Question

E18.18 (LO 2, 3, 4, 5, 8) (One Temporary Difference, Future Taxable Amount Becoming Future Deductible Amount, One Tax Rate, Change in Rate) Refer to

E18.18 (LO 2, 3, 4, 5, 8) (One Temporary Difference, Future Taxable Amount Becoming Future Deductible Amount, One Tax Rate, Change in Rate) Refer to the information for Henry Limited in BE18.11. Following the year ended December 31, 2020, Henry continued to actively trade its securities investments until the end of its 2021 fiscal year, when it was forced to sell several of them at a loss, because of the need for cash for operations. By December 31, 2021, the portfolio of investments contained a single investment in shares, which was purchased in November 2021. Henry Limited had paid $42,000 for these remaining shares. At December 31, 2021, the shares' market value was $40,000. Income before income tax for Henry was $120,000 for the year ended December 31, 2021. There are no other permanent or reversing/timing differences in arriving at the taxable income for Henry Limited for the fiscal year ended December 31, 2021. The enacted tax rate for 2021 and future years is 30%.

My question is related to Question C

Why the balance before adjustment is 1125?

Instructions

a. Prepare the necessary journal entry for Henry Limited to accrue the unrealized loss on its securities investments.

b. Explain the tax treatment that should be given to the unrealized accrued loss that Henry Limited reported on its income statement.

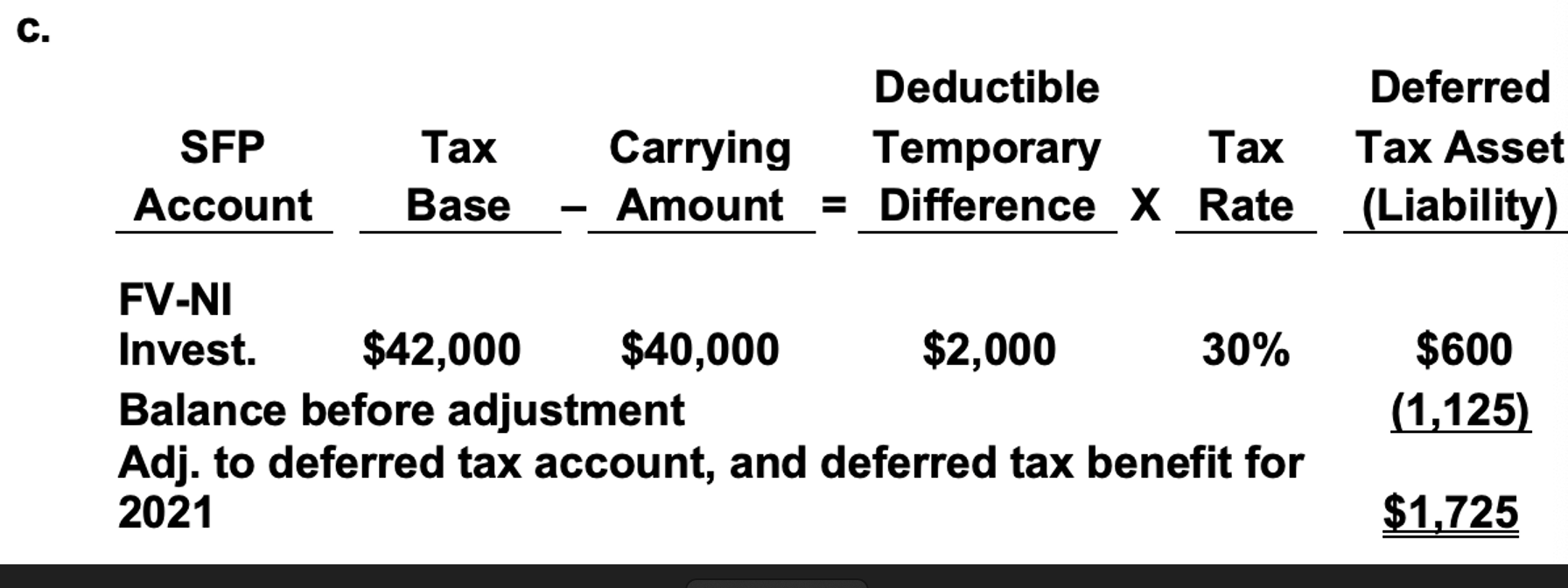

c. Calculate the deferred tax balance at December 31, 2021.

42,000-40,000= 2000*30%=600

why tax balance is 1125?

d. Calculate the current tax expense for the year ended December 31, 2021.

e. Prepare the journal entries to record income taxes for 2021. Assume that there have been no entries to the ending balances of deferred taxes reported at December 31, 2020.

f. Prepare the income statement for 2021, beginning with the line Income before income tax.

g. Provide the presentation for the SFP for any resulting deferred tax accounts at December 31, 2021. Be clear on the classification you have chosen and explain your choice.

h. Prepare the journal entries in part (e) under the assumption that, late in 2021, the income tax rate changed to 25% for 2022 and subsequent years.

i. Repeat the balance sheet presentation in part (g) assuming Henry reports under the ASPE future/deferred income taxes method and has chosen the fair value through net income model to account for its securities investments.

C. SFP Account Tax Base Deductible Carrying Temporary Tax Amount = Difference X Rate Deferred Tax Asset (Liability) FV-NI Invest. $42,000 $40,000 $2,000 30% Balance before adjustment Adj. to deferred tax account, and deferred tax benefit for 2021 $600 (1,125) $1,725Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started