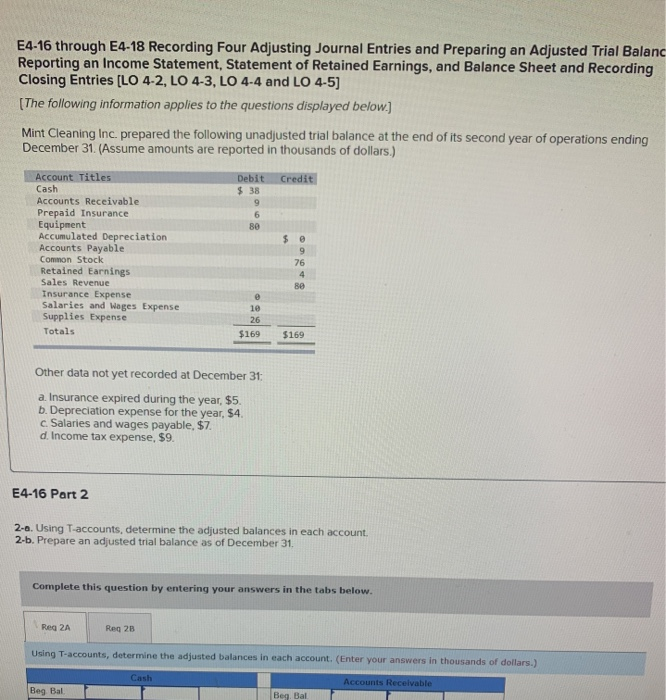

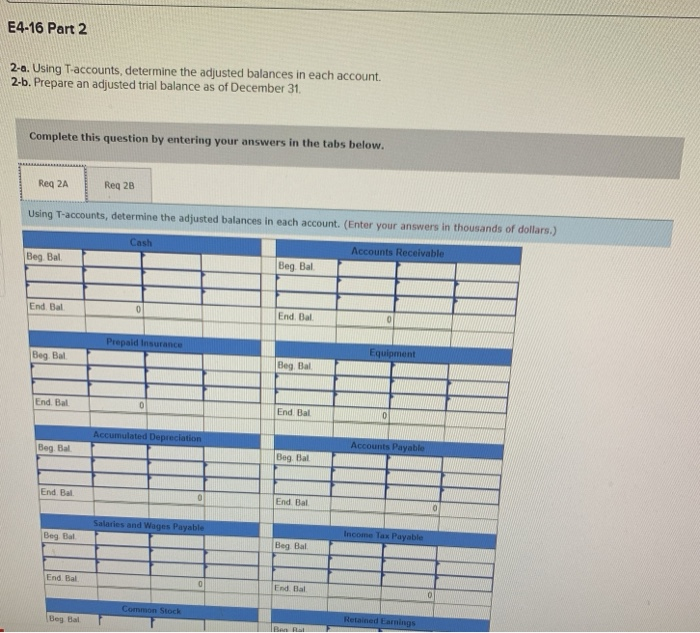

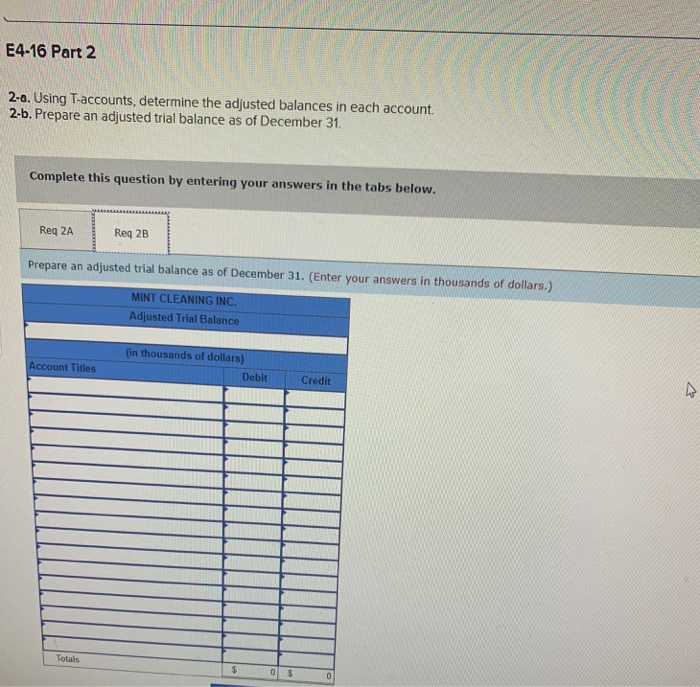

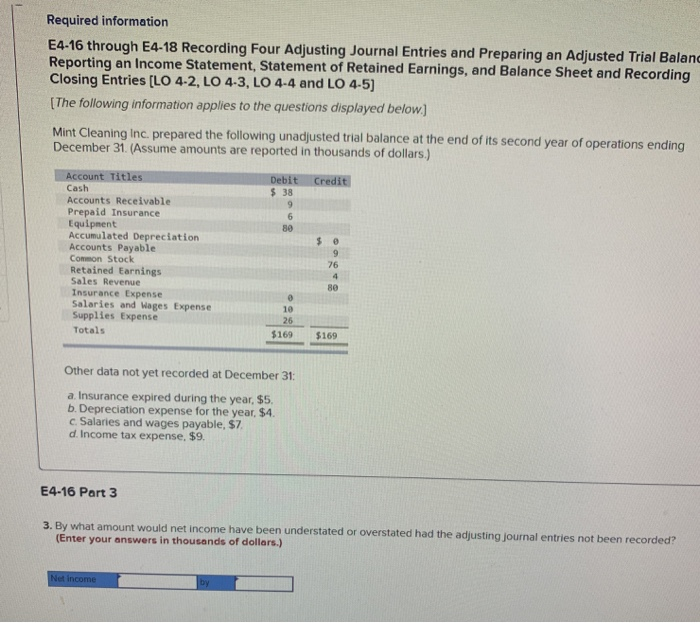

E4-16 through E4-18 Recording Four Adjusting Journal Entries and Preparing an Adjusted Trial Balanc Reporting an Income Statement, Statement of Retained Earnings, and Balance Sheet and Recording Closing Entries [LO 4-2, LO 4-3, LO 4-4 and LO 4-5) (The following information applies to the questions displayed below.) Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations ending December 31. (Assume amounts are reported in thousands of dollars.) Credit Debit $ 38 9 6 80 Account Titles Cash Accounts Receivable Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Sales Revenue Insurance Expense Salaries and Wages Expense Supplies Expense Totals $ 0 9 76 4 80 10 26 $169 $169 Other data not yet recorded at December 31 a Insurance expired during the year, $5. b. Depreciation expense for the year, $4. c. Salaries and wages payable, $7. d. Income tax expense, $9. E4-16 Part 2 2-a. Using T-accounts, determine the adjusted balances in each account. 2-b. Prepare an adjusted trial balance as of December 31. Complete this question by entering your answers in the tabs below. Reg 2 Reg 28 Using T-accounts, determine the adjusted balances in each account. (Enter your answers in thousands of dollars.) Cash Accounts Receivable Beg Bal Beg Bal E4-16 Part 2 2-a. Using T-accounts, determine the adjusted balances in each account. 2b. Prepare an adjusted trial balance as of December 31, Complete this question by entering your answers in the tabs below. Reg 2A Reg 28 Using T-accounts, determine the adjusted balances in each account. (Enter your answers in thousands of dollars.) Cash Accounts Receivable Beg Bal Beg Bal End