Question

E3.9 Consolidation at reporting date with fair value adjustments for land and buildings (Section 3.4.3) On 1 January 20X0, ABC Ltd acquired all of the

E3.9 Consolidation at reporting date with fair value adjustments for land and buildings (Section 3.4.3)

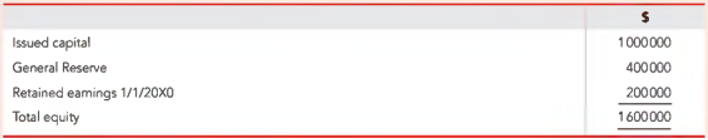

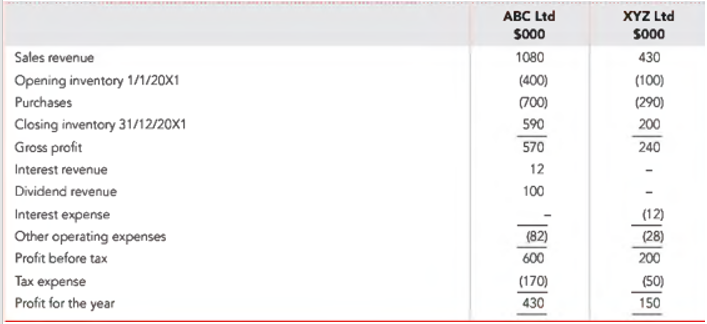

On 1 January 20X0, ABC Ltd acquired all of the one million issued ordinary shares of XYZ Ltd for $1.8million. At this date, the shareholders' equity of XYZ Ltd was as follows:

Issued capital

ADDITIONAL INFORMATION

At the acquisition date, all the identifiable net assets of XYZ Ltd were recorded at their fair values in the accounts of XYZ Ltd except land and buildings. On 1 January 20X0, XYZ Ltd's land had a carrying amount of $1. 4million, but a fair value of $1.5million, and XYZ Ltd's buildings had a carrying amount of $100000, but a fair value of $150000. ABC Ltd and XYZ Ltd use the cost basis of measurement for their property, plant, and equipment. The buildings of XYZ Ltd are depreciated 20% p.a. on cost (note, we have not told you anything here about the accumulated depreciation balance for the property, plant, and equipment in XYZ Ltd's ledger. You need to check it! .... Clue: refer to the Statement of Financial Position two years later as presented below and work backward)

During the year ended 31 December 20X1. XYZ Ltd borrowed S250000 from its parent, ABC Ltd, and was charged and paid $12000 interest on the loan. Dividends paid or declared? Review the accounting information provided below to assess whether any consolidation adjustments in relation to dividends are required. An impairment loss of $40000 relating to the goodwill arising on the acquisition of XYZ Ltd was recognized during the year ended 31 December 20X0. The directors of ABC Ltd believe that the goodwill relating to the acquisition of XYZ Ltd has been impaired by a further $20 000 during the year ended 31 December 20X1.The company income tax rate is 30%

