Answered step by step

Verified Expert Solution

Question

1 Approved Answer

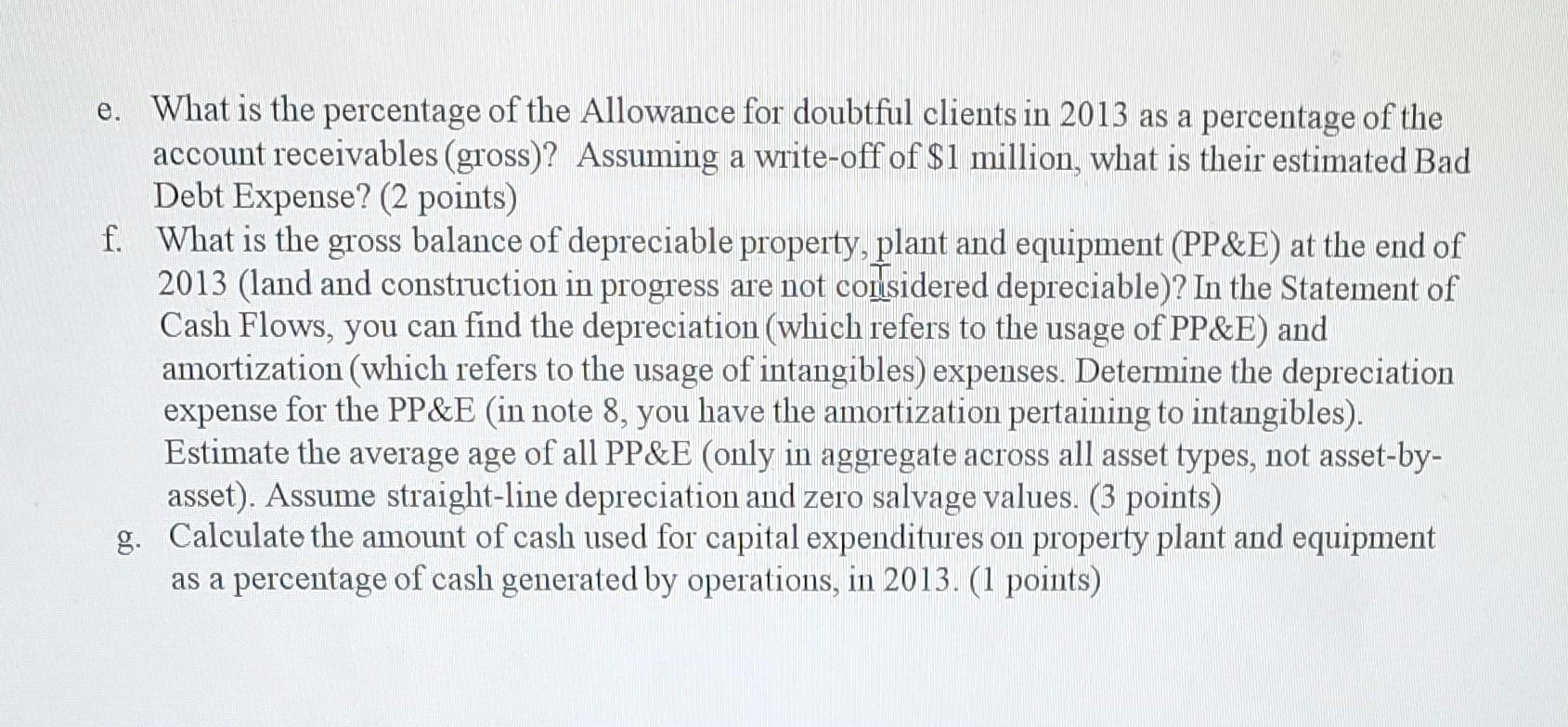

e. What is the percentage of the Allowance for doubtful clients in 2013 as a percentage of the account receivables (gross)? Assuming a write-off of

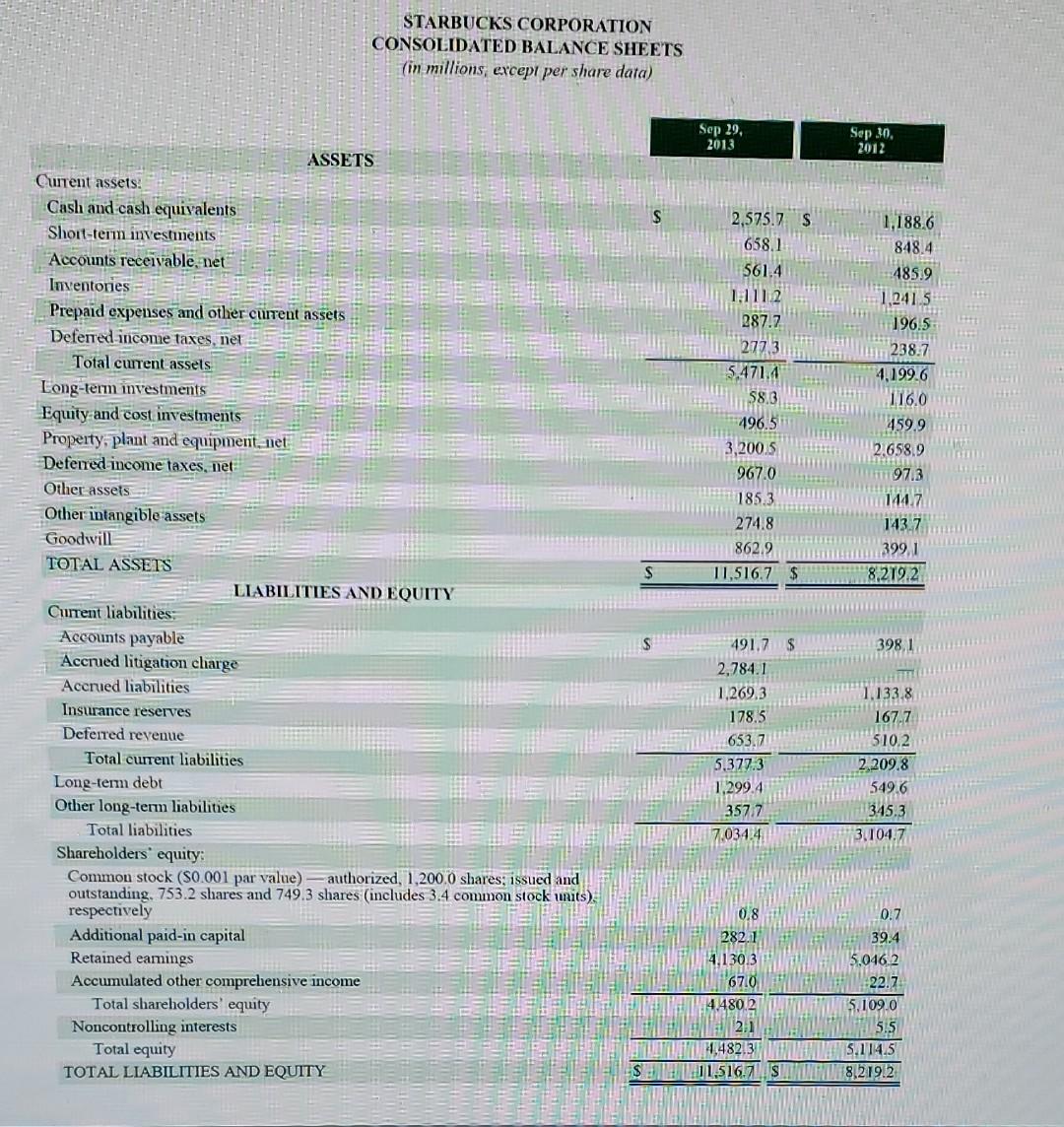

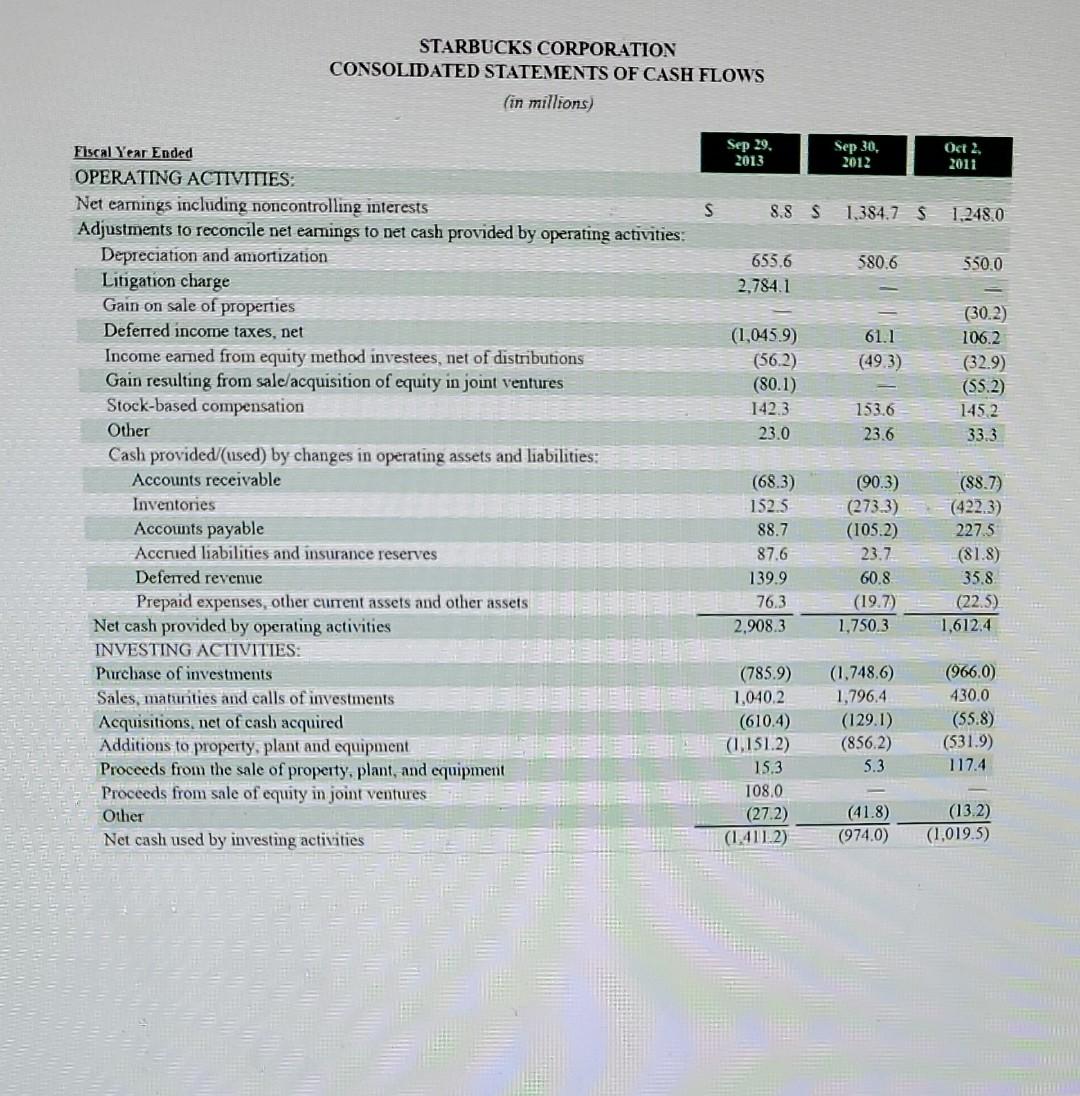

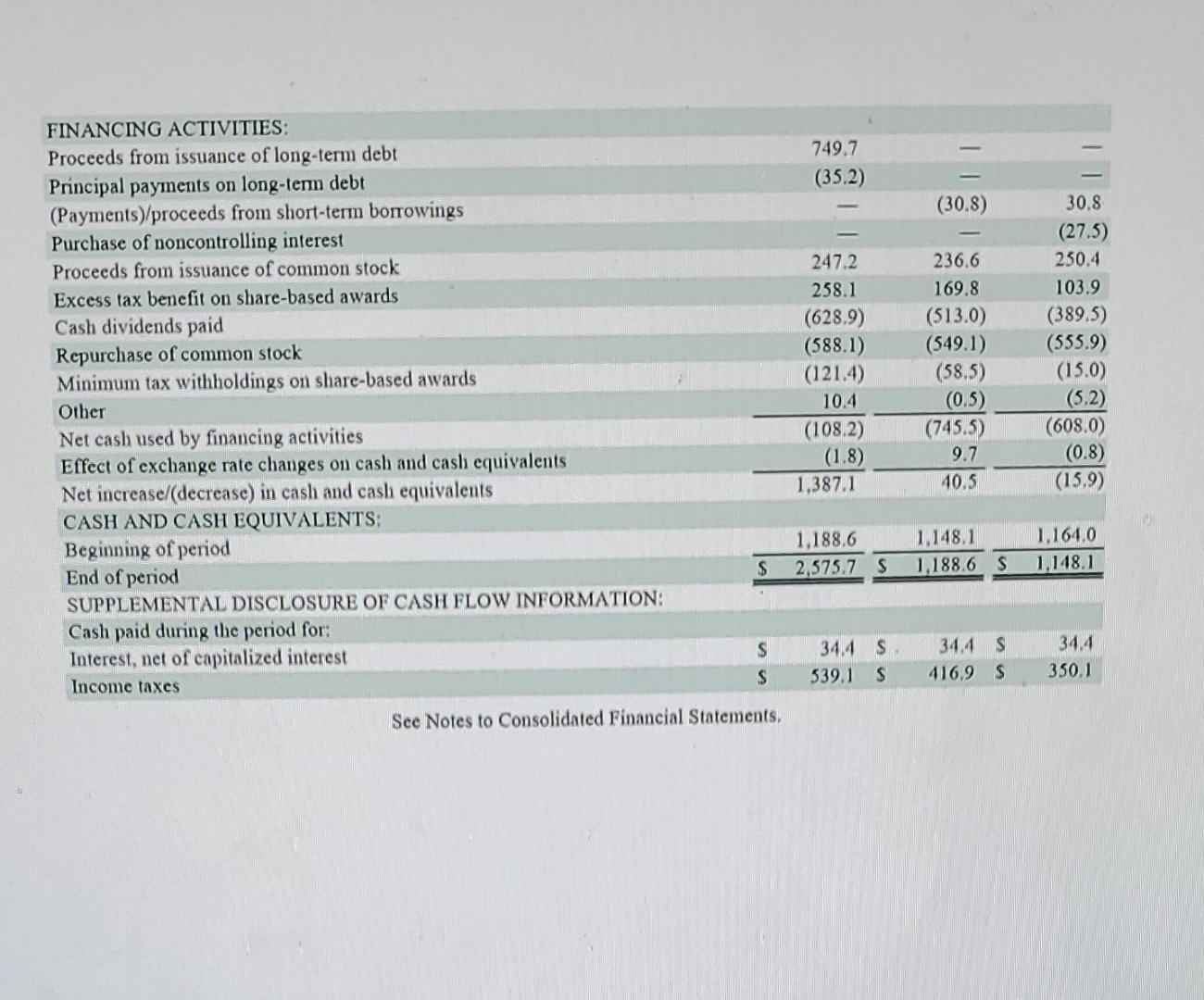

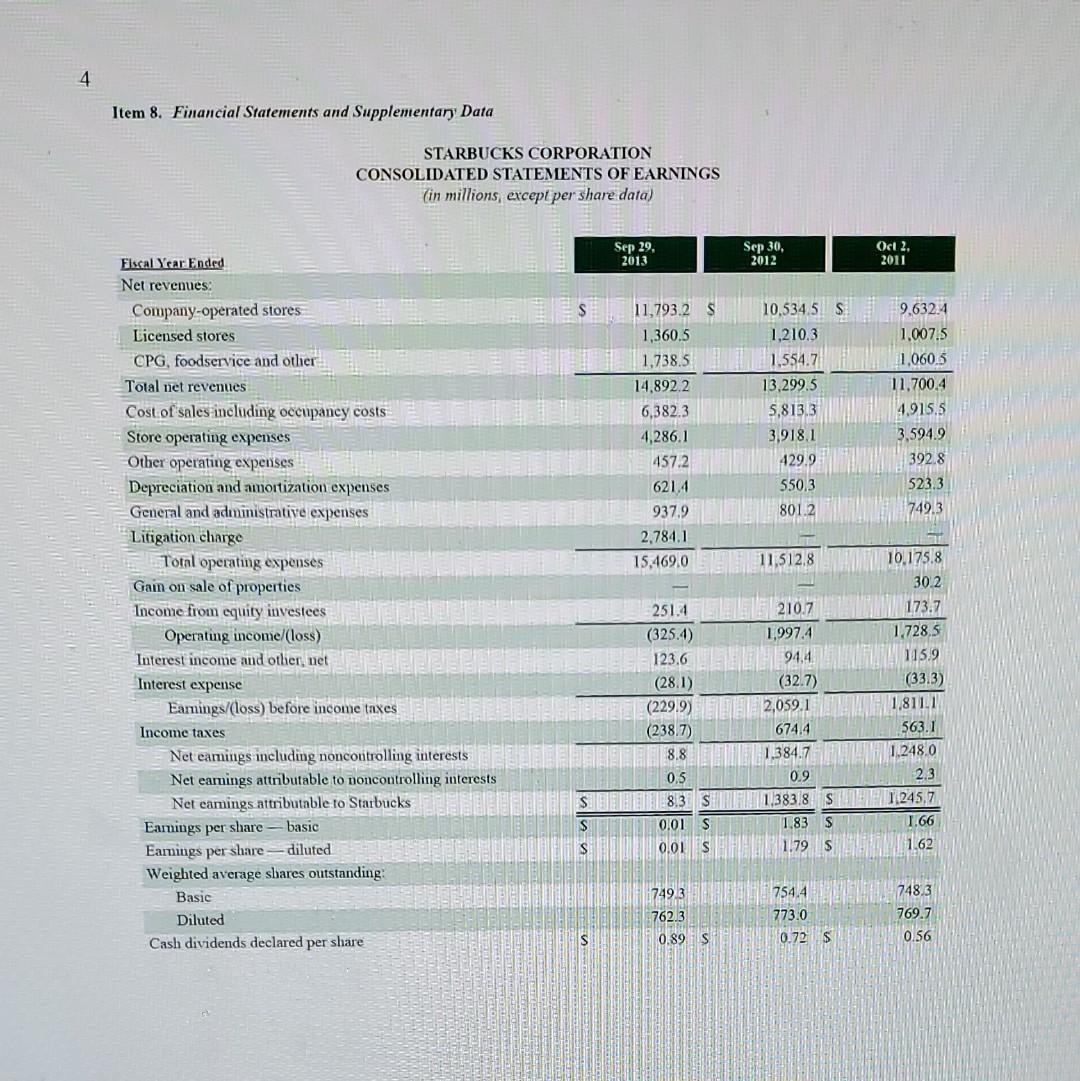

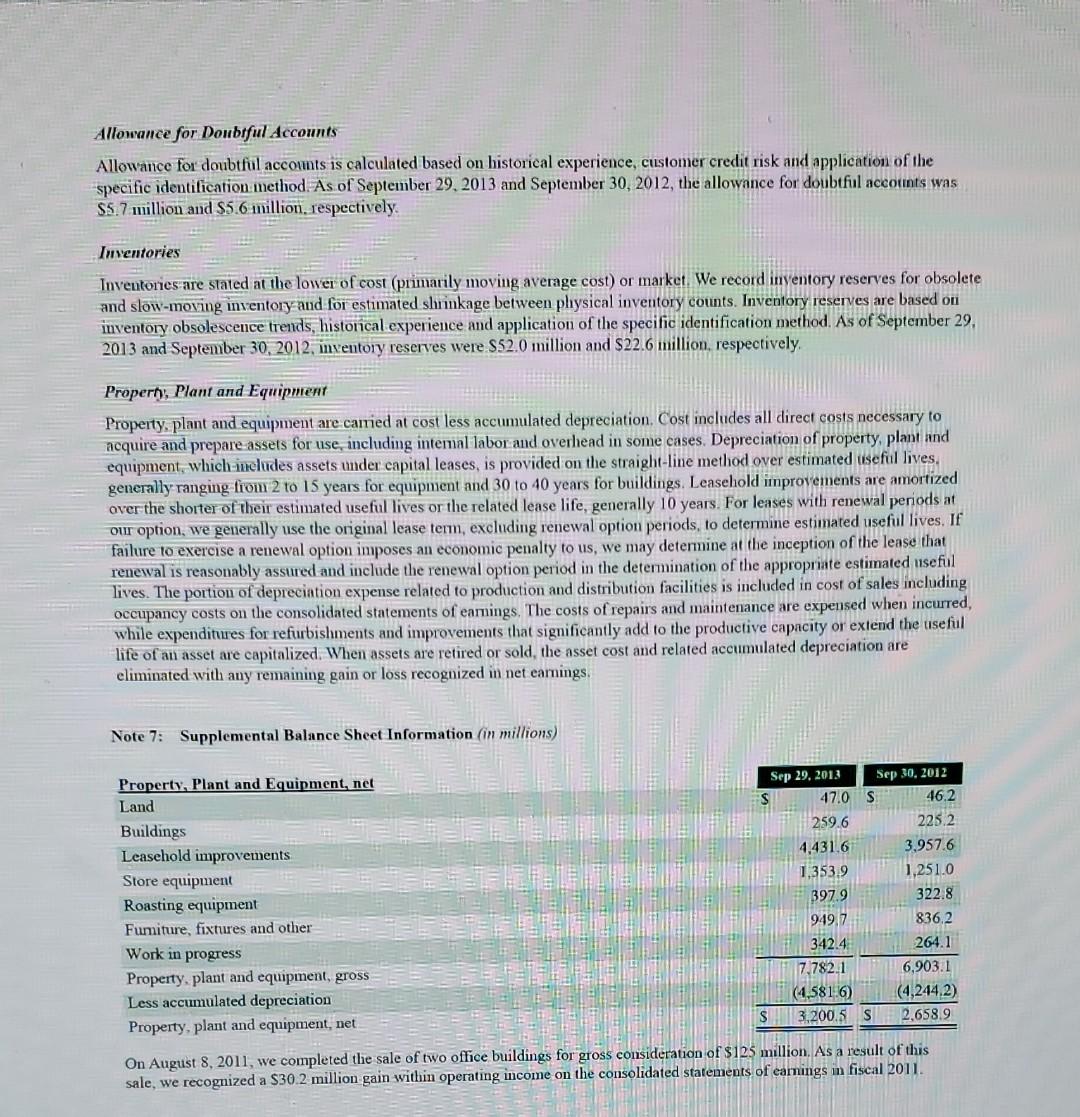

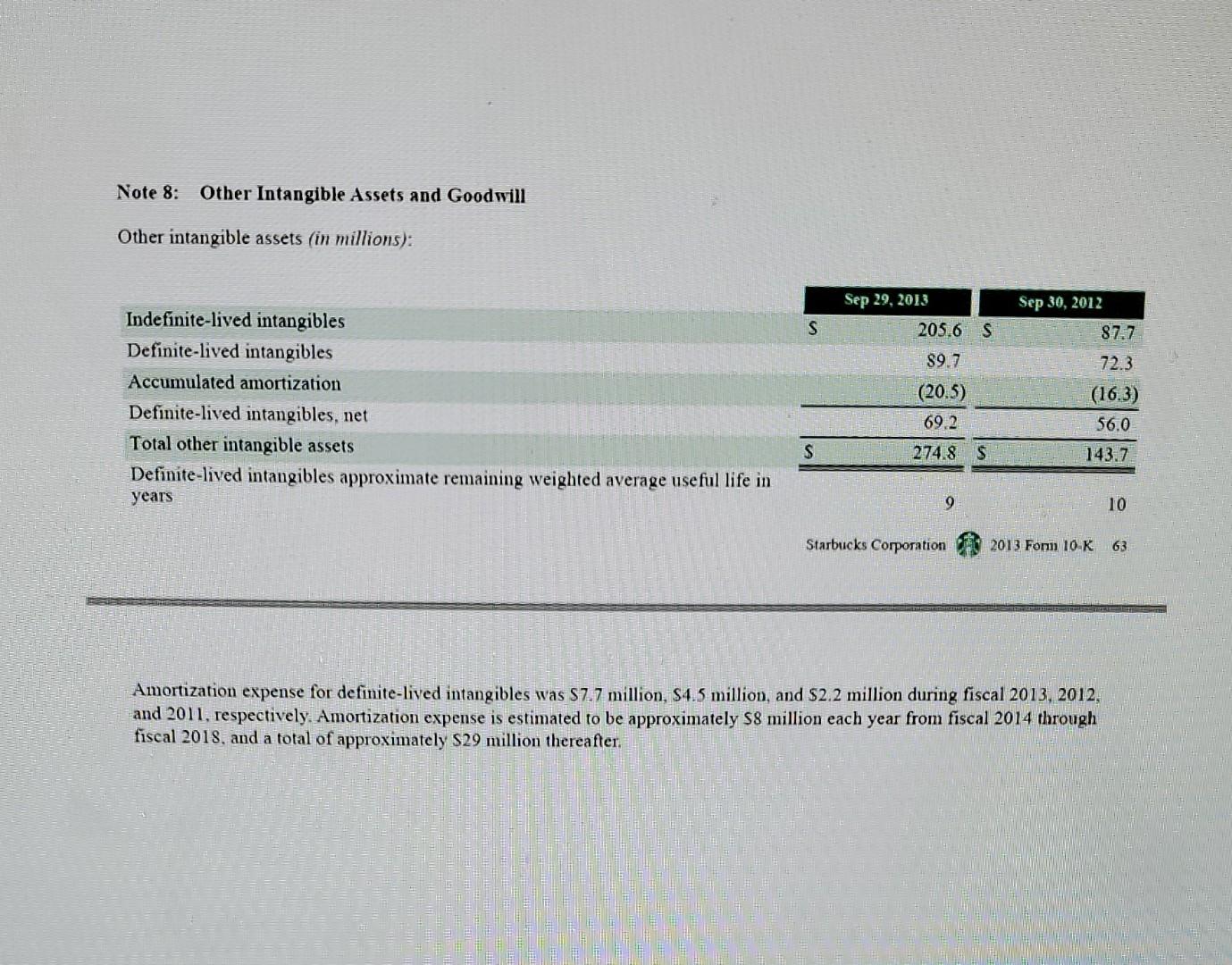

e. What is the percentage of the Allowance for doubtful clients in 2013 as a percentage of the account receivables (gross)? Assuming a write-off of $1 million, what is their estimated Bad Debt Expense? (2 points) f. What is the gross balance of depreciable property, plant and equipment (PP\&E) at the end of 2013 (land and construction in progress are not conisidered depreciable)? In the Statement of Cash Flows, you can find the depreciation (which refers to the usage of PP\&E) and amortization (which refers to the usage of intangibles) expenses. Determine the depreciation expense for the PP\&E (in note 8, you have the amortization pertaining to