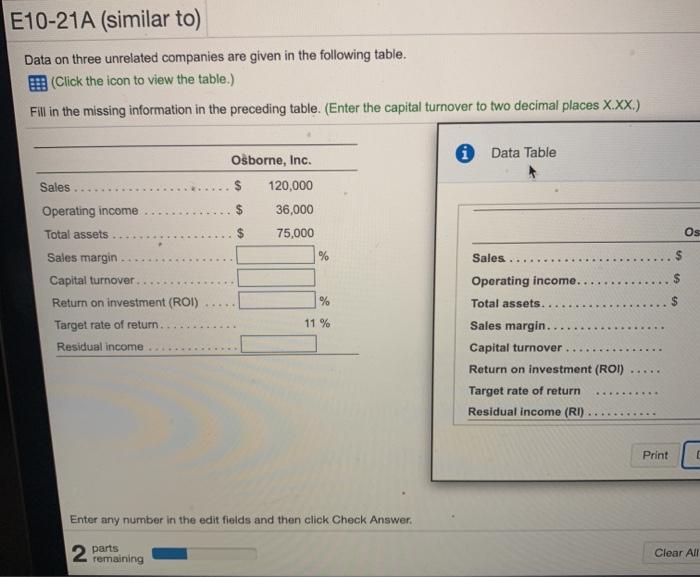

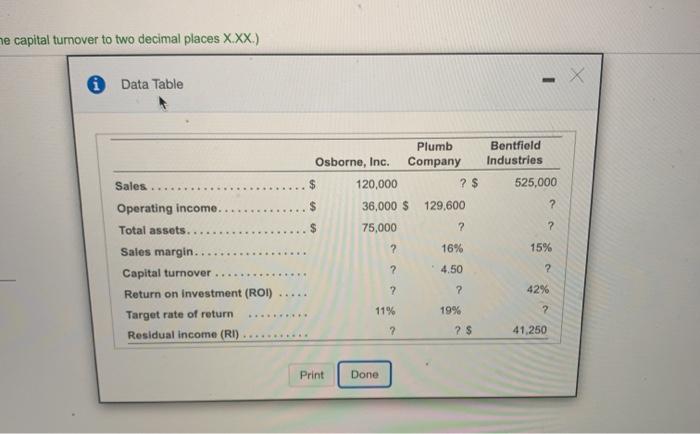

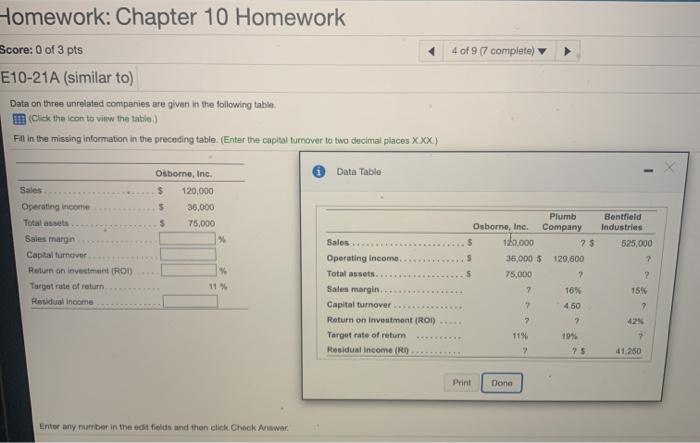

E10-21A (similar to) Data on three unrelated companies are given in the following table. E (Click the icon to view the table.) Fill in the missing information in the preceding table. (Enter the capital turnover to two decimal places X.XX.) Osborne, Inc. Data Table Sales Operating income 120,000 36,000 75,000 Total assets Os % Sales .. 5 Operating income. Sales margin Capital turnover Return on investment (ROI) Target rate of return Residual income % Total assets. $ 11 % Sales margin. Capital turnover. Return on investment (ROI) Target rate of return Residual income (RI) ...... Print Enter any number in the edit fields and then click Check Answer 2 remaining parts Clear All he capital tumover to two decimal places X.XX.) Data Table Plumb Osborne, Inc. Company $ 120,000 ? $ $ 36,000 $ 129,600 Bentfield Industries 525,000 Sales. ? 75,000 ? ? ? 16% 15% Operating income. Total assets.... Sales margin.. Capital turnover .... Return on investment (ROI) Target rate of return Residual income (RI) ? 4.50 ? ? ? 42% 11% 19% ? 2 ? $ 41.250 Print Done Homework: Chapter 10 Homework 4 of 9.7 complete) Score: 0 of 3 pts E10-21A (similar to) Data on three unrelated companies are given in the following table (click the icon to view the table) Fill in the missing information in the preceding table. (Enter the capital tumover to two decimal places XXX) Data Table X Sales Operating income Totalsts Osborne, Inc. $ 120,000 5 36,000 5 75,000 Bentfield Industries 525.000 Sales margin Plumb Osborne, Ine. Company $ 10,000 75 5 35,000 $ 129,600 5 75,000 7 16% Capital turnover Return on investment (ROU Target nate of return Residual income 7 11% Sales Operating income Total assets. Sales margin Capital turnover Return on investment (RON) Target rate of return Residual income (RD 2 15% 2 425 7 4.50 11% 2 7 10% 75 41.250 Print Dena Dona Enter any number in the edities and then click Check Answer E10-21A (similar to) Data on three unrelated companies are given in the following table. E (Click the icon to view the table.) Fill in the missing information in the preceding table. (Enter the capital turnover to two decimal places X.XX.) Osborne, Inc. Data Table Sales Operating income 120,000 36,000 75,000 Total assets Os % Sales .. 5 Operating income. Sales margin Capital turnover Return on investment (ROI) Target rate of return Residual income % Total assets. $ 11 % Sales margin. Capital turnover. Return on investment (ROI) Target rate of return Residual income (RI) ...... Print Enter any number in the edit fields and then click Check Answer 2 remaining parts Clear All he capital tumover to two decimal places X.XX.) Data Table Plumb Osborne, Inc. Company $ 120,000 ? $ $ 36,000 $ 129,600 Bentfield Industries 525,000 Sales. ? 75,000 ? ? ? 16% 15% Operating income. Total assets.... Sales margin.. Capital turnover .... Return on investment (ROI) Target rate of return Residual income (RI) ? 4.50 ? ? ? 42% 11% 19% ? 2 ? $ 41.250 Print Done Homework: Chapter 10 Homework 4 of 9.7 complete) Score: 0 of 3 pts E10-21A (similar to) Data on three unrelated companies are given in the following table (click the icon to view the table) Fill in the missing information in the preceding table. (Enter the capital tumover to two decimal places XXX) Data Table X Sales Operating income Totalsts Osborne, Inc. $ 120,000 5 36,000 5 75,000 Bentfield Industries 525.000 Sales margin Plumb Osborne, Ine. Company $ 10,000 75 5 35,000 $ 129,600 5 75,000 7 16% Capital turnover Return on investment (ROU Target nate of return Residual income 7 11% Sales Operating income Total assets. Sales margin Capital turnover Return on investment (RON) Target rate of return Residual income (RD 2 15% 2 425 7 4.50 11% 2 7 10% 75 41.250 Print Dena Dona Enter any number in the edities and then click Check