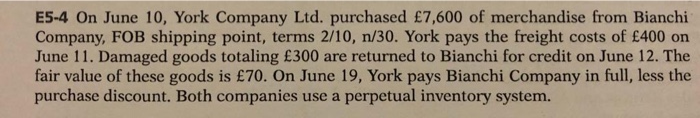

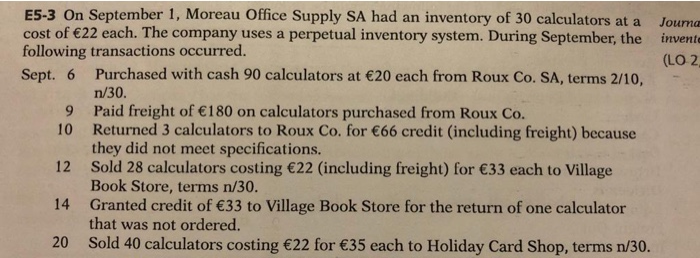

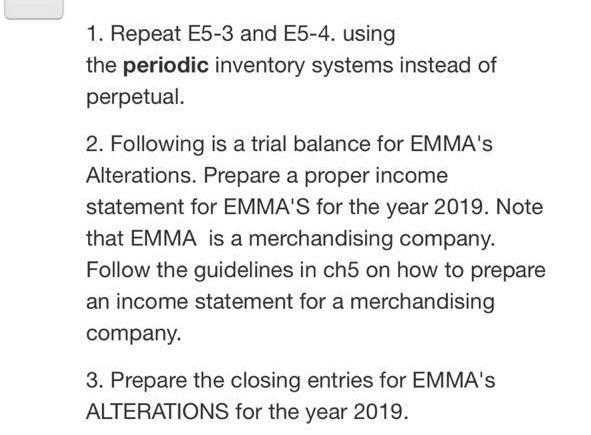

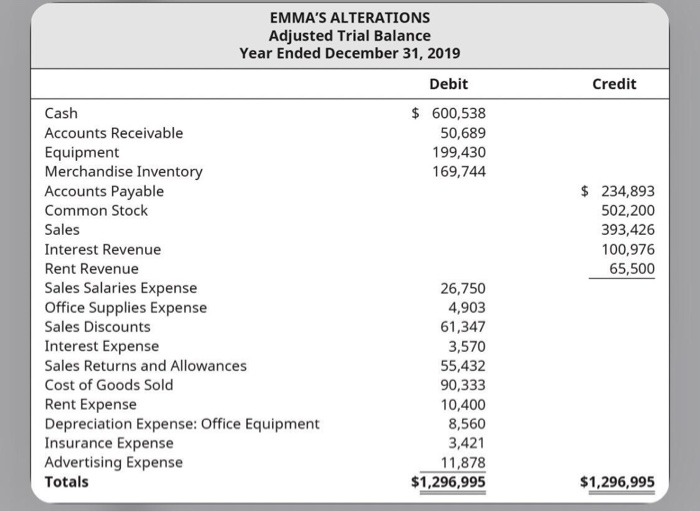

E5-4 On June 10, York Company Ltd. purchased 7,600 of merchandise from Bianchi Company, FOB shipping point, terms 2/10, n/30. York pays the freight costs of 400 on June 11. Damaged goods totaling 300 are returned to Bianchi for credit on June 12. The fair value of these goods is 70. On June 19, York pays Bianchi Company in full, less the purchase discount. Both companies use a perpetual inventory system. invente E5-3 On September 1, Moreau Office Supply SA had an inventory of 30 calculators at a Journa cost of 22 each. The company uses a perpetual inventory system. During September, the following transactions occurred. (LO 2 Sept. 6 Purchased with cash 90 calculators at 20 each from Roux Co. SA, terms 2/10, n/30 9 Paid freight of 180 on calculators purchased from Roux Co. 10 Returned 3 calculators to Roux Co. for 66 credit (including freight) because they did not meet specifications. 12 Sold 28 calculators costing 22 (including freight) for 33 each to Village Book Store, terms n/30. 14 Granted credit of 33 to Village Book Store for the return of one calculator that was not ordered. 20 Sold 40 calculators costing 22 for 35 each to Holiday Card Shop, terms n/30. 1. Repeat E5-3 and E5-4. using the periodic inventory systems instead of perpetual. 2. Following is a trial balance for EMMA'S Alterations. Prepare a proper income statement for EMMA'S for the year 2019. Note that EMMA is a merchandising company. Follow the guidelines in ch5 on how to prepare an income statement for a merchandising company 3. Prepare the closing entries for EMMA'S ALTERATIONS for the year 2019. Credit EMMA'S ALTERATIONS Adjusted Trial Balance Year Ended December 31, 2019 Debit Cash $ 600,538 Accounts Receivable 50,689 Equipment 199,430 Merchandise Inventory 169,744 Accounts Payable Common Stock Sales Interest Revenue Rent Revenue Sales Salaries Expense 26,750 Office Supplies Expense 4,903 Sales Discounts 61,347 Interest Expense 3,570 Sales Returns and Allowances 55,432 Cost of Goods Sold 90,333 Rent Expense 10,400 Depreciation Expense: Office Equipment 8,560 Insurance Expense 3,421 Advertising Expense 11,878 Totals $1,296,995 $ 234,893 502,200 393,426 100,976 65,500 $1,296,995 E5-4 On June 10, York Company Ltd. purchased 7,600 of merchandise from Bianchi Company, FOB shipping point, terms 2/10, n/30. York pays the freight costs of 400 on June 11. Damaged goods totaling 300 are returned to Bianchi for credit on June 12. The fair value of these goods is 70. On June 19, York pays Bianchi Company in full, less the purchase discount. Both companies use a perpetual inventory system. invente E5-3 On September 1, Moreau Office Supply SA had an inventory of 30 calculators at a Journa cost of 22 each. The company uses a perpetual inventory system. During September, the following transactions occurred. (LO 2 Sept. 6 Purchased with cash 90 calculators at 20 each from Roux Co. SA, terms 2/10, n/30 9 Paid freight of 180 on calculators purchased from Roux Co. 10 Returned 3 calculators to Roux Co. for 66 credit (including freight) because they did not meet specifications. 12 Sold 28 calculators costing 22 (including freight) for 33 each to Village Book Store, terms n/30. 14 Granted credit of 33 to Village Book Store for the return of one calculator that was not ordered. 20 Sold 40 calculators costing 22 for 35 each to Holiday Card Shop, terms n/30. 1. Repeat E5-3 and E5-4. using the periodic inventory systems instead of perpetual. 2. Following is a trial balance for EMMA'S Alterations. Prepare a proper income statement for EMMA'S for the year 2019. Note that EMMA is a merchandising company. Follow the guidelines in ch5 on how to prepare an income statement for a merchandising company 3. Prepare the closing entries for EMMA'S ALTERATIONS for the year 2019. Credit EMMA'S ALTERATIONS Adjusted Trial Balance Year Ended December 31, 2019 Debit Cash $ 600,538 Accounts Receivable 50,689 Equipment 199,430 Merchandise Inventory 169,744 Accounts Payable Common Stock Sales Interest Revenue Rent Revenue Sales Salaries Expense 26,750 Office Supplies Expense 4,903 Sales Discounts 61,347 Interest Expense 3,570 Sales Returns and Allowances 55,432 Cost of Goods Sold 90,333 Rent Expense 10,400 Depreciation Expense: Office Equipment 8,560 Insurance Expense 3,421 Advertising Expense 11,878 Totals $1,296,995 $ 234,893 502,200 393,426 100,976 65,500 $1,296,995