intangibles). Estimate the average age of all PP\&E (only in aggregate across all asset types, not asset-byasset). Assume straight-line depreciation and zero salvage values. (3 points) g. Calculate the amount of cash used for capital expenditures on property plant and equipment as a percentage of cash generated by operations, in 2013. (1 points) STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) See Notes to Consolidated Financial Statements. Item 8. Financial Statements and Supplementan Data STARBUCKS CORPORATION CONSOLID ATED STATEMENTS OF EARNINGS (in millions, except per share data) Allowance for Doubtful Accounts Allowance for doubtful accounts is calculated based on historical experience, customer credit risk and application of the specific identification method. As of September 29,2013 and September 30, 2012, the allowance for doubtful accorints was \$5.7 million and $5.6 million, respectively. Inventories Inveutories are stated at the lower of cost (primarily moving average cost) or market. We record inventory reserves for obsolete and slow-moving inventory=and for estimated slirinkage between physical inventory counts. Inventory reserves are based on iiventory obsolescence trends, histoncal experience and application of the specific identification method. As of September 29 , 2013 and September 30,2012 , imventory reserves were S52.0 million and \$22.6 million, respectively. Propert, Plant and Equipment Property, plant and equipment are carried at cost less accumulated depreciation. Cost includes all direct costs necessary to acquire and prepare assets for use, including intemal labor and overhead in some cases. Depreciation of property, plant and equipment, which-includes assets under capital leases, is provided on the straight-line method over estimated useful lives. generally ranging from 2 to 15 years for equipment and 30 to 40 years for buildings. Leasehold improvements are amortized over the shorter of their estimated useful lives or the related lease life, generally 10 years. For leases with renewal periods at our option, we generally use the original lease term, excluding renewal option periods, to determine estimated useful lives. If failure to exercise a renewal option imposes an economic penalty to us, we may deternine at the inception of the lease that renewal is reasonably assured and include