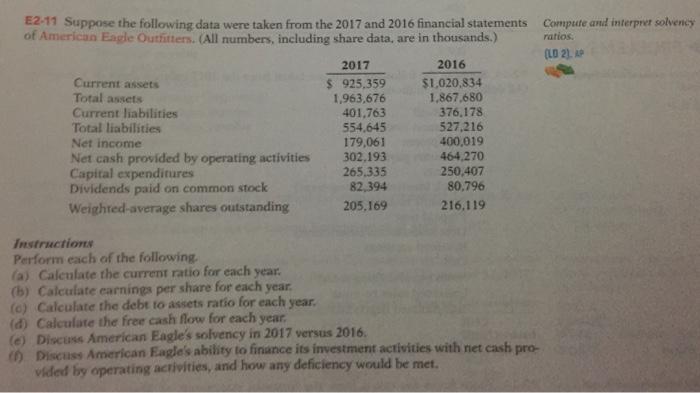

E2-11 Suppose the following data were taken from the 2017 and 2016 financial statements of American Eagle Outfitters. (All numbers, including share data, are

E2-11 Suppose the following data were taken from the 2017 and 2016 financial statements of American Eagle Outfitters. (All numbers, including share data, are in thousands.) Compute and interpret solvency ratios. (LD 2). P 2017 2016 Current assets Total assets Current liabilities Total liabilities Net income $ 925,359 1,963,676 401,763 554,645 179,061 302,193 265,335 82,394 $1,020,834 1,867,680 376,178 527,216 400,019 464,270 250,407 80,796 Net cash provided by operating activities Capital expenditures Dividends paid on common stock Weighted-average shares outstanding 205,169 216,119 Instructions Perform each of the following. (a) Caleulate the current ratio for each year. (b) Calculate earnings per share for each year. (0) Calculate the debt to assets ratio for each year. (d) Calculate the free cash flow for each year. (e) Discuss American Eagle's solvency in 2017 versus 2016. ) Discuss American Eagle's ability to finance its investment activities with net cash pro- vided by operating activities, and how any deficiency would be met.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer of Part a For 2017 Current Ratio Current Assets Current Liabilities Current Ratio 925359 4017...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started