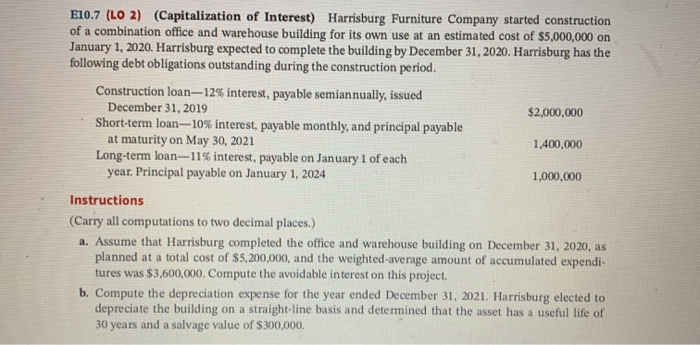

E10.7 (LO 2) (Capitalization of Interest) Harrisburg Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $5,000,000 on January 1, 2020. Harrisburg expected to complete the building by December 31, 2020. Harrisburg has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2019 $2,000,000 Short-term loan--10% interest, payable monthly, and principal payable at maturity on May 30, 2021 1,400,000 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2024 1,000,000 Instructions (Carry all computations to two decimal places.) a. Assume that Harrisburg completed the office and warehouse building on December 31, 2020, as planned at a total cost of $5,200,000, and the weighted average amount of accumulated expendi tures was $3,600,000. Compute the avoidable interest on this project. b. Compute the depreciation expense for the year ended December 31, 2021. Harrisburg elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $300,000 E10.7 (LO 2) (Capitalization of Interest) Harrisburg Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $5,000,000 on January 1, 2020. Harrisburg expected to complete the building by December 31, 2020. Harrisburg has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2019 $2,000,000 Short-term loan--10% interest, payable monthly, and principal payable at maturity on May 30, 2021 1,400,000 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2024 1,000,000 Instructions (Carry all computations to two decimal places.) a. Assume that Harrisburg completed the office and warehouse building on December 31, 2020, as planned at a total cost of $5,200,000, and the weighted average amount of accumulated expendi tures was $3,600,000. Compute the avoidable interest on this project. b. Compute the depreciation expense for the year ended December 31, 2021. Harrisburg elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $300,000