the renewal option period in the determination of the appropriate estimated useful lives. The portiou of depreciation expense related to production and distribution facilities is included in cost of sales including occupancy costs on the consolidated statements of eamings. The costs of repairs and maintenance are expensed when incurred, while expenditures for refurbishments and improvements that significantly add to the productive capacity or extend the useful life of au asset are capitalized. When assets are retired or sold, the asset cost and related accumulated depreciation are eliminated with any remaining gain or loss recognized in net eamings. Note 7: Supplemental Balance Sheet Information (in millions) On August 8,2011, we completed the sale of two office buildings for gross consideration of \$125 million. As a result of this sale, we recognized a $30.2 million gain within operating income on the consolidated statements of earnings in fiscal 2011. Note 8: Other Intangible Assets and Goodwill Other intangible assets (in millions): Starbucks Corporation 6 2013 Form 10K63 Amortization expense for definite-lived intangibles was $7.7 million, $4.5 million, and $2.2 million during fiscal 2013,2012 , and 2011, respectively. Amortization expense is estimated to be approximately $8 million each year from fiscal 2014 through fiscal 2018 , and a total of approximately $29 million thereafter. e. What is the percentage of the Allowance for doubtful clients in 2013 as a percentage of the account receivables (gross)? Assuming a write-off of $1 million, what is their estimated Bad Debt Expense? (2 points) f. What is the gross balance of depreciable property, plant and equipment (PP\&E) at the end of 2013 (land and construction in progress are not conisidered depreciable)? In the Statement of Cash Flows, you can find the depreciation (which refers to the usage of PP\&E) and amortization (which refers to the usage of intangibles) expenses. Determine the depreciation expense for the PP\&E (in note 8, you have the amortization pertaining to intangibles). Estimate the average age of all PP\&E (only in aggregate across all asset types, not asset-byasset). Assume straight-line depreciation and zero salvage values. (3 points) g. Calculate the amount of cash used for capital expenditures on property plant and equipment as a percentage