Answered step by step

Verified Expert Solution

Question

1 Approved Answer

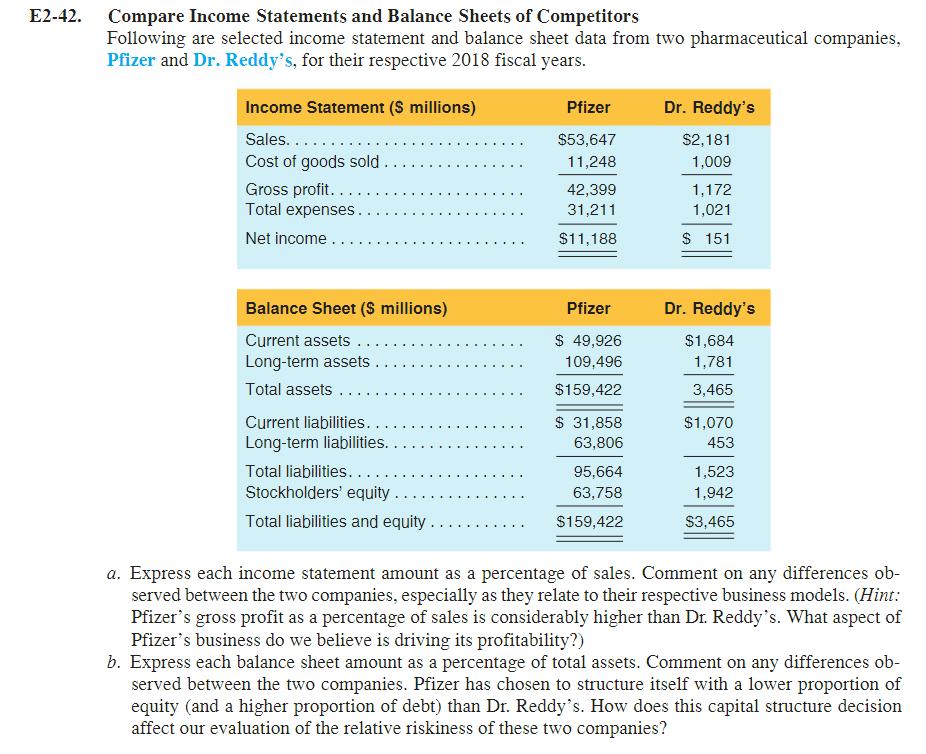

E2-42. Compare Income Statements and Balance Sheets of Competitors Following are selected income statement and balance sheet data from two pharmaceutical companies, Pfizer and

E2-42. Compare Income Statements and Balance Sheets of Competitors Following are selected income statement and balance sheet data from two pharmaceutical companies, Pfizer and Dr. Reddy's, for their respective 2018 fiscal years. Income Statement ($ millions) Sales...... Cost of goods sold.. Gross profit.... Total expenses.. Net income... Pfizer Dr. Reddy's $53,647 $2,181 11,248 1,009 42,399 1,172 31,211 1,021 $11,188 $ 151 Balance Sheet ($ millions) Current assets ... Long-term assets.. Total assets ... Current liabilities... Long-term liabilities.. Total liabilities.. Stockholders' equity.... Total liabilities and equity.... Pfizer Dr. Reddy's $ 49,926 $1,684 109,496 1,781 $159,422 3,465 $ 31,858 $1,070 63,806 453 95,664 1,523 63,758 1,942 $159,422 $3,465 a. Express each income statement amount as a percentage of sales. Comment on any differences ob- served between the two companies, especially as they relate to their respective business models. (Hint: Pfizer's gross profit as a percentage of sales is considerably higher than Dr. Reddy's. What aspect of Pfizer's business do we believe is driving its profitability?) b. Express each balance sheet amount as a percentage of total assets. Comment on any differences ob- served between the two companies. Pfizer has chosen to structure itself with a lower proportion of equity (and a higher proportion of debt) than Dr. Reddy's. How does this capital structure decision affect our evaluation of the relative riskiness of these two companies?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started