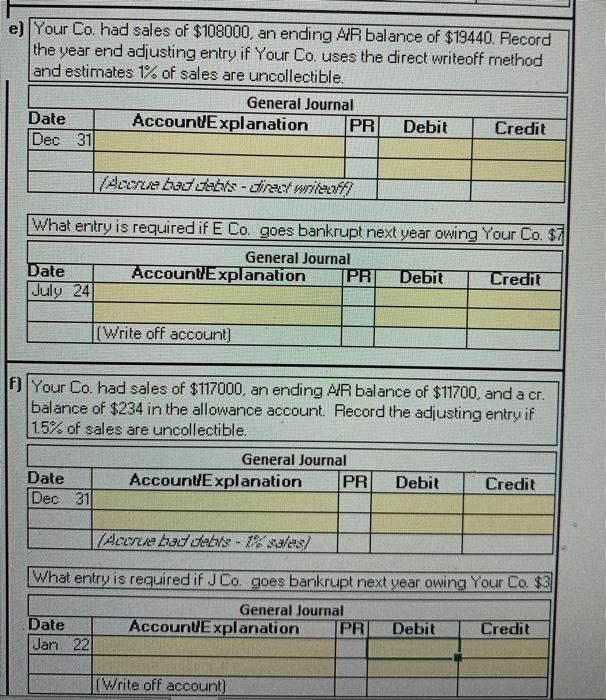

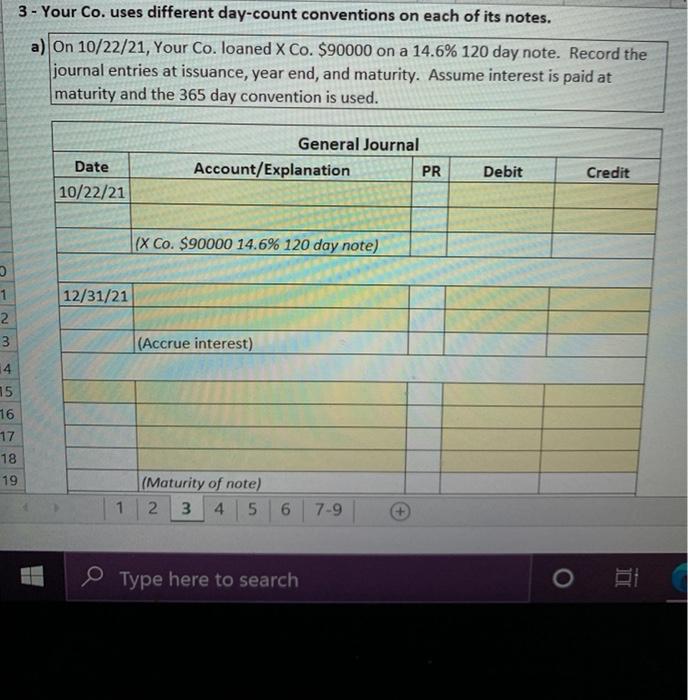

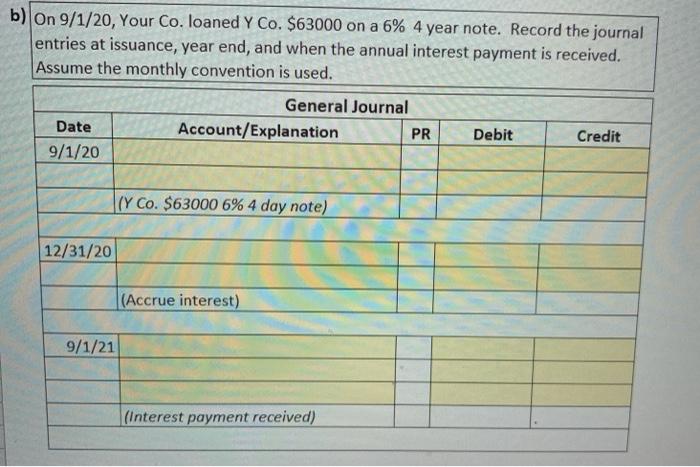

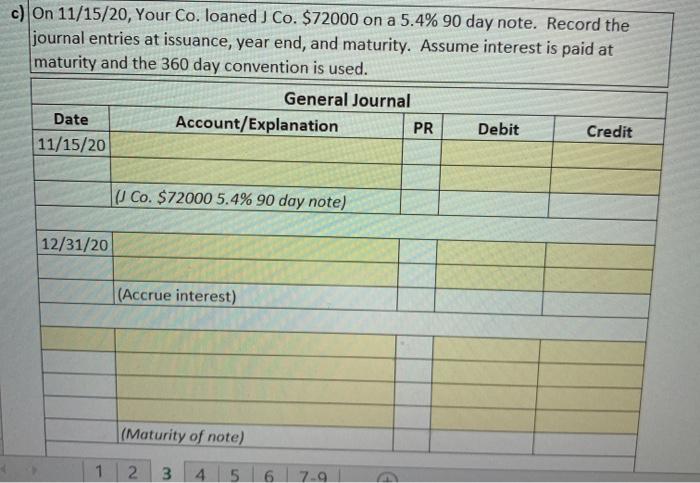

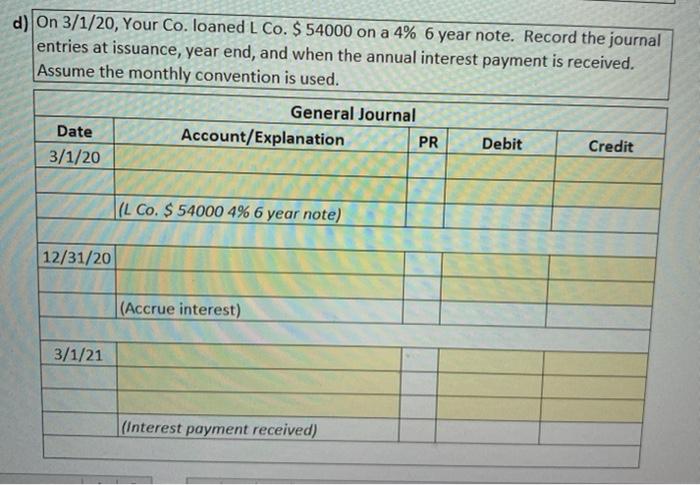

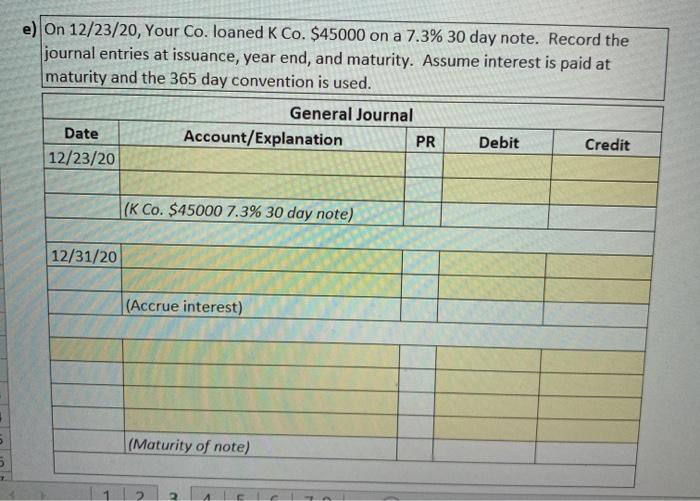

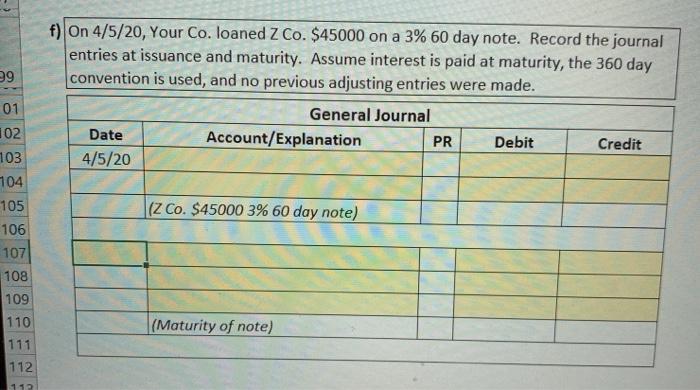

e) Your Co. had sales of $108000, an ending A/R balance of $19440. Record the year end adjusting entry if Your Co. uses the direct writeoff method and estimates 1% of sales are uncollectible. General Journal Date AccountExplanation PR Debit Credit Dec 31 Meerde but sehrs-Siracy wilaya What entry is required if E Co. goes bankrupt next year owing Your Co. $7 General Journal Date AccountExplanation PRI Debit Credit July 24 (Write off account) A) Your Co. had sales of $117000, an ending A/R balance of $11700, and a cr. balance of $234 in the allowance account. Record the adjusting entry if 1.5% of sales are uncollectible. General Journal Date Account'Explanation PR Debit Credit Dec 31 Accruebas de - % sales/ What entry is required if J Co, goes bankrupt next year owing Your Co $3 General Journal Date Account Explanation PR Debit Credit Jan 22 (Write off account) 