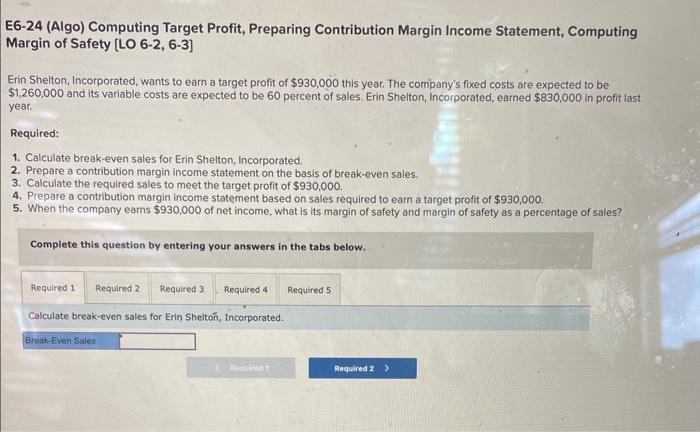

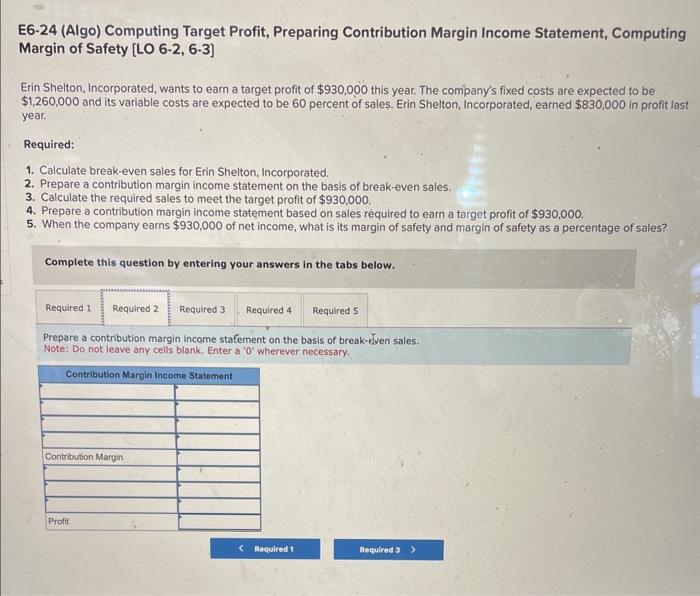

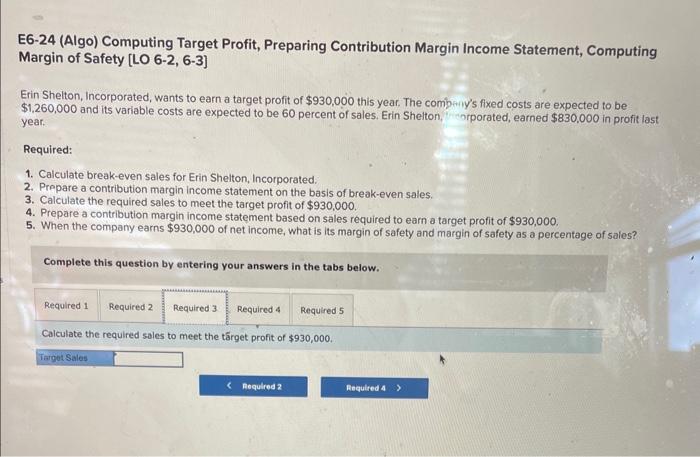

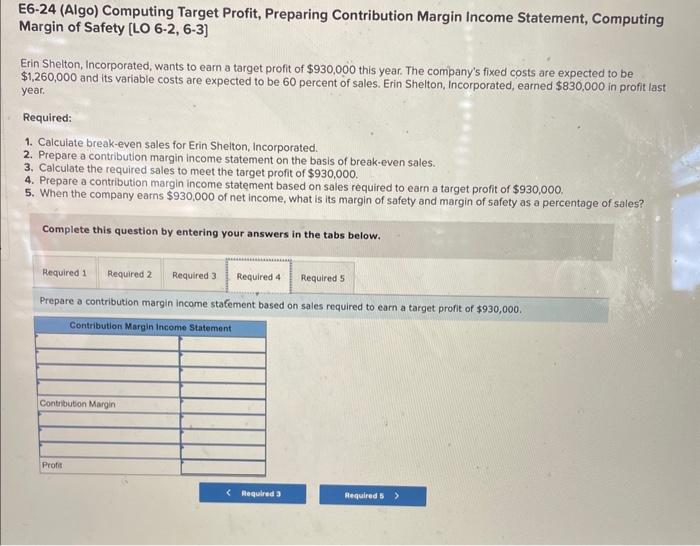

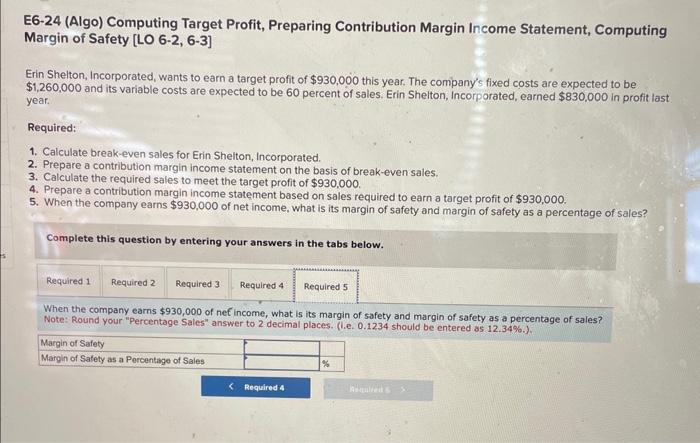

E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [ LO 6-2, 6-3] Erin Shelton, Incorporated, wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,260,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Incorporated, earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated, 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. 5. When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Calculate break-even sales for Erin Shelton, Incorporated. E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [ LO 6-2, 6-3] Erin Shelton, Incorporated, wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,260,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Incorporated, earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. 5. When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of saies? Complete this question by entering your answers in the tabs below. Prepare a contribution margin income stafement on the basis of break-elven sales. Note: Do not leave any cells blank. Enter a ' 0 ' wherever necessary. E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO62,63] Erin Shelton, Incorporated, wants to earn a target profit of $930,000 this year. The combeny's fixed costs are expected to be $1,260,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, , orporated, earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. 5. When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Calculate the required soles to meet the tafrget profit of $930,000. E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3] Erin Shelton, Incorporated, wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,260,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Incorporated, earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. 5. When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Prepare a contribution margin income stafement based on sales required to earn a target profit of $930,000. E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3] Erin Shelton, Incorporated, wants to earn a target profit of $930,000 this year. The company's fixed costs are expected to be $1,260,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Incorporated, earned $830,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $930,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $930,000. 5. When the company earns $930,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. When the company earns $930,000 of nef income, what is its margin of safety and margin of safety as a percentage of sales? Note: Round your "Percentage Sales" answer to 2 decimal places. (i.e. 0.1234 should be entered as 12.34%.)