Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E2.7 (easy) An investor is seeking to choose a portfolio into a get of stocks wisely. To do this s/he has collected historical data

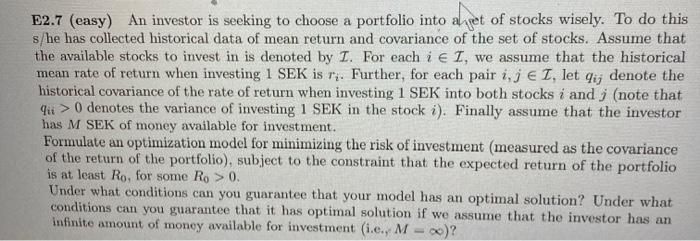

E2.7 (easy) An investor is seeking to choose a portfolio into a get of stocks wisely. To do this s/he has collected historical data of mean return and covariance of the set of stocks. Assume that the available stocks to invest in is denoted by I. For each i I, we assume that the historical mean rate of return when investing 1 SEK is ri. Further, for each pair i, j E I, let qij denote the historical covariance of the rate of return when investing 1 SEK into both stocks i and j (note that qu> 0 denotes the variance of investing 1 SEK in the stock i). Finally assume that the investor has M SEK of money available for investment. Formulate an optimization model for minimizing the risk of investment (measured as the covariance of the return of the portfolio), subject to the constraint that the expected return of the portfolio is at least Ro, for some Ro> 0. Under what conditions can you guarantee that your model has an optimal solution? Under what conditions can you guarantee that it has optimal solution if we assume that the investor has an infinite amount of money available for investment (i.e., M-co)?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Ans Stocks Investment Return Variance covariance table Stock 1 2 Objective i1 All dia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started