Answered step by step

Verified Expert Solution

Question

1 Approved Answer

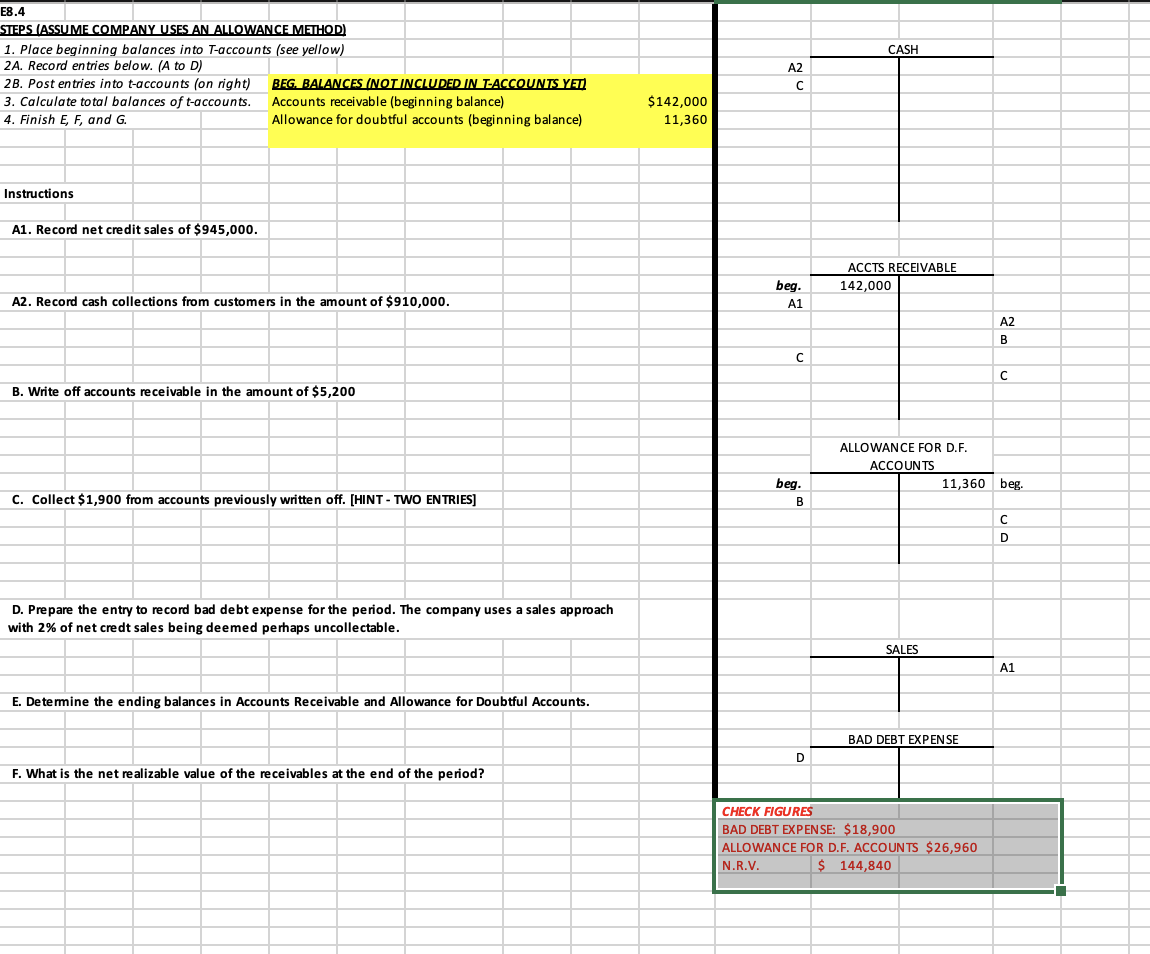

E8.4 STEPS (ASSUME COMPANY USES AN ALLOWANCE METHOD) 1. Place beginning balances into T-accounts (see yellow) 2A. Record entries below. (A to D) 2B.

E8.4 STEPS (ASSUME COMPANY USES AN ALLOWANCE METHOD) 1. Place beginning balances into T-accounts (see yellow) 2A. Record entries below. (A to D) 2B. Post entries into t-accounts (on right) 3. Calculate total balances of t-accounts. 4. Finish E, F, and G. Instructions A1. Record net credit sales of $945,000. A2. Record cash collections from customers in the amount of $910,000. B. Write off accounts receivable in the amount of $5,200 C. Collect $1,900 from accounts previously written off. [HINT-TWO ENTRIES] D. Prepare the entry to record bad debt expense for the period. The company uses a sales approach with 2% of net credt sales being deemed perhaps uncollectable. E. Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. F. What is the net realizable value of the receivables at the end of the period? BEG. BALANCES (NOT INCLUDED IN T-ACCOUNTS YET) Accounts receivable (beginning balance) Allowance for doubtful accounts (beginning balance) $142,000 11,360 CASH ACCTS RECEIVABLE 142,000 ALLOWANCE FOR D.F. ACCOUNTS SALES BAD DEBT EXPENSE D CHECK FIGURES BAD DEBT EXPENSE: $18,900 ALLOWANCE FOR D.F. ACCOUNTS $26,960 N.R.V. $ 144,840 A2 beg. A1 C beg. B A2 B 11,360 beg. D A1

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Account Title and Explanation Accounts Receivable AC To Sales AC To Record Net Credit S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started