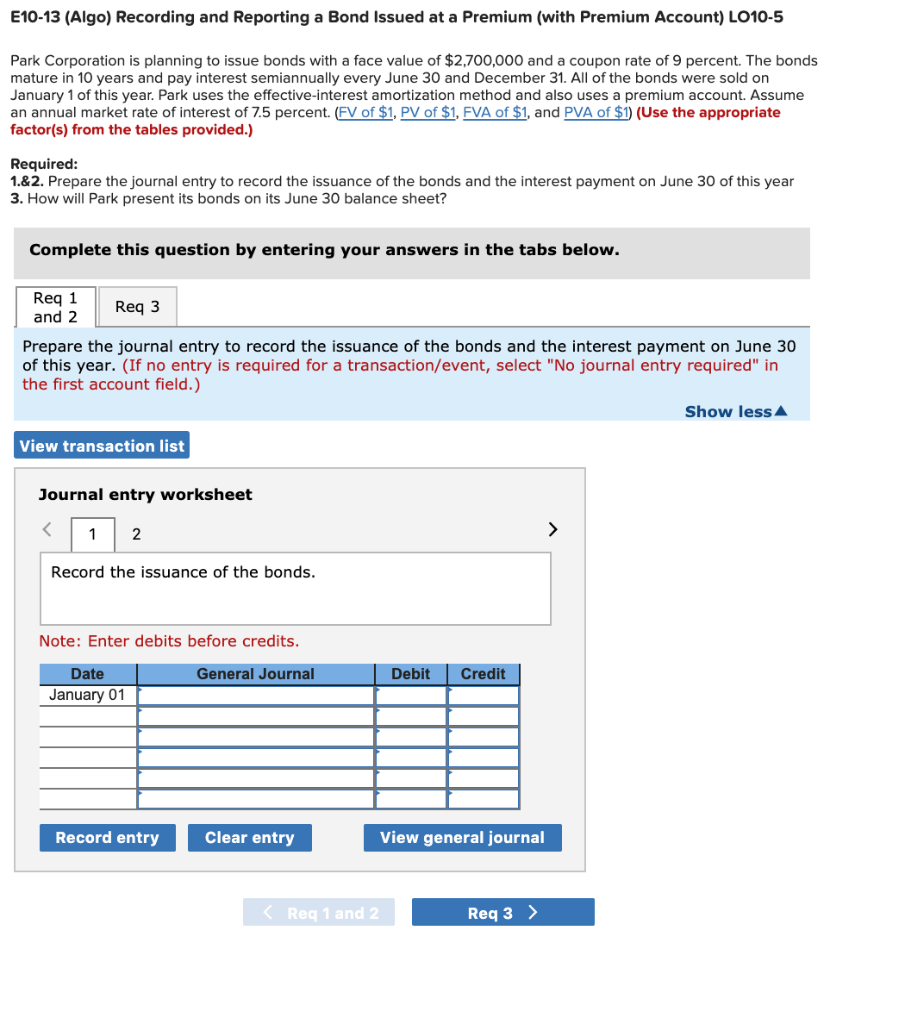

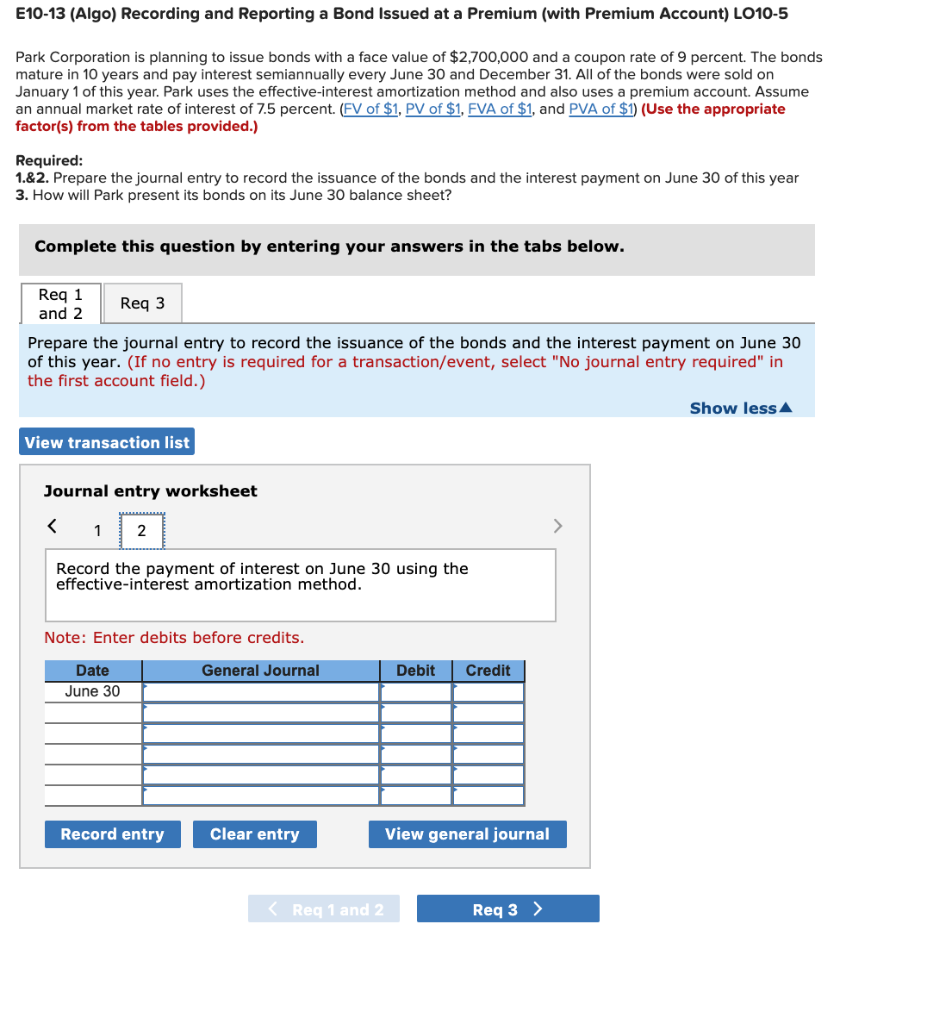

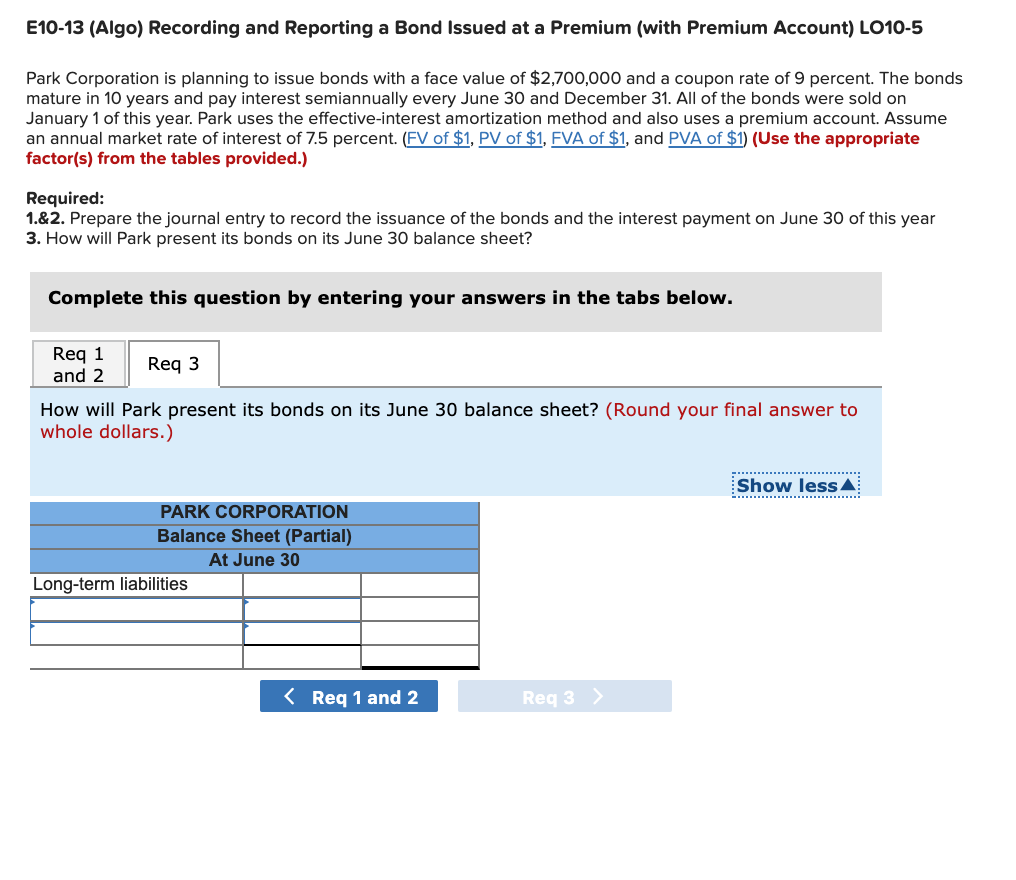

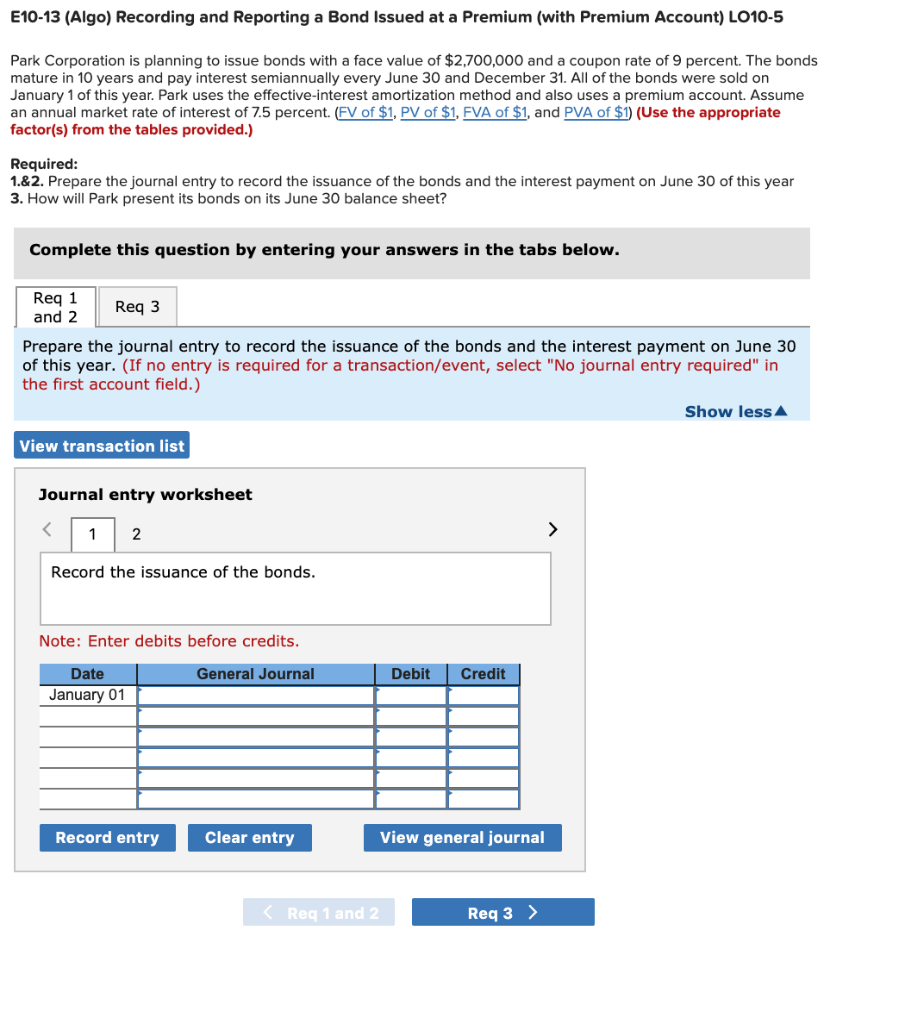

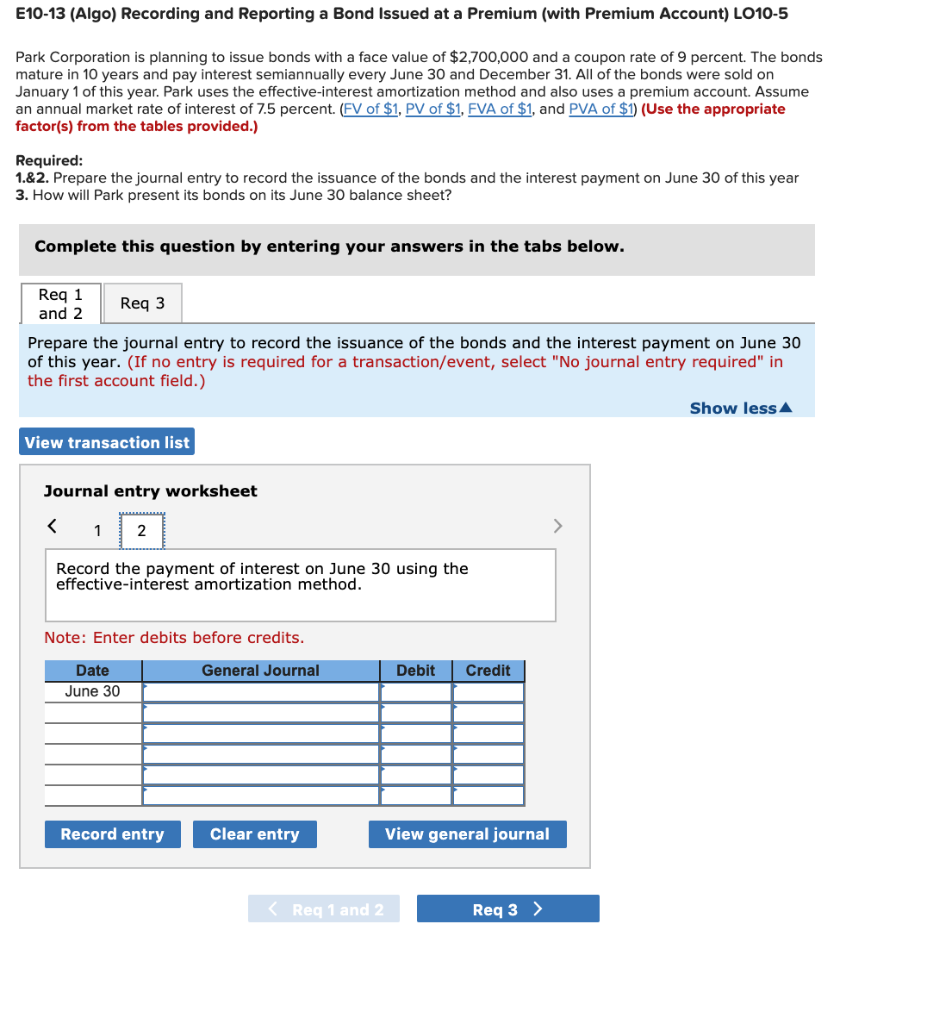

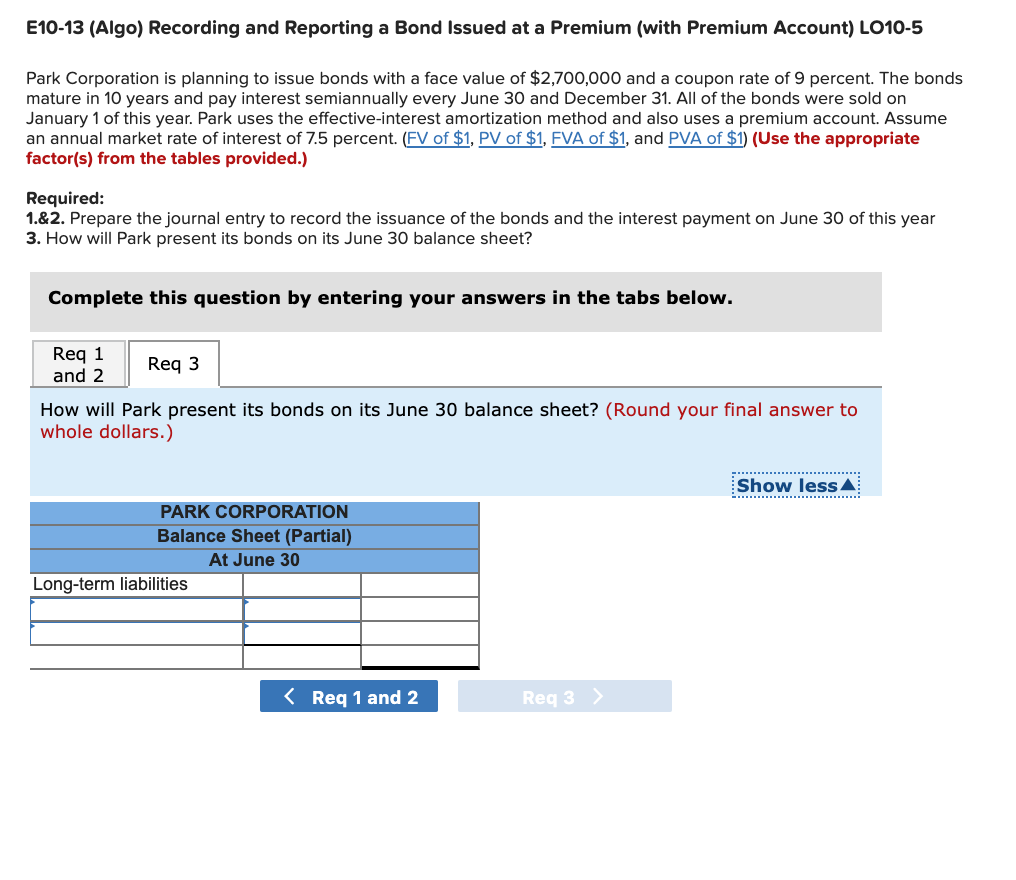

E10-13 (Algo) Recording and Reporting a Bond Issued at a Premium (with Premium Account) LO10-5 Park Corporation is planning to issue bonds with a face value of $2,700,000 and a coupon rate of 9 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Park uses the effective interest amortization method and also