Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E5-1B how do you do it? At year-end, SourceOne estimates there remain $700,000 of sales (with a cost to SourceOne of $245.000) that are still

E5-1B how do you do it?

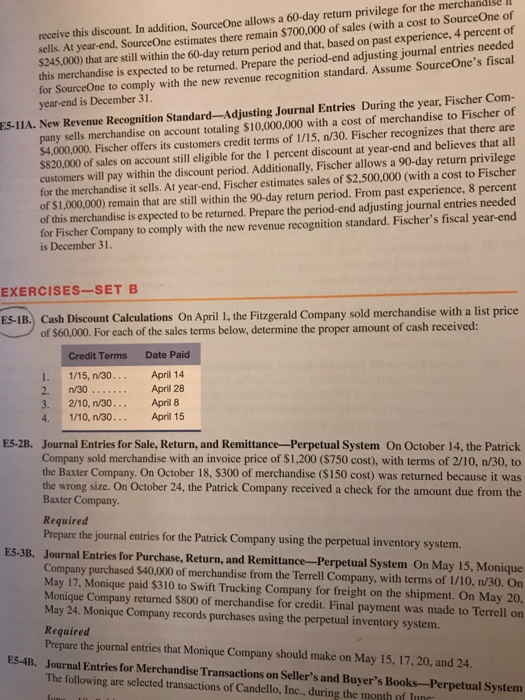

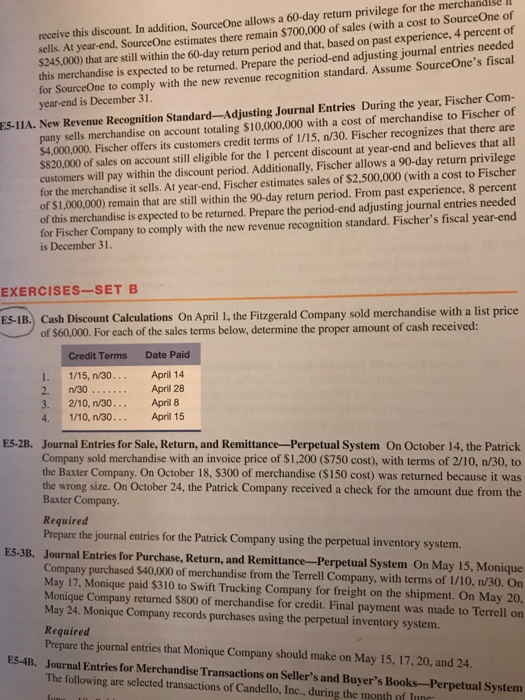

At year-end, SourceOne estimates there remain $700,000 of sales (with a cost to SourceOne of $245.000) that are still within the 60-day returm period and that, based on past experience, 4 percent of merchandise is expected to be returned. Prepare the period-end adjusting journal entries needed rceOne to comply with the new revenue recognition standard. Assume SourceOne's fiscal receive this discount. In addition, SourceOne allows a 60-day return privilege for the merchandise ES-11A. New Revenue Recognition Standard-Adjusting Journal Entries During the year, Fischer Com- pany sells merchandise on account totaling $10,000,000 with a cost of merchandise to Fischer of $4,000,000. Fischer offers its customers credit terms of 1/15n/30. Fischer recognizes that there are $820,000 of sales on account still eligible for the 1 percent discount at year-end and believes that all customers will pay within the discount period. Additionally. Fischer allows a 90-day return privilege for the merchandise it sells. At year-end, Fischer estimates sales of $2,500,000 (with a cost to Fischer of $1,000,000) remain that are still within the 90-day return period. From past experience, 8 percent of this merchandise is expected to be returned. Prepare the period-end adjusting journal entries needed for Fischer Company to comply with the new revenue recognition standard. Fischer's fiscal year-end year-end is December 31 is December 31 EXERCISES-SET B ES-1B. Cash Discount Calculations On April I, the Fitzgerald Company sold merchandise with a list price f $60,000. For each of the sales terms below, determine the proper amount of cash received Credit Terms Date Paid 1. 1/15, n/30. 2. n/30 3. 2/10, n/30 4. 1/10, n/30 April 14 April 28 April 8 April 15 E5-2B. Journal Entries for Sale, Return, and Remittance-Perpetual System On October 14, the Patrick Company sold merchandise with an invoice price of $1,200 ($750 cost), with terms of 2/10, n/30, to the Baxter Company. On October 18, $300 of merchandise ($150 cost) was returned because it was he wrong size. On October 24, the Patrick Company received a check for the amount due from the Baxter Company Required Prepare the journal entries for the Patrick Company using the perpetual inventory system. ES-3B. Journal Entries for Purchase, Return, and Remittance-Perpetual System On May 15, Monique Company purchased $40,000 of merchandise from the Terrell Company, with terms of 1/10, n/30. On May 17, Monique paid $310 to Swift Trucking Company for freight on the shipment. On May 20 nique Company returned $800 of merchandise for credit. Final payment was made to Terrell o 4. Monique Company records purchases using the perpetual inventory systen Required Prepare the journal entries that Monique Company should make on May 15, 17, 20, and 24 ES-4B. Journal Entries for Merchandise Transactions on Seller's and Buyer's Books-Perpetual System The following are selected transactions of Candello, Inc., during the month of lunr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started