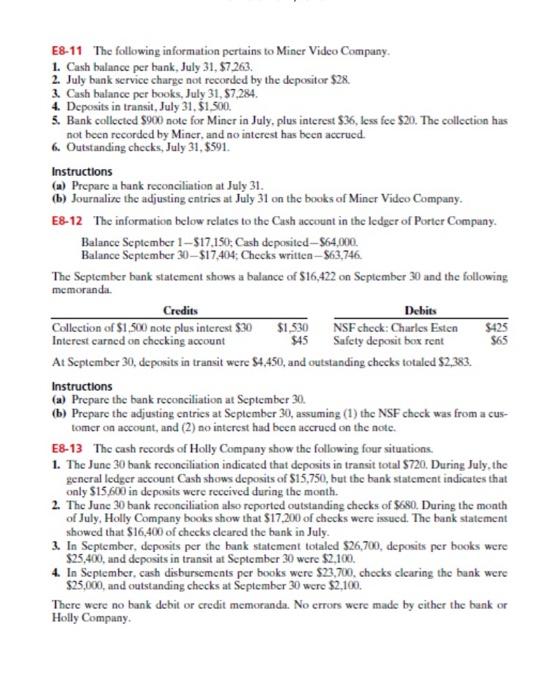

E8-11 The following information pertains to Miner Video Company. 1. Cash balance per bank, July 31, 7.263, 2. July bank service charge not recorded by the depositor $28. 3. Cash bulance per books, July 31,87,284. 4. Deposits in transit, July 31. $1.500. 5. Bank collected $900 note for Miner in July, plus interest $36, less fee $20. The collection has not been recorded by Miner, and no interest has been accrued. 6. Outstanding checks, July 31, $591 Instructions (a) Prepare a bank reconciliation at July 31. b) Journalize the adjusting entries at July 31 on the books of Miner Video Company. E8-12 The information below relates to the Cash account in the ledger of Porter Company. Balance September 1-517.150; Cash deposited - $64,000. Balance September 30-$17.404; Checks written -S63,746. The September bunk statement shows a balance of $16,422 on September 30 and the following memoranda Credits Debits Collection of $1,500 note plus interest $30 $1,530 NSF check: Charles Esten $425 Interest carned on checking account $45 Safety deposit box rent At September 30, deposits in transit were $4,450, and outstanding checks totaled $2,383 Instructions (a) Prepare the bank reconciliation at September 30. (b) Prepare the adjusting entries at September 30, assuming (1) the NSF check was from a cus tomer on account, and (2) ao interest had been accrued on the note. E8-13 The cash records of Holly Company show the following four situations 1. The June 30 bank reconciliation indicated that deposits in transit total $720. During July, the general ledger account Cash shows deposits of $15,750, but the bank statement indicates that only $15.600 in deposits were received during the month. 2. The June 30 bank reconciliation also reported outstanding checks of 5680. During the month of July. Holly Company books show that $17.200 of checks were issued. The bank statement showed that $16,400 of checks cleared the bank in July 3. In September, deposits per the bank statement totaled $26,700, deposits per books were $25,400, and deposits in transit at September 30 were $2,100. 4. In September, cash disbursements per books were $23,700, checks clearing the bank were $25,000, and outstanding checks at September 30 were $2,100. There were no bank debit or credit memoranda. No errors were made by cither the bank or Holly Company S65 E8-11 The following information pertains to Miner Video Company. 1. Cash balance per bank, July 31, 7.263, 2. July bank service charge not recorded by the depositor $28. 3. Cash bulance per books, July 31,87,284. 4. Deposits in transit, July 31. $1.500. 5. Bank collected $900 note for Miner in July, plus interest $36, less fee $20. The collection has not been recorded by Miner, and no interest has been accrued. 6. Outstanding checks, July 31, $591 Instructions (a) Prepare a bank reconciliation at July 31. b) Journalize the adjusting entries at July 31 on the books of Miner Video Company. E8-12 The information below relates to the Cash account in the ledger of Porter Company. Balance September 1-517.150; Cash deposited - $64,000. Balance September 30-$17.404; Checks written -S63,746. The September bunk statement shows a balance of $16,422 on September 30 and the following memoranda Credits Debits Collection of $1,500 note plus interest $30 $1,530 NSF check: Charles Esten $425 Interest carned on checking account $45 Safety deposit box rent At September 30, deposits in transit were $4,450, and outstanding checks totaled $2,383 Instructions (a) Prepare the bank reconciliation at September 30. (b) Prepare the adjusting entries at September 30, assuming (1) the NSF check was from a cus tomer on account, and (2) ao interest had been accrued on the note. E8-13 The cash records of Holly Company show the following four situations 1. The June 30 bank reconciliation indicated that deposits in transit total $720. During July, the general ledger account Cash shows deposits of $15,750, but the bank statement indicates that only $15.600 in deposits were received during the month. 2. The June 30 bank reconciliation also reported outstanding checks of 5680. During the month of July. Holly Company books show that $17.200 of checks were issued. The bank statement showed that $16,400 of checks cleared the bank in July 3. In September, deposits per the bank statement totaled $26,700, deposits per books were $25,400, and deposits in transit at September 30 were $2,100. 4. In September, cash disbursements per books were $23,700, checks clearing the bank were $25,000, and outstanding checks at September 30 were $2,100. There were no bank debit or credit memoranda. No errors were made by cither the bank or Holly Company S65