uses a premium account. Assume an annual market rate of interest of 7.5 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Required: 1.&2. Prepare the journal entry to record the issuance of the bonds and the interest payment on June 30 of this year 3. How will Park present its bonds on its June 30 balance sheet? Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Prepare the journal entry to record the issuance of the bonds and the interest payment on June 30 of this year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet E10-13 (Algo) Recording and Reporting a Bond Issued at a Premium (with Premium Account) LO10-5 Park Corporation is planning to issue bonds with a face value of $2,700,000 and a coupon rate of 9 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Park uses the effective interest amortization method and also uses a premium account. Assume an annual market rate of interest of 7.5 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Required: 1.&2. Prepare the journal entry to record the issuance of the bonds and the interest payment on June 30 of this year 3. How will Park present its bonds on its June 30 balance sheet? Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 Prepare the journal entry to record the issuance of the bonds and the interest payment on June 30 of this year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet E10-13 (Algo) Recording and Reporting a Bond Issued at a Premium (with Premium Account) LO10-5 Park Corporation is planning to issue bonds with a face value of $2,700,000 and a coupon rate of 9 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Park uses the effective-interest amortization method and also uses a premium account. Assume an annual market rate of interest of 7.5 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Required: 1.&2. Prepare the journal entry to record the issuance of the bonds and the interest payment on June 30 of this year 3. How will Park present its bonds on its June 30 balance sheet? Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 How will Park present its bonds on its June 30 balance sheet? (Round your final answer to whole dollars.) Show less PARK CORPORATION Balance Sheet (Partial) At June 30 Long-term liabilities