Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E19-5 Ikerd Company is a manufacturer of personal computers. Various costs and expenses associated with its operations are as follows 24/35 7,500 Delivery expense Property

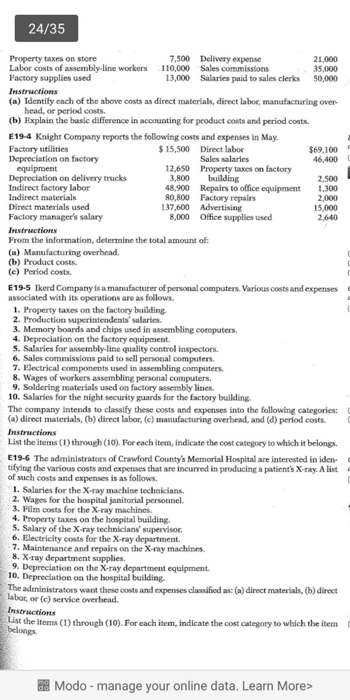

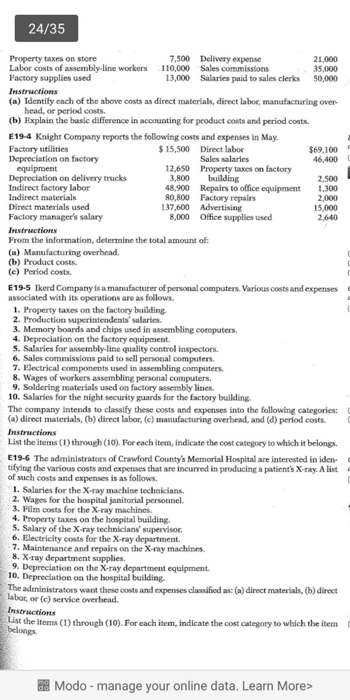

E19-5 Ikerd Company is a manufacturer of personal computers. Various costs and expenses associated with its operations are as follows  24/35 7,500 Delivery expense Property taxes on store Labor costs of assembly-line workers Factory supplies used 21,000 35,000 50,000 110,000 Sales commissions Salaries paid to sales clerks 13,000 (a) Identify each of the above costs as direct materials, direct labor, manufacturing over head, or period costs (b) Explain the basic difference in accounting for product costs and period costs. E19-4 Knight Company reports the following costs and expenses in May Factory utilities Depreciation on factory 15,500 Direct labor $69,100 46,400 Sales salaries Property taxes on factory 12,650 Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory managers salary Instructions From the information, determine the total amount of 3,800 building 48,900 80,800 Factory repairs 137,600 Advertising 8,000 Ofice supplies used 2,500 1,300 2,000 15,000 2,640 Repairs to office equipment (b) Product costs. (e) Period costs E19-5 Ikerd Company is a manuafacturer of personal computers. Various costs and expenses associated with its operations are as 1. Property taxes on the factory building 3. Memory boards and chips used in assembling computers. 4. Depreciation on the factory equipment. S. Salaries for assembly-line quality control inspectors. 6. Sales commissions paid to sell personal computers 7. Electrical components used in assembling computers. 8. Wages of workers assembling personal computers 9. Soldering materials used on factory assembly lines. 10. Salaries for the night security guards for the factory building The company intends to classify these costs and expenses into the following categories: (a) direct materials, (b) direct labor, (c) manufacturing overhead, and (d) period costs. List the items (1) through (10). For each item, indicate the cost category to which it belongs. E19-6 The administrators of Crawford County's Memorial Hospital are interested in iden- tifying the various costs and expenses that are incurred in producing a patient's X-ray. A list of such costs and expenses is as follows. 1. Salaries for the X-ray machine technicians 2. Wages for the hospital janitorial personnel. 3. Film costs for the X-ray machines. 4. Property taxes on the hospital building. 5. Salary of the X-ray technicians' supervisor. 6. Electrieity costs for the X-ray department. 7. Maintenance and repairs on the X-ray machines. 8. X- ray department supplies. 9. Depreciation on the X-ray department equipment 10. Depreciation oa the bospital building The administrators want these costs and expenses classified as: (a) direct materials, (b) direct labor or (c) service overhead List the items (1)through (10). For each item, indicate the cost category to which the item belongs. Modo-manage your online data. Learn More>

24/35 7,500 Delivery expense Property taxes on store Labor costs of assembly-line workers Factory supplies used 21,000 35,000 50,000 110,000 Sales commissions Salaries paid to sales clerks 13,000 (a) Identify each of the above costs as direct materials, direct labor, manufacturing over head, or period costs (b) Explain the basic difference in accounting for product costs and period costs. E19-4 Knight Company reports the following costs and expenses in May Factory utilities Depreciation on factory 15,500 Direct labor $69,100 46,400 Sales salaries Property taxes on factory 12,650 Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory managers salary Instructions From the information, determine the total amount of 3,800 building 48,900 80,800 Factory repairs 137,600 Advertising 8,000 Ofice supplies used 2,500 1,300 2,000 15,000 2,640 Repairs to office equipment (b) Product costs. (e) Period costs E19-5 Ikerd Company is a manuafacturer of personal computers. Various costs and expenses associated with its operations are as 1. Property taxes on the factory building 3. Memory boards and chips used in assembling computers. 4. Depreciation on the factory equipment. S. Salaries for assembly-line quality control inspectors. 6. Sales commissions paid to sell personal computers 7. Electrical components used in assembling computers. 8. Wages of workers assembling personal computers 9. Soldering materials used on factory assembly lines. 10. Salaries for the night security guards for the factory building The company intends to classify these costs and expenses into the following categories: (a) direct materials, (b) direct labor, (c) manufacturing overhead, and (d) period costs. List the items (1) through (10). For each item, indicate the cost category to which it belongs. E19-6 The administrators of Crawford County's Memorial Hospital are interested in iden- tifying the various costs and expenses that are incurred in producing a patient's X-ray. A list of such costs and expenses is as follows. 1. Salaries for the X-ray machine technicians 2. Wages for the hospital janitorial personnel. 3. Film costs for the X-ray machines. 4. Property taxes on the hospital building. 5. Salary of the X-ray technicians' supervisor. 6. Electrieity costs for the X-ray department. 7. Maintenance and repairs on the X-ray machines. 8. X- ray department supplies. 9. Depreciation on the X-ray department equipment 10. Depreciation oa the bospital building The administrators want these costs and expenses classified as: (a) direct materials, (b) direct labor or (c) service overhead List the items (1)through (10). For each item, indicate the cost category to which the item belongs. Modo-manage your online data. Learn More>

E19-5 Ikerd Company is a manufacturer of personal computers. Various costs and expenses associated with its operations are as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started