of cash generated by operations, in 2013. (1 points) STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) See Notes to Consolidated Financial Statements. Item 8. Financial Statements and Supplementan Data STARBUCKS CORPORATION CONSOLID ATED STATEMENTS OF EARNINGS (in millions, except per share data) Allowance for Doubtful Accounts Allowance for doubtful accounts is calculated based on historical experience, customer credit risk and application of the specific identification method. As of September 29,2013 and September 30, 2012, the allowance for doubtful accorints was \$5.7 million and $5.6 million, respectively. Inventories Inveutories are stated at the lower of cost (primarily moving average cost) or market. We record inventory reserves for obsolete and slow-moving inventory=and for estimated slirinkage between physical inventory counts. Inventory reserves are based on iiventory obsolescence trends, histoncal experience and application of the specific identification method. As of September 29 , 2013 and September 30,2012 , imventory reserves were S52.0 million and \$22.6 million, respectively. Propert, Plant and Equipment Property, plant and equipment are carried at cost less accumulated depreciation. Cost includes all direct costs necessary to acquire and prepare assets for use, including intemal labor and overhead in some cases. Depreciation of property, plant and equipment, which-includes assets under capital leases, is provided on the straight-line method over estimated useful lives. generally ranging from 2 to 15 years for equipment and 30 to 40 years for buildings. Leasehold improvements are amortized over the shorter of their estimated useful lives or the related lease life, generally 10 years. For leases with renewal periods at our option, we generally use the original lease term, excluding renewal option periods, to determine estimated useful lives. If failure to exercise a renewal option imposes an economic penalty to us, we may deternine at the inception of the lease that renewal is reasonably assured and include the renewal option period in the determination of the appropriate estimated useful lives. The portiou of depreciation expense related to production and distribution facilities is included in cost of sales including occupancy costs on the consolidated statements of eamings. The costs of repairs and maintenance are expensed when incurred, while expenditures for refurbishments and improvements that significantly add to the productive capacity or extend the useful life of au asset are capitalized. When assets are retired or sold, the asset cost and related accumulated depreciation are eliminated with any remaining gain or loss recognized in net eamings. Note 7: Supplemental Balance Sheet Information (in millions) On August 8,2011, we completed the sale of two office buildings for gross consideration of \$125 million. As a result of this sale, we recognized a $30.2 million gain within operating income on the consolidated statements of earnings in fiscal 2011. Note 8: Other Intangible Assets and Goodwill Other intangible assets (in millions): Starbucks Corporation 6 2013 Form 10K63 Amortization expense for definite-lived intangibles was $7.7 million, $4.5 million, and $2.2 million during fiscal 2013,2012 , and 2011, respectively. Amortization expense is estimated to be approximately $8 million each year from fiscal 2014 through fiscal 2018 , and a total of approximately $29 million thereafter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started