3 - Your Co. uses different day-count conventions on each of its notes. a) On 10/22/21, Your Co. loaned X Co. $90000 on a 14.6% 120 day note. Record the journal entries at issuance, year end, and maturity. Assume interest is paid at maturity and the 365 day convention is used. General Journal Account/Explanation PR Date Debit Credit 10/22/21 (X Co. $90000 14.6% 120 day note) 12/31/21 5 1 2 3 (Accrue interest) 4 15 76 17 18 19 (Maturity of note) 2 3 4 5 1 6 7-9 O Type here to search b) on 9/1/20, Your Co. loaned Y Co. $63000 on a 6% 4 year note. Record the journal entries at issuance, year end, and when the annual interest payment is received. Assume the monthly convention is used. General Journal Date Account/Explanation PR Debit Credit 9/1/20 (Y Co. $63000 6% 4 day note) 12/31/20 (Accrue interest) 9/1/21 (interest payment received) c) On 11/15/20, Your Co. loaned J Co. $72000 on a 5.4% 90 day note. Record the journal entries at issuance, year end, and maturity. Assume interest is paid at maturity and the 360 day convention is used. General Journal Date Account/Explanation Debit Credit 11/15/20 PR ( Co. $72000 5.4% 90 day note) 12/31/20 (Accrue interest) (Maturity of note) 1 2 3 4 5 6 7-9 d) On 3/1/20, Your Co. loaned L Co. $ 54000 on a 4% 6 year note. Record the journal entries at issuance, year end, and when the annual interest payment is received. Assume the monthly convention is used. Date 3/1/20 General Journal Account/Explanation PR Debit Credit (L Co. $ 54000 4% 6 year note) 12/31/20 (Accrue interest) 3/1/21 (Interest payment received) e) On 12/23/20, Your Co. loaned K Co. $45000 on a 7.3% 30 day note. Record the journal entries at issuance, year end, and maturity. Assume interest is paid at maturity and the 365 day convention is used. General Journal Date Account/Explanation PR Debit Credit 12/23/20 (K Co. $45000 7.3% 30 day note) 12/31/20 (Accrue interest) (Maturity of note) 5 12 2 29 f) On 4/5/20, Your Co. loaned Z Co. $45000 on a 3% 60 day note. Record the journal entries at issuance and maturity. Assume interest is paid at maturity, the 360 day convention is used, and no previous adjusting entries were made. General Journal Date Account/Explanation PR Debit Credit 4/5/20 01 102 103 104 105 106 107 108 109 (z Co. $45000 3% 60 day note) (Maturity of note) 110 111 112 12