Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E SHOW Lecture Note 8 - Stock Valuation.pptx - Power Point REVIEW VIEW ILA Text Direction Align Text AZ Zoro Arrange Quick Convert to SmartArt-an{

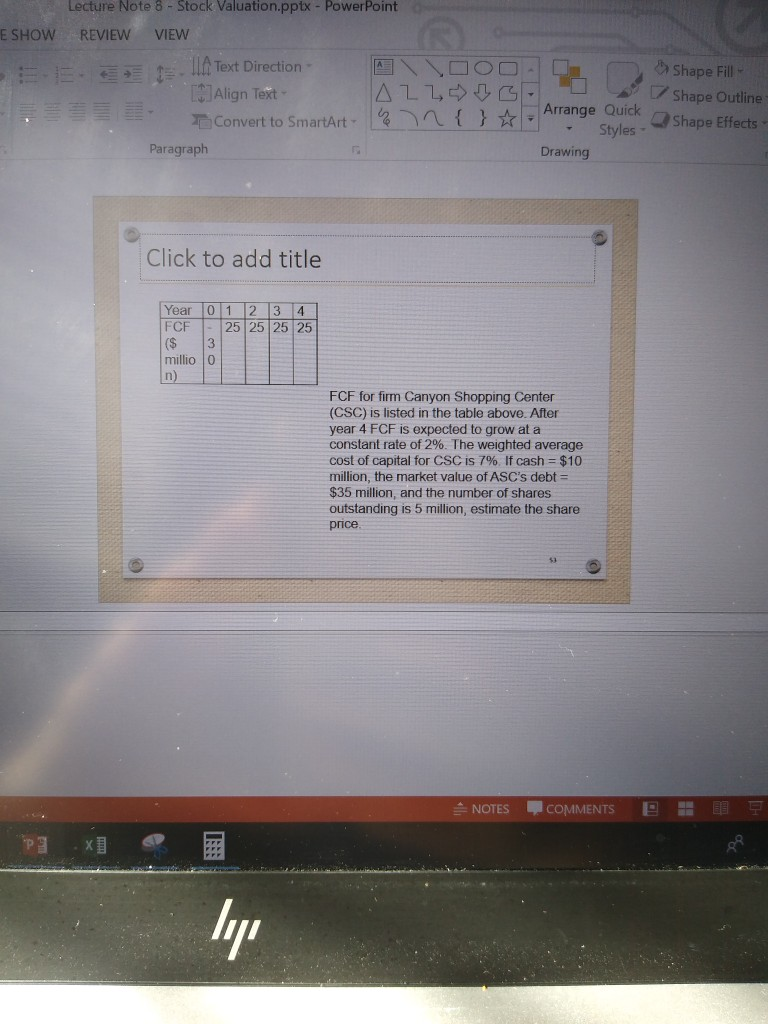

E SHOW Lecture Note 8 - Stock Valuation.pptx - Power Point REVIEW VIEW ILA Text Direction Align Text AZ Zoro Arrange Quick Convert to SmartArt-an{ } - Styles Paragraph Drawing Shape Fill Shape Outline Shape Effects Click to add title Year 0 1 2 3 4 FCF 25 25 25 25 ($ 3 millio o n) FCF for firm Canyon Shopping Center (CSC) is listed in the table above. After year 4 FCF is expected to grow at a constant rate of 2%. The weighted average cost of capital for CSC is 7% If cash = $10 million, the market value of ASC's debt = $35 million, and the number of shares outstanding is 5 million, estimate the share price NOTES COMMENTS ly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started