payable Accrued Taxes Payable Total Current Liabilities Long-Term abilities $54.258 $20,150 58,118 $1,344 $1,785 $1.967 $87.622 $23,905 5263,375 $30.189 (continued) 7.07 9.37 days 39.28 days 3.26 Ratio Comparison All Is Not Paradise in Eden's Garden: Part 2 Operating Ratios Remember Joe and Kaitlin Eden, co-owners of Eden's Garden? Assume the role of Shelley Edison, their accountant. Tomorrow, Average-inventory-turnover you have scheduled a meeting with them to review their company's ratio financial statements and to make recommendations about how Average collection-period they can improve their company's financial position. Use the follow- ratio ing worksheet to summarize the ratios you calculated earlier in this chapter. Then compare them against the industry averages for busi- Average payable-period ratio Net-sales-to-total-assets ratio nesses of a similar size from BizMiner's Industry Financial Report Profitability Ratios Nursery, Garden Center, and Farm Net-profit-on-sales ratio 2.90% Eden's Supply Stores Net-profit-to-assets ratio 11.13% Garden Industry Average Net-profit-to-equity ratio 28.79% * BizMiner's Industry Financial Report 1.89 1. Analyze the comparisons you have made of Eden's 0.66 Garden's ratios with those from BizMiner. What red flags do you see? 0.61 2. What might be causing the deviations you have observed? 1.59 3. What recommendations can you make to the Edens to 3.45 improve their company's financial performance in the future? Ratio Liquidity Ratios Current ratio Quick ratio Leverage Ratios Debt ratio Debt-to-net-worth ratio Times-interest-earned ratio