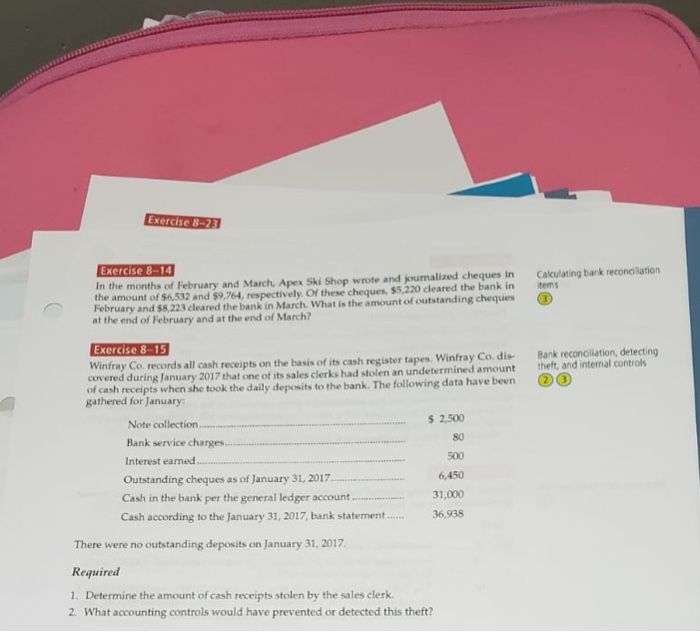

E8-15

Een 5 2500 1,2007, k A juryconvited the trasurer of GTX Company of sneaing cash tom the conpany Over a Acplingieal controls toe Oree year peril the teasubr alnpy ok almost 5130,000 ad tempted to cower the bane re teh by manipulating the bank ecncilation Reguid What s a lkely wy thut a person would manipulate a bank rwonclbation to of the sale, the cash ed, and ary dange neturned to yos Suppose the regier a c co pary bnk Reeied Wrne a meme to Tent Simen, the owner enify the internal costnod weak to shral cash State hew to poevent such a thet endos a cuatne but keeps re recced of the slies trensactiora At the end of tw detk auta the ash in the 5eparr and giv it to the cashier for deposit n the the scouetant for Cary's, venites ect of manchandis and then preparen, sigres, and mals the cheque to the vendae of monchandie and then prepares, signs, and s pynets Repaie Mently de inermal control wekress over cash payments in this scenaria ould the busincss do to coect the Chapter&nenal Central and Cash 485 2 Discuss the rile accounting plays in tis stin Chapter 8 htenal Conol and Cav Exercise 8-14 amount of $6,532 and $9,764, respectively. Of these cheques, $5,220 cleared the bank in tems February and $8,223 cleared the bank in March. What is the amount of outstanding cheques In the months of February and March, Apex Ski Shop wrote and journalized cheques in Calculating bak reconc/lation at the end of February and at the end of March? Exercise 8-15 Winfray Co. records all cash receipts on the basis of its cash register tapes Winfray Co.dis Bank reconcilation, detecting of cash receipts when she took the daily deposits to the bank. The following data have beeno gathered for January vered during January 2017 that one of its sales clerks had stolen an undetermined amount theft, and internal controls $2,500 80 500 6,450 31,000 36,938 Note collection Bank service charges Interest earned Outstanding cheques as of January 31, 2017 Cash in the bank per the general ledger account Cash according to the January 31, 2017, bank statement There were no outstanding deposits on January 31, 2017 Required 1. Determine the amount of cash receipts stolen by the sales clerk 2 What accounting controls would have prevented or detected this theft