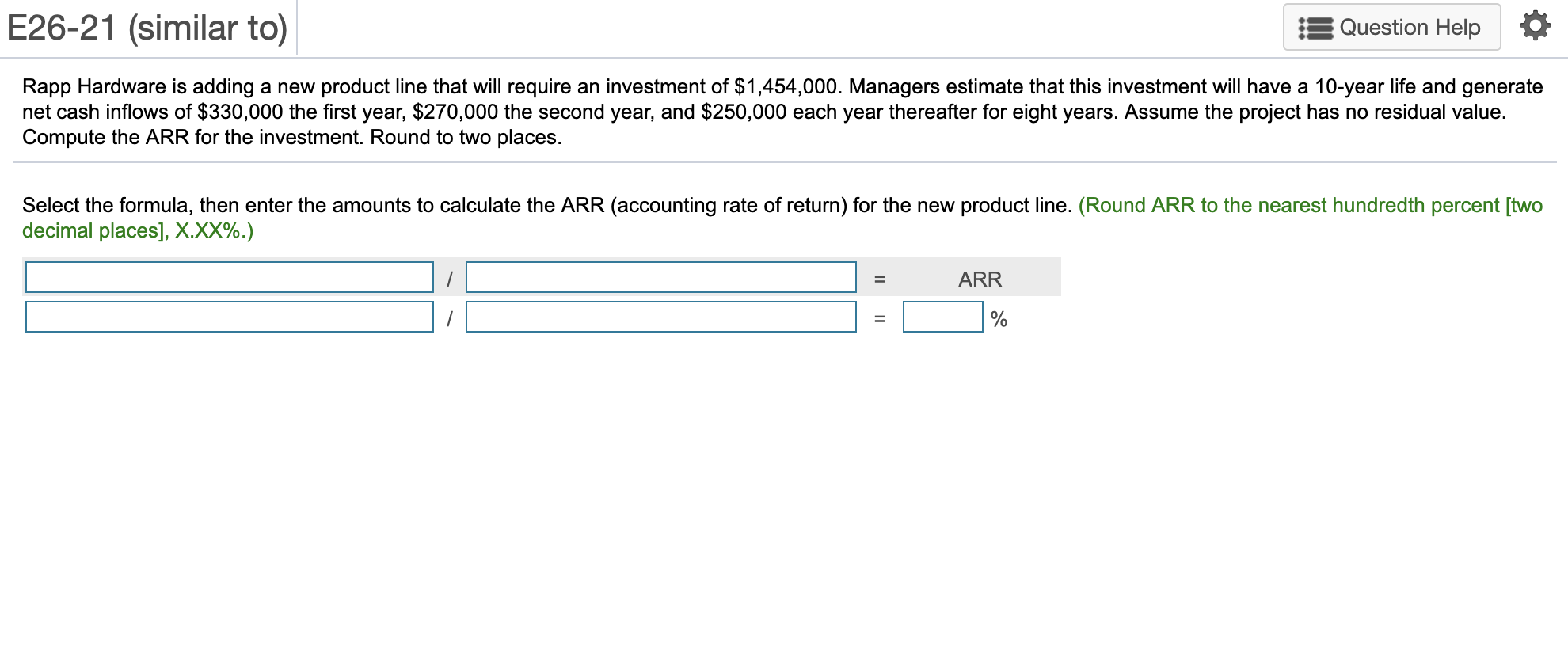

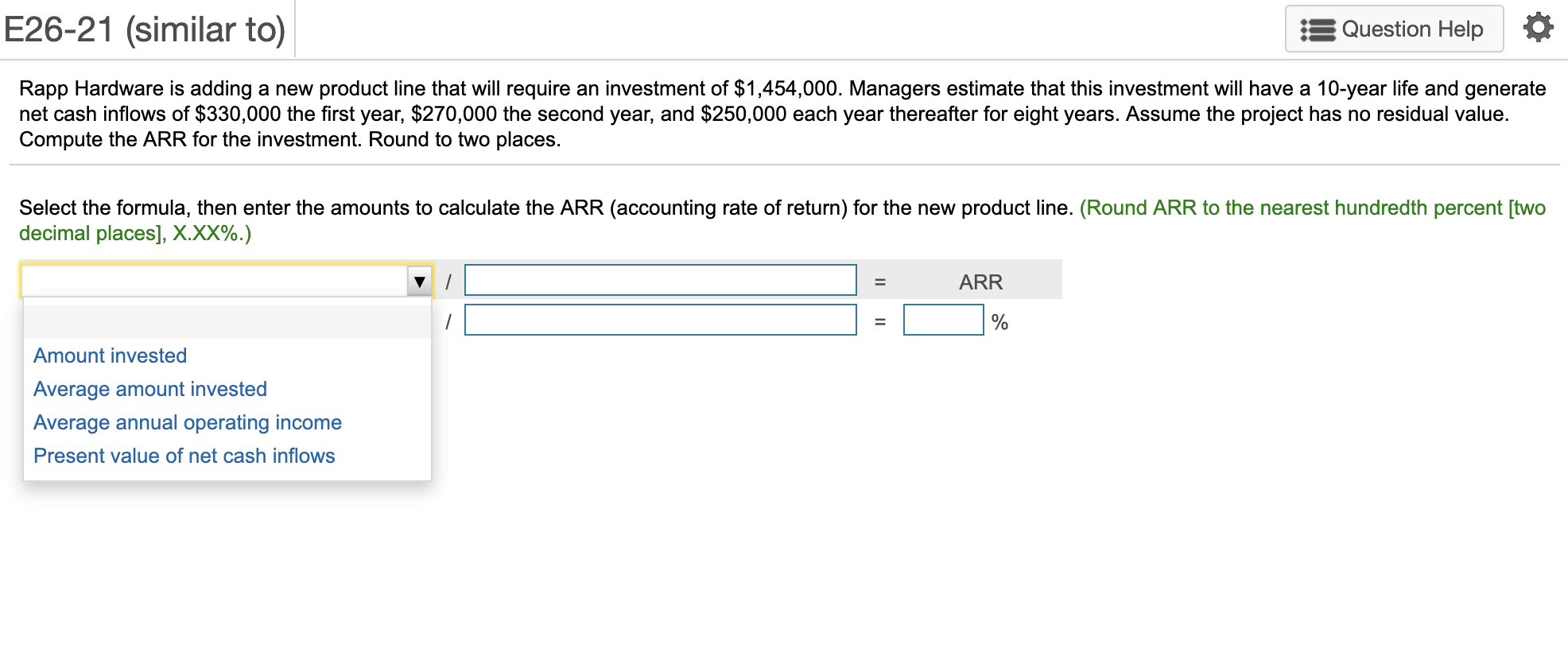

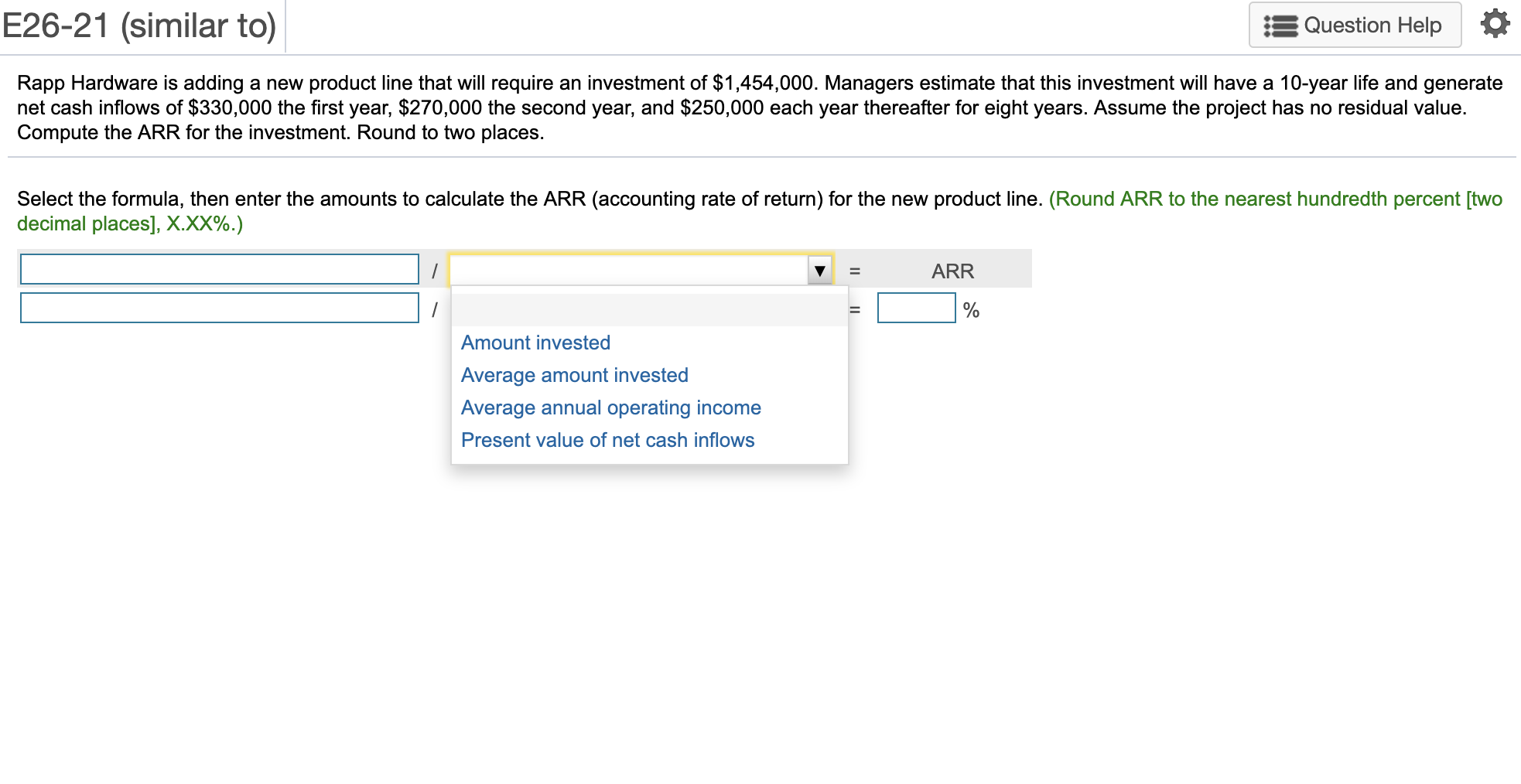

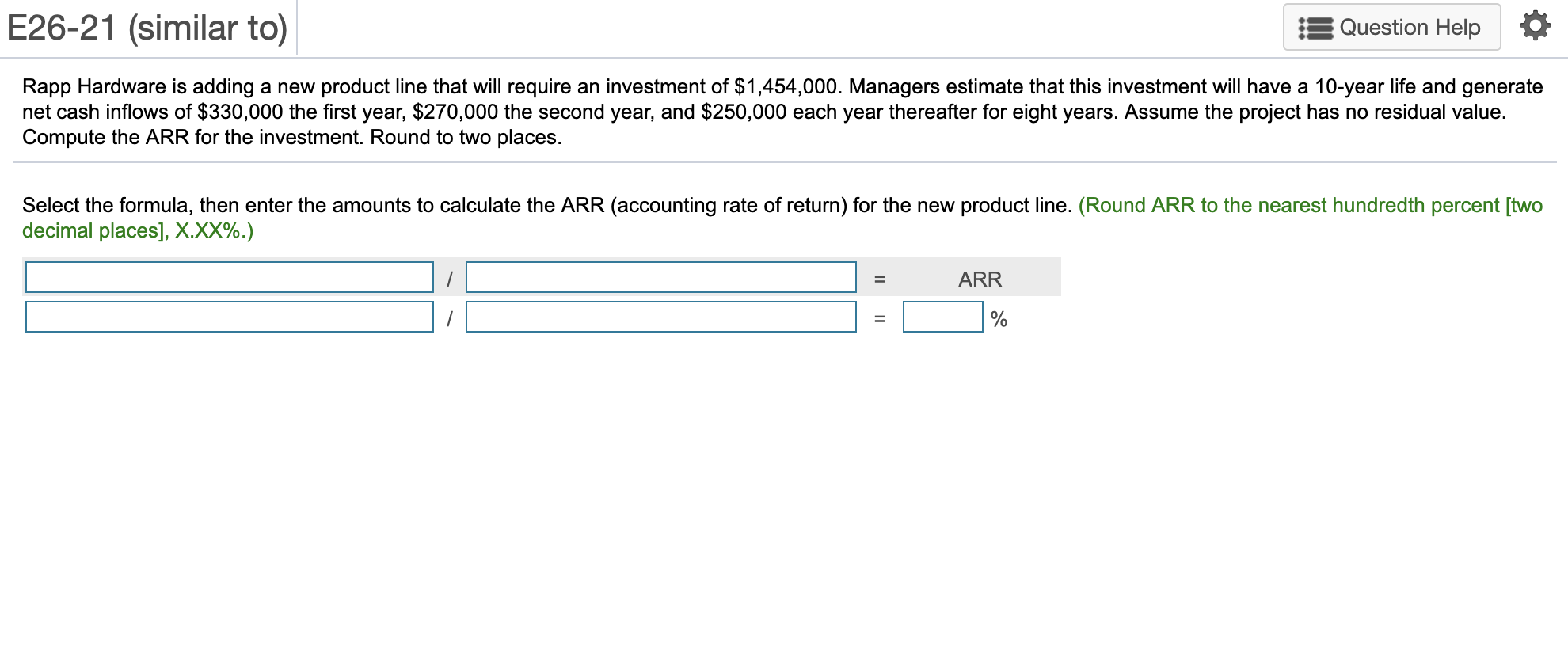

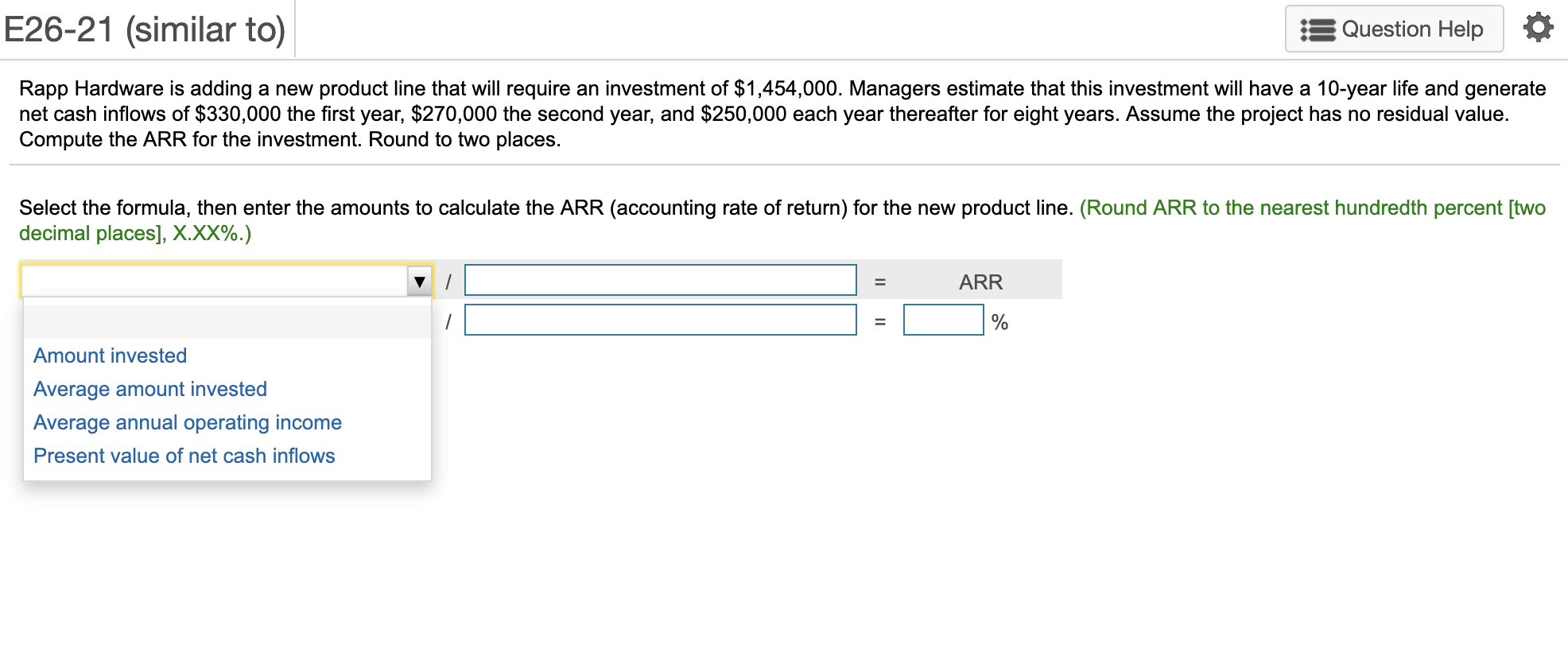

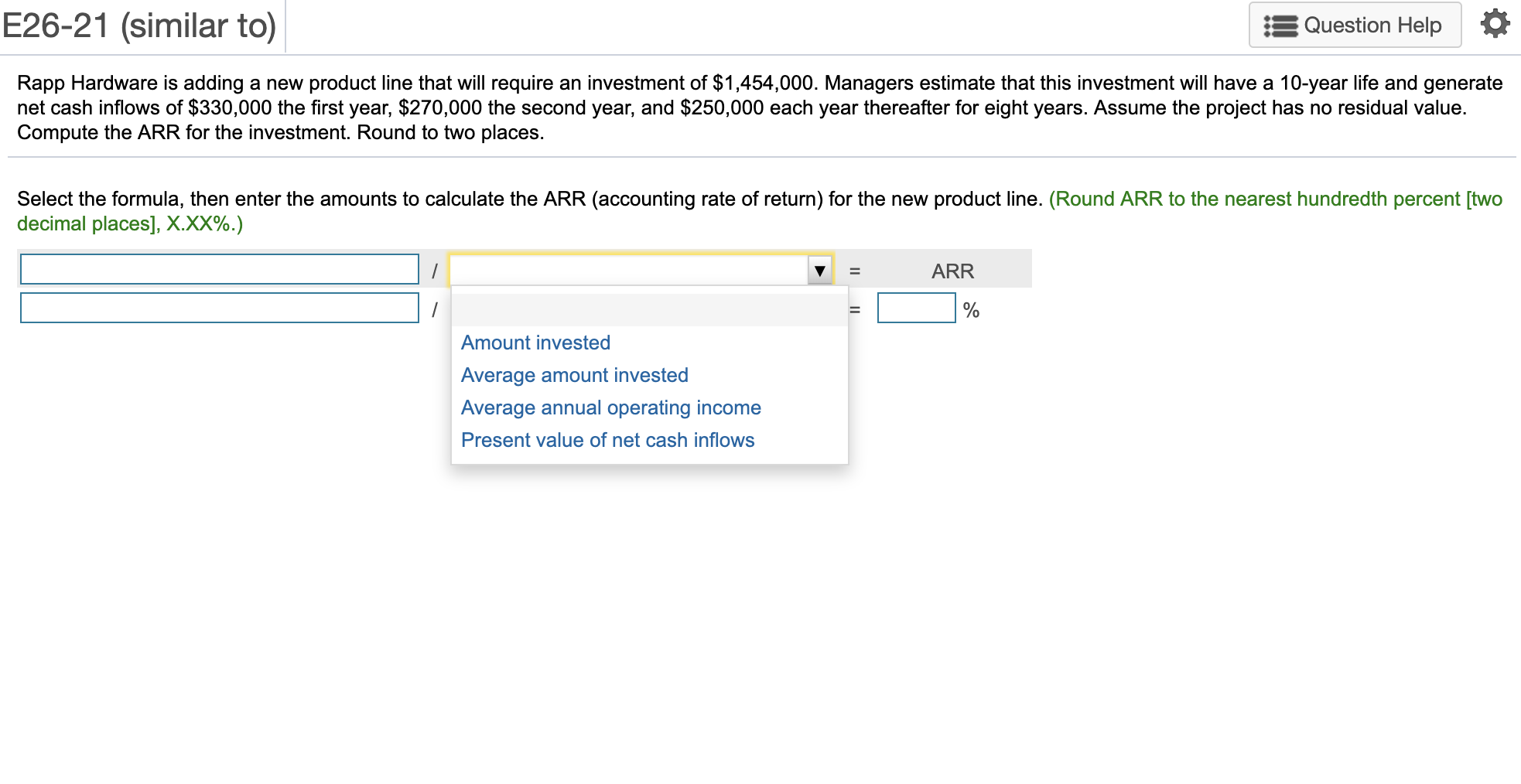

E26-21 (similar to) Question Help Rapp Hardware is adding a new product line that will require an investment of $1,454,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $330,000 the first