Answered step by step

Verified Expert Solution

Question

1 Approved Answer

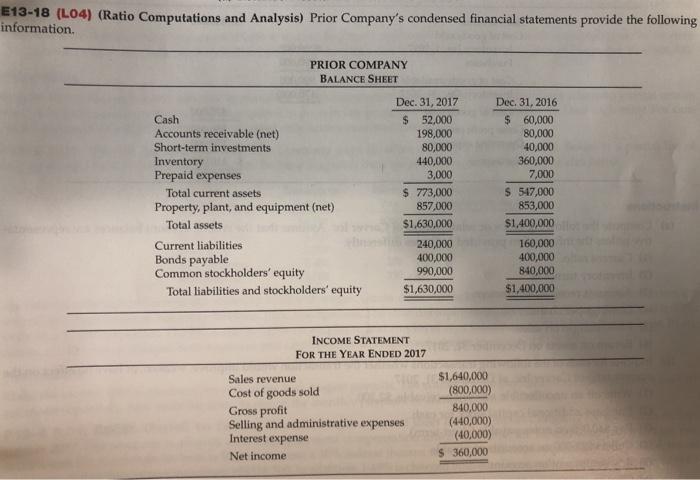

E13-18 (L04) (Ratio Computations and Analysis) Prior Company's condensed financial statements provide the following information. Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses

E13-18 (L04) (Ratio Computations and Analysis) Prior Company's condensed financial statements provide the following information. Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses PRIOR COMPANY BALANCE SHEET Total current assets Property, plant, and equipment (net) Total assets Current liabilities Bonds payable Common stockholders' equity Total liabilities and stockholders' equity Dec. 31, 2017 $ 52,000 198,000 80,000 440,000 3,000 $ 773,000 857,000 $1,630,000 240,000 400,000 990,000 $1,630,000 INCOME STATEMENT FOR THE YEAR ENDED 2017 Sales revenue Cost of goods sold Gross profit Selling and administrative expenses Interest expense Net income $1,640,000 (800,000) 840,000 (440,000) (40,000) $ 360,000 Dec. 31, 2016 $ 60,000 80,000 40,000 360,000 7,000 $ 547,000 853,000 $1,400,000 160,000 400,000 840,000 $1,400,000 Instructions (a) Determine the following for 2017. (1) Current ratio at December 31. (2) Acid-test ratio at December 31. (3) Accounts receivable turnover. (4) Inventory turnover. (5) Return on assets. (6) Profit margin on sales. (b) Prepare a brief evaluation of the financial condition of Prior Company and of the adequacy of its profits.

Step by Step Solution

★★★★★

3.28 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A 1 2 3 4 5 6 B For the year 2017 Current Ratio Current Assets Current Liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started