Answered step by step

Verified Expert Solution

Question

1 Approved Answer

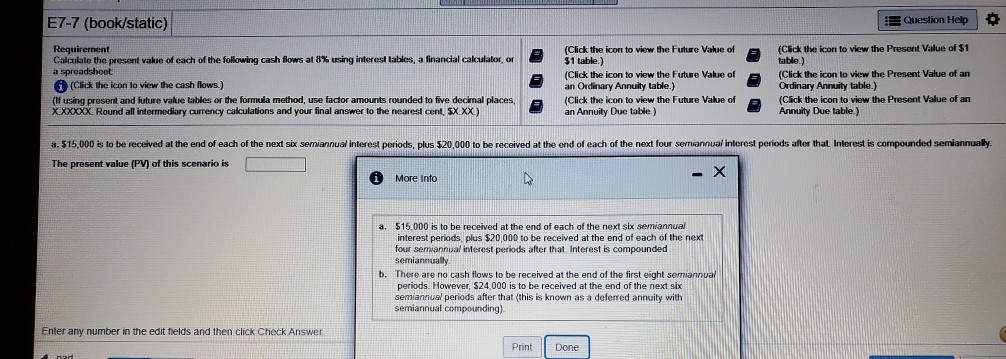

E7-7 (book/static) Question Help E Requirement Calculate the present value of each of the following cash flows at 8% using interes tables, a financial calculator,

E7-7 (book/static) Question Help E Requirement Calculate the present value of each of the following cash flows at 8% using interes tables, a financial calculator, or a spreadsheet i (Click the icon lo view the cash flows.) (If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, XXXXXX. Round all intermediary currency calculations and your final answer to the nearest cent, SX XX) (Click the icon to view the Future Value of $1 table.) (Click the icon to view the Future Value of an Ordinary Annuity table.) (Click the icon to view the Future Value of an Annuity Due table) (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of an Ordinary Annuity table.) (Click the icon to view the Present Value of an Annuity Due table.) E a $15,000 is to be received at the end of each of the next six semiannual interest periods, plus $20,000 to be received at the end of each of the next four semiannual interest periods after that. Interest is compounded semiannually. The present value (PV) of this scenario is More Info - X $15.000 is to be received at the end of each of the next six semiannual interest periods, plus $20,000 to be received at the end of each of the next four semiannual interest periods after that Interest is compounded semiannually There are no cash flows to be received at the end of the first eight semiannual periods. However, S24.000 is to be received at the end of the next six semiannual periods after that this is known as a deferred annuity with semiannual compounding) Enter any number in the edit fields and then click Check Answer Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started