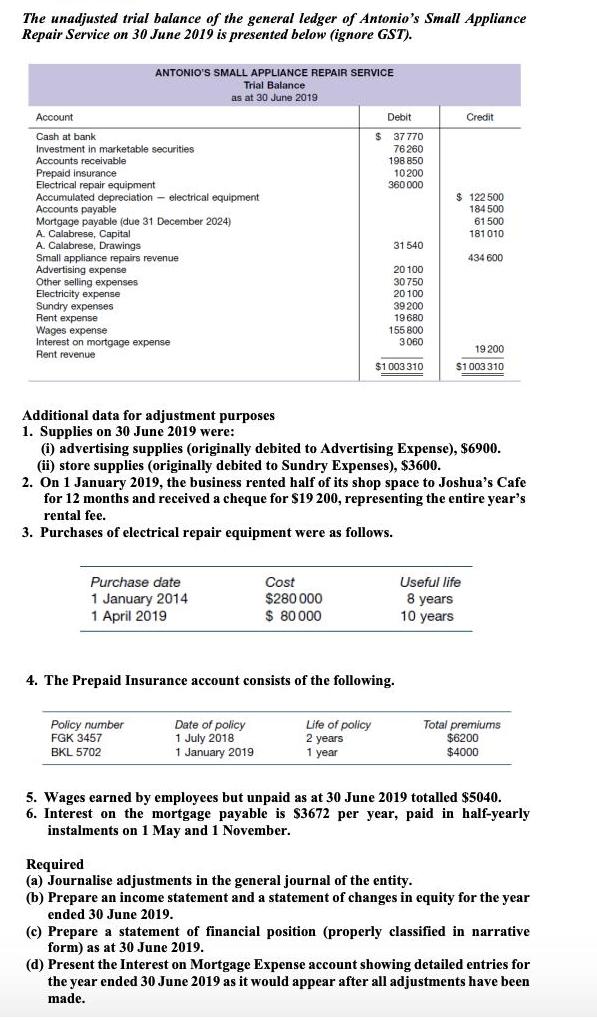

The unadjusted trial balance of the general ledger of Antonio's Small Appliance Repair Service on 30 June 2019 is presented below (ignore GST). ANTONIO'S

The unadjusted trial balance of the general ledger of Antonio's Small Appliance Repair Service on 30 June 2019 is presented below (ignore GST). ANTONIO'S SMALL APPLIANCE REPAIR SERVICE Trial Balance as at 30 June 2019 Account Debit Credit Cash at bank $ 37770 Investment in marketable securities Accounts receivable 76260 198 850 Prepaid insurance 10.200 Electrical repair equipment 360000 Accumulated depreciation - electrical equipment Accounts payable $ 122500 184 500 Mortgage payable (due 31 December 2024) 61 500 181010 A. Calabrese, Capital A. Calabrese, Drawings 31 540 Small appliance repairs revenue 434 600 Advertising expense 20100 Other selling expenses Electricity expense Sundry expenses Rent expense 30 750 20100 39 200 19680 155 800 3060 Wages expense Interest on mortgage expense Rent revenue 19 200 $1003 310 $1003 310 Additional data for adjustment purposes 1. Supplies on 30 June 2019 were: (i) advertising supplies (originally debited to Advertising Expense), $6900. (ii) store supplies (originally debited to Sundry Expenses), $3600. 2. On 1 January 2019, the business rented half of its shop space to Joshua's Cafe for 12 months and received a cheque for $19 200, representing the entire year's rental fee. 3. Purchases of electrical repair equipment were as follows. Cost Purchase date 1 January 2014 1 April 2019 $280 000 Useful life 8 years. 10 years $ 80000 4. The Prepaid Insurance account consists of the following. Policy number Date of policy Life of policy 2 years FGK 3457 1 July 2018 Total premiums $6200 $4000 BKL 5702 1 January 2019 1 year 5. Wages earned by employees but unpaid as at 30 June 2019 totalled $5040. 6. Interest on the mortgage payable is $3672 per year, paid in half-yearly instalments on 1 May and 1 November. Required. (a) Journalise adjustments in the general journal of the entity. (b) Prepare an income statement and a statement of changes in equity for the year ended 30 June 2019. (c) Prepare a statement of financial position (properly classified in narrative form) as at 30 June 2019. (d) Present the Interest on Mortgage Expense account showing detailed entries for the year ended 30 June 2019 as it would appear after all adjustments have been made.

Step by Step Solution

3.38 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started