Bal 0 End Bal Prepaid Insurance Beg Bal Equipment Beg Bal End. Bal 0 End Bal 0 Accumulated Depreciation Beg Bal Accounts Payable Beg Bal End Bal 0 End Bal 0 Salaries and Wages Payable Beg Bal Income Tax Payable Beg Bal End Bal End. Bal 0 Common Stock Bey Ball Retained Langs E4-16 Part 2 2-a. Using T-accounts, determine the adjusted balances in each account. 2-b. Prepare an adjusted trial balance as of December 31. Complete this question by entering your answers in the tabs below. Reg 2A Req 2B Prepare an adjusted trial balance as of December 31. (Enter your answers in thousands of dollars.) MINT CLEANING INC. Adjusted Trial Balance (in thousands of dollars) Debit Account Titles Credit Totals 05 0 Required information E4-16 through E4-18 Recording Four Adjusting Journal Entries and Preparing an Adjusted Trial Balanc Reporting an Income Statement, Statement of Retained Earnings, and Balance Sheet and Recording Closing Entries [LO 4-2, LO 4-3, LO 4.4 and LO 4-5) [The following information applies to the questions displayed below.) Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations ending December 31. (Assume amounts are reported in thousands of dollars.) Account Titles Debit Credit Cash $ 38 Accounts Receivable Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Sales Revenue 80 Insurance Expense Salaries and Wages Expense Supplies Expense 26 Totals $169 $169 9 6 80 $ 9 76 4 0 10 Other data not yet recorded at December 31: a. Insurance expired during the year, $5. b. Depreciation expense for the year, $4. c. Salaries and wages payable, $7 d. Income tax expense. $9. E4-16 Part 3 3. By what amount would net income have been understated or overstated had the adjusting journal entries not been recorded? (Enter your answers in thousands of dollars.) Net Income by