Answered step by step

Verified Expert Solution

Question

1 Approved Answer

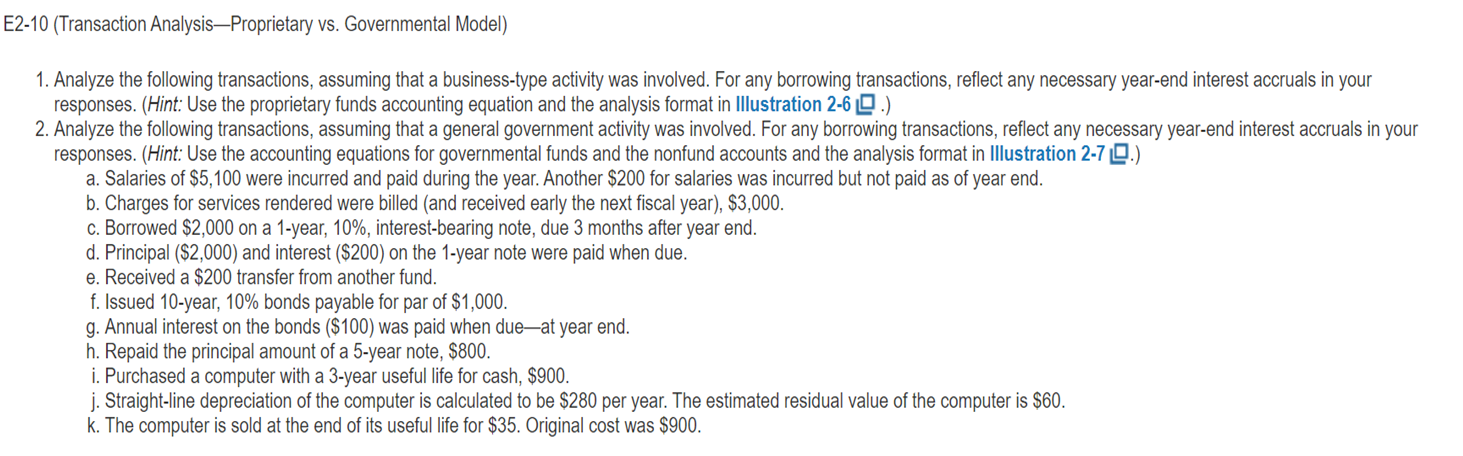

E2-10 (Transaction Analysis-Proprietary vs. Governmental Model) 1. Analyze the following transactions, assuming that a business-type activity was involved. For any borrowing transactions, reflect any

E2-10 (Transaction Analysis-Proprietary vs. Governmental Model) 1. Analyze the following transactions, assuming that a business-type activity was involved. For any borrowing transactions, reflect any necessary year-end interest accruals in your responses. (Hint: Use the proprietary funds accounting equation and the analysis format in Illustration 2-6.) 2. Analyze the following transactions, assuming that a general government activity was involved. For any borrowing transactions, reflect any necessary year-end interest accruals in your responses. (Hint: Use the accounting equations for governmental funds and the nonfund accounts and the analysis format in Illustration 2-7.) a. Salaries of $5,100 were incurred and paid during the year. Another $200 for salaries was incurred but not paid as of year end. b. Charges for services rendered were billed (and received early the next fiscal year), $3,000. c. Borrowed $2,000 on a 1-year, 10%, interest-bearing note, due 3 months after year end. d. Principal ($2,000) and interest ($200) on the 1-year note were paid when due. e. Received a $200 transfer from another fund. f. Issued 10-year, 10% bonds payable for par of $1,000. g. Annual interest on the bonds ($100) was paid when due at year end. h. Repaid the principal amount of a 5-year note, $800. i. Purchased a computer with a 3-year useful life for cash, $900. j. Straight-line depreciation of the computer is calculated to be $280 per year. The estimated residual value of the computer is $60. k. The computer is sold at the end of its useful life for $35. Original cost was $900.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started