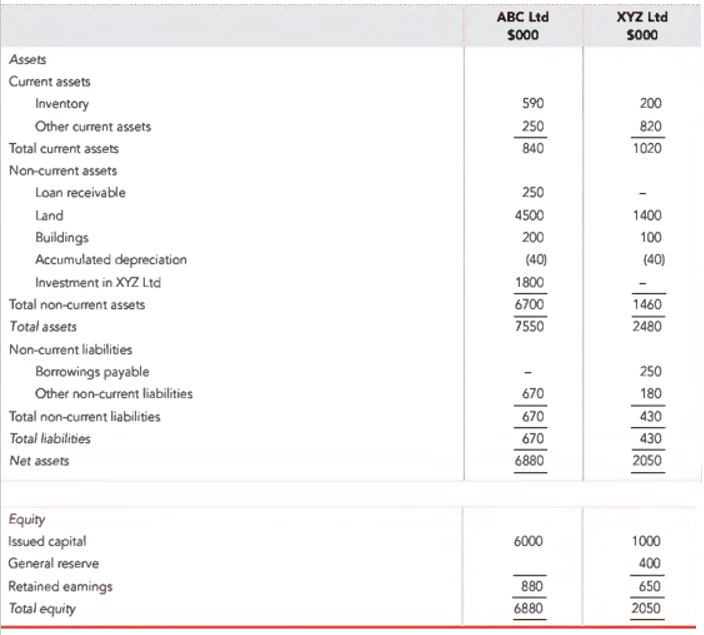

The statements of comprehensive income, extract from the statement of changes in equity and statements of financial position of ABC Ltd and XYZ Ltd for the year ended 31 December 20X1 are as follows:

Statements of comprehensive income

Extract from retained earnings notes

Statements of financial position

Prepare the consolidated statement of comprehensive income, consolidated statement of changes in equity, and consolidated statement of financial position of the ABC Ltd group for the year ended 31 December 20X1 as required by AASB 10. Show all relevant consolidation journal entries.

Note: please give me the entry as well as how the numbers are calculated, thank you very much. I will give you the thumb up if the solution is appropriate!

Issued capital General Reserve Retained eamings 1/1/20x0 Total equity $ 1000000 400000 200000 1600000 XYZ Ltd 5000 430 ABC Ltd 5000 1080 (400) (700) 590 570 12 100 Sales revenue Opening inventory 1/1/20X1 Purchases Closing inventory 31/12/20X1 Gross profit Interest revenue Dividend revenue Interest expense Other operating expenses Profit before tax Tax expense Profit for the year (100) (290) 200 240 (82) 600 (170) 430 (12) (28) 200 (50) 150 Retained earnings at 1/1/20X1 Profit for the year Dividends paid Retained earnings at 31/12/20X1 5000 700 430 (250) 880 5000 600 150 (100) 650 ABC Ltd 5000 XYZ Ltd S000 590 250 840 200 820 1020 250 4500 200 Assets Current assets Inventory Other current assets Total current assets Non-current assets Loan receivable Land Buildings Accumulated depreciation Investment in XYZ Ltd Total non-current assets Total assets Non-current liabilities Borrowings payable Other non-current liabilities Total non-current liabilities Total liabilities Net assets 1400 100 (40) (40) 1800 6700 7550 1460 2480 - 670 670 670 6880 250 180 430 430 2050 6000 Equity Issued capital General reserve Retained eamings Total equity 1000 400 650 2050 880 6880 Issued capital General Reserve Retained eamings 1/1/20x0 Total equity $ 1000000 400000 200000 1600000 XYZ Ltd 5000 430 ABC Ltd 5000 1080 (400) (700) 590 570 12 100 Sales revenue Opening inventory 1/1/20X1 Purchases Closing inventory 31/12/20X1 Gross profit Interest revenue Dividend revenue Interest expense Other operating expenses Profit before tax Tax expense Profit for the year (100) (290) 200 240 (82) 600 (170) 430 (12) (28) 200 (50) 150 Retained earnings at 1/1/20X1 Profit for the year Dividends paid Retained earnings at 31/12/20X1 5000 700 430 (250) 880 5000 600 150 (100) 650 ABC Ltd 5000 XYZ Ltd S000 590 250 840 200 820 1020 250 4500 200 Assets Current assets Inventory Other current assets Total current assets Non-current assets Loan receivable Land Buildings Accumulated depreciation Investment in XYZ Ltd Total non-current assets Total assets Non-current liabilities Borrowings payable Other non-current liabilities Total non-current liabilities Total liabilities Net assets 1400 100 (40) (40) 1800 6700 7550 1460 2480 - 670 670 670 6880 250 180 430 430 2050 6000 Equity Issued capital General reserve Retained eamings Total equity 1000 400 650 2050 880 6880Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started