Answered step by step

Verified Expert Solution

Question

1 Approved Answer

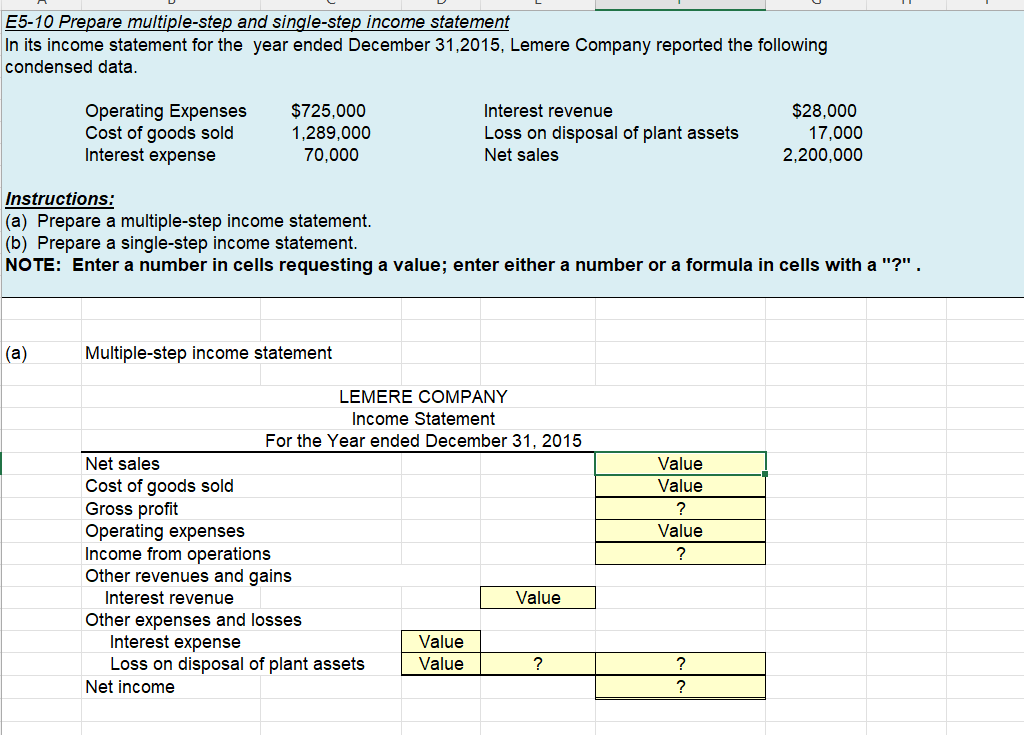

E5-10 Prepare multiple-step and single-step income statement In its income statement for the year ended December 31,2015, Lemere Company reported the following condensed data.

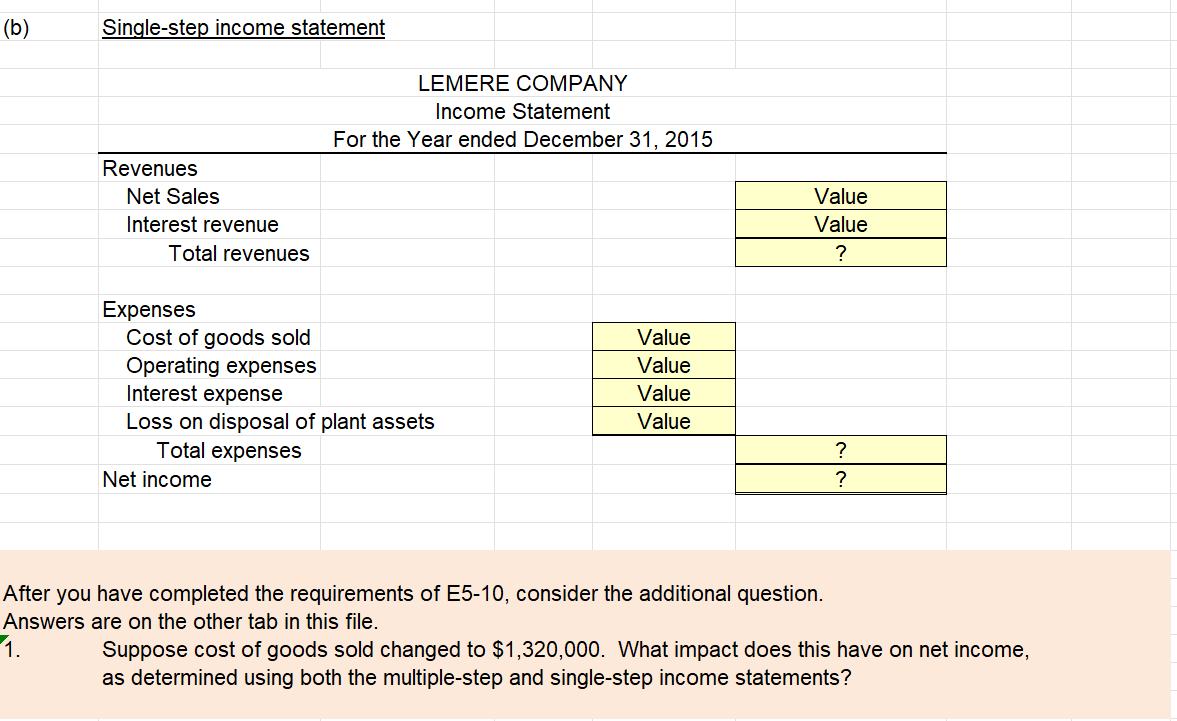

E5-10 Prepare multiple-step and single-step income statement In its income statement for the year ended December 31,2015, Lemere Company reported the following condensed data. Operating Expenses Cost of goods sold $725,000 1,289,000 Interest revenue $28,000 Interest expense 70,000 Loss on disposal of plant assets Net sales 17,000 2,200,000 Instructions: (a) Prepare a multiple-step income statement. (b) Prepare a single-step income statement. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". (a) Multiple-step income statement LEMERE COMPANY Income Statement For the Year ended December 31, 2015 Net sales Cost of goods sold Value Value Gross profit Operating expenses Income from operations Other revenues and gains ? Value ? Interest revenue Value Other expenses and losses Interest expense Value Loss on disposal of plant assets Value ? ? ? Net income (b) Single-step income statement Revenues Net Sales Interest revenue Total revenues Expenses LEMERE COMPANY Income Statement For the Year ended December 31, 2015 Value Value ? Cost of goods sold Value Operating expenses Value Interest expense Value Loss on disposal of plant assets Value Total expenses ? Net income ? After you have completed the requirements of E5-10, consider the additional question. Answers are on the other tab in this file. 1. Suppose cost of goods sold changed to $1,320,000. What impact does this have on net income, as determined using both the multiple-step and single-step income statements?

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Multiplestep income statement LEMERE COMPANY Income Statement For the Year ended December 31 2015 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started