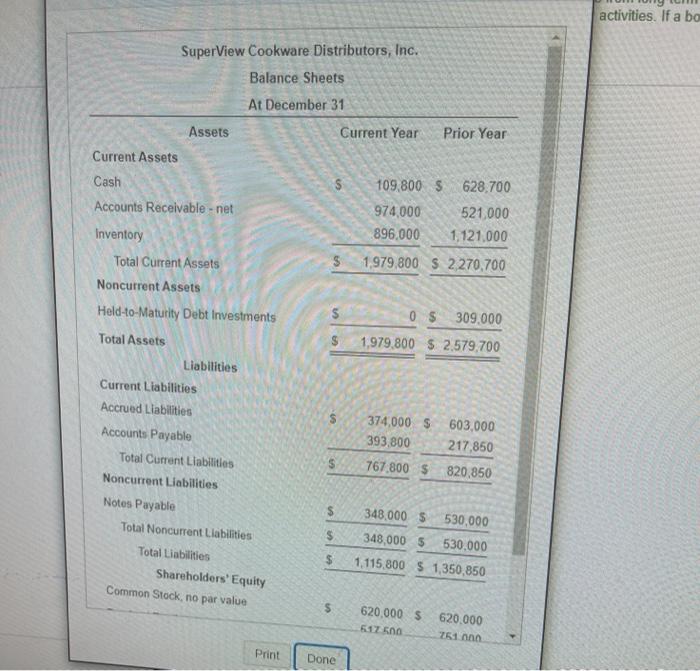

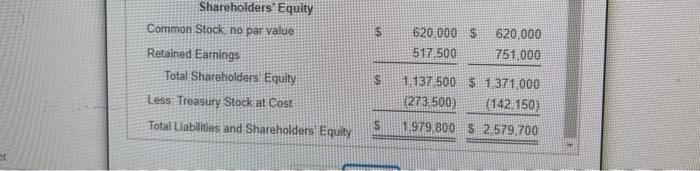

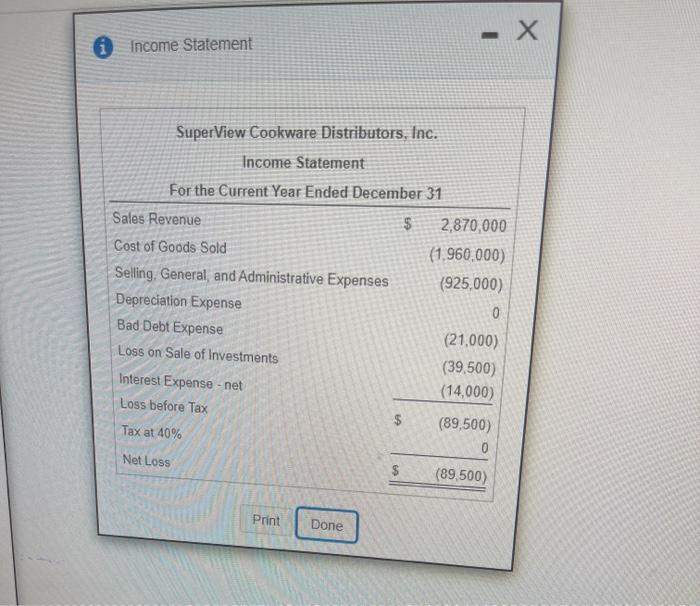

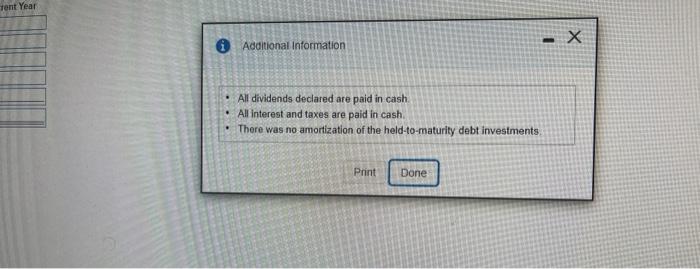

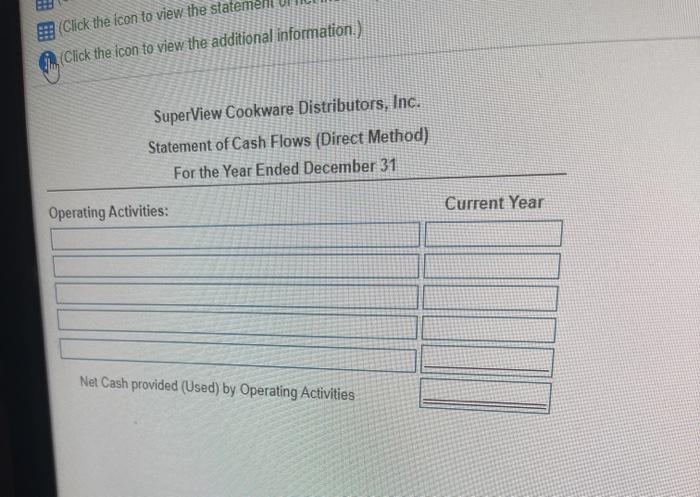

E22-16 (similar to) SuperView Cookware Distributors, Inc is a wholesale distributor of brand name cookware products. The company's current-year comparative balance sheets and Income statement follow (Click the icon to view the balance sheets.) FE(Click the icon to view the statement of net incomo (Click the icon to view the additional information ) Requirement Prepare SuperView's current-year statement of cash flows under the direct reporting format. Assume that accrued liabilities relate to seling, general, and administrative expenses. (Assume no proceeds from long-term debt were acquired, and no treasury stock was sold Use a minus sign or parentheses for any numbers to be subtracted and/or cash used by activities. If a box is not used in the statement leave the box empty: do not select a label or enter a zero.) activities. If a bo SuperView Cookware Distributors, Inc. Balance Sheets CA $ At December 31 Assets Current Year Prior Year Current Assets Cash $ 109,800S 628,700 Accounts Receivable - net 974,000 521,000 896.000 1,121,000 Inventory Total Current Assets 1.979,800 $ 2,270,700 Noncurrent Assets Held-o-Maturity Debt Investments 0 $ 309.000 Total Assets 1,979,800 $ 2.579.700 Liabilities Current Liabilities Accrued Liabilities 374,000 $ 603,000 