year, $270,000 the second year, and $250,000 each year thereafter for eight years. Assume the project has no residual value. Compute the ARR for the investment. Round to two places. Select the formula, then enter the amounts to calculate the ARR (accounting rate of return) for the new product line. (Round ARR to the nearest hundredth percent [two decimal places], X.XX%.) ARR % E26-21 (similar to) Question Help a new product line that will require an investment of $1,454,000. Managers estimate that this investment will have a 10-year life and generate Rapp Hardware is adding net cash inflows of $330,000 the first year, $270,000 the second year, and $250,000 each year thereafter for eight years. Assume the project has no residual value. Compute the ARR for the investment. Round to two places. Select the formula, then enter the amounts to calculate the ARR (accounting rate of return) for the new product line. (Round ARR to the nearest hundredth percent [two decimal places], X.XX%.) ARR Amount invested Average amount invested Average annual operating income Present value of net cash inflows E26-21 (similar to) Question Help Rapp Hardware is adding a new product line that will require an investment of $1,454,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $330,000 the first year, $270,000 the second year, and $250,000 each year thereafter for eight years. Assume the project has no residual value. Compute the ARR for the investment. Round to two places. Select the formula, then enter the amounts to calculate the ARR (accounting rate of return) for the new product line. (Round ARR to the nearest hundredth percent [two decimal places], X.XX%.) ARR Amount invested Average amount invested Average annual operating income Present value of net cash inflows