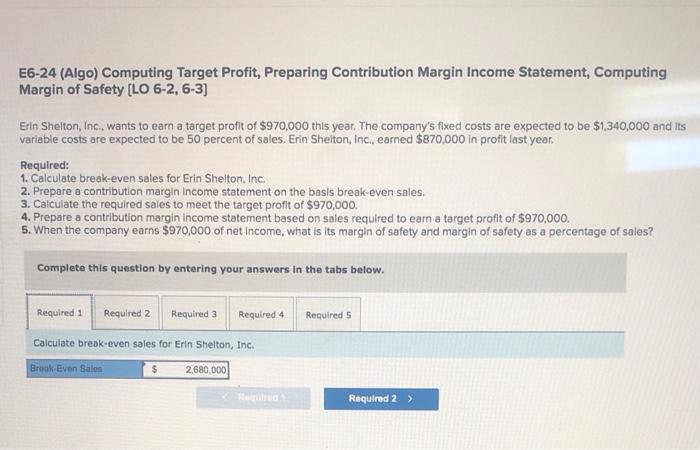

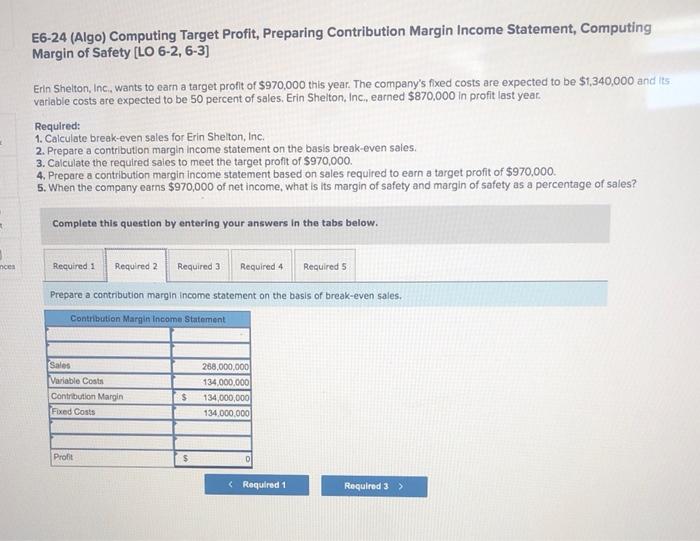

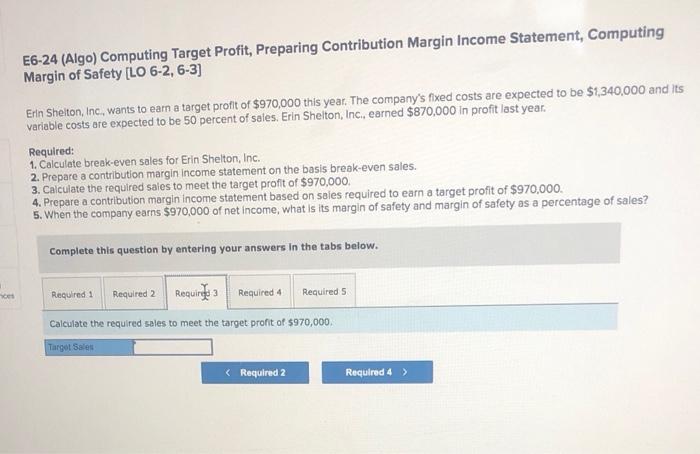

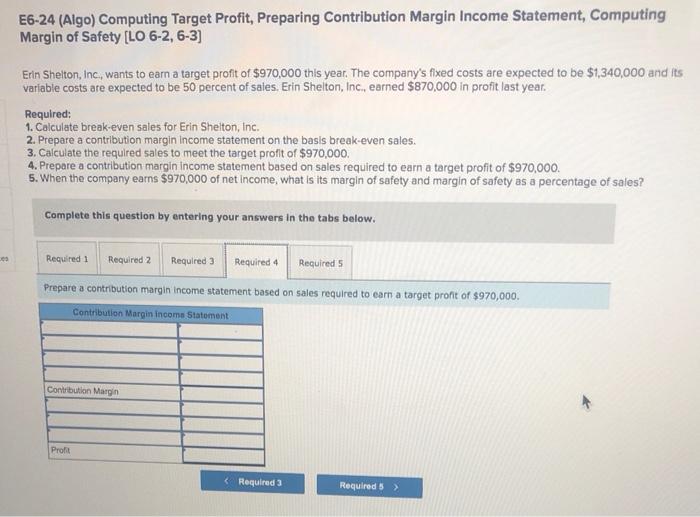

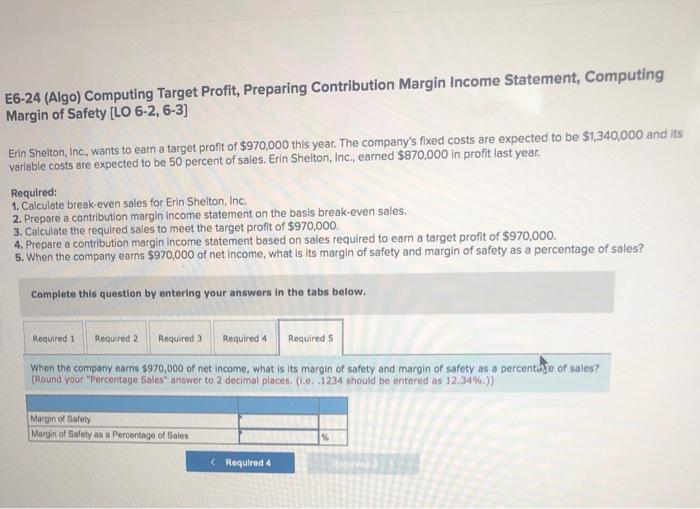

E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3) Erin Shelton, Inc. wants to earn a target profit of $970,000 this year. The company's fixed costs are expected to be $1,340,000 and its variable costs are expected to be 50 percent of sales. Erin Shelton, Inc., earned $870,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $970,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $970,000 5. When the company earns $970,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 5 Required 1 Required 2 Required 3 Required 4 Calculate break-even sales for Erin Shelton, Inc. Break-Even Sales 2,680,000 HO Required 2 > E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety (LO 6-2, 6-3) Erin Shelton, Inc., wants to earn a target profit of $970,000 this year. The company's fixed costs are expected to be $1,340,000 and its variable costs are expected to be 50 percent of sales, Erin Shelton, Inc, earned $870,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin Income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $970,000 4. Prepare a contribution margin Income statement based on sales required to earn a target profit of $970,000. 5. When the company earns $970,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. nces Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a contribution margin income statement on the basis of break-even sales. Contribution Margin Income Statement Sales Variable Costs Contribution Margin Fixed Costs 258.000.000 134,000,000 134,000,000 134.000.000 $ Profit $ 0 E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3) Erin Shelton, Inc., wants to earn a target profit of $970,000 this year. The company's fixed costs are expected to be $1,340,000 and its variable costs are expected to be 50 percent of sales, Erin Shelton, Inc., earned $870,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin Income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $970,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $970,000. 5. When the company earns $970,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Requirge Required 4 Required 5 Calculate the required sales to meet the target profit of $970,000 Targot Sales E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3) Erin Shelton, Inc, wants to earn a target profit of $970,000 this year. The company's fixed costs are expected to be $1,340,000 and its variable costs are expected to be 50 percent of sales. Erin Shelton, Inc., earned $870,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $970,000. 4. Prepare a contribution margin Income statement based on sales required to earn a target profit of $970,000. 5. When the company earns $970,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required Prepare a contribution margin income statement based on sales required to earn a target profit of $970,000. Contribution Margin income Statement Contribution Margin Prot E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3) Erin Shelton, Inc., wants to earn a target profit of $970,000 this year. The company's fixed costs are expected to be $1,340,000 and its variable costs are expected to be 50 percent of sales. Erin Shelton, Inc., earned $870,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $970,000 4. Prepare a contribution margin Income statement based on sales required to earn a target profit of $970,000. 5. When the company earns $970,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 When the company carns $970,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? (Round your "Percentage Sales" answer to 2 decimal places. (l. 1231 should be entered os 12.34%) Margin of Safety Margin of Safety as a Percentage of Sales %