Accounts Payable 393,800 217,850 Total Current Liabilities S 767 800 $ 820,850 Noncurrent Liabilities Notes Payable 348,000 $ 530,000 Total Noncurrent Liabilities $ 348,000 $ 530.000 Total Liabilities $ 1.115,800 $ 1,350,850 Shareholders' Equity Common Stock, no par value $ 620.000 251 0 $ $ 620,000 $ 517.500 Print Done Shareholders' Equity Common Stock no par value 620.000 $ 517 500 620,000 751,000 Retained Earnings Total Shareholders Equity Less Treasury Stock at Cost Total abilities and Shareholders Equity 1.137 500 $ 1,371,000 (273.500) (142, 150) 1.979,800 $ 2,579,700 $ ar - X Income Statement Super View Cookware Distributors, Inc. Income Statement For the Current Year Ended December 31 Sales Revenue $ Cost of Goods Sold Selling, General and Administrative Expenses Depreciation Expense Bad Debt Expense Loss on Sale of Investments Interest Expense - net Loss before Tax Tax at 40% 2,870,000 (1,960,000) (925,000) 0 (21,000) (39,500) (14,000) $ (89,500) Net Loss (89,500) Print Done Tent Year * Additional Information - X All dividends declared are paid in cash All interest and taxes are paid in cash There was no amortization of the held-to-maturity debt investments Print Done Click the icon to view the state (Click the icon to view the additional information.) SuperView Cookware Distributors, Inc. Statement of Cash Flows (Direct Method) For the Year Ended December 31 Current Year Operating Activities: Net Cash provided (Used) by Operating Activities