Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E9.10 Fair Value Hedge: Put Options On September 1, 2021, American Metals Distribution (AMD) has an inventory of 10,000 pounds of copper that it

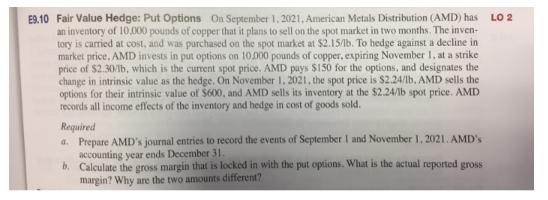

E9.10 Fair Value Hedge: Put Options On September 1, 2021, American Metals Distribution (AMD) has an inventory of 10,000 pounds of copper that it plans to sell on the spot market in two months. The inven- tory is carried at cost, and was purchased on the spot market at $2.15/lb. To hedge against a decline in market price, AMD invests in put options on 10000 pounds of copper, expiring November 1, at a strike price of $2.30/b, which is the current spot price. AMD pays $150 for the options, and designates the change in intrinsic value as the hedge. On November 1, 2021, the spot price is $2.24/lb, AMD sells the options for their intrinsic value of $600, and AMD sells its inventory at the $2.24/lb spot price. AMD records all income effects of the inventory and hedge in cost of goods sold. LO 2 Required a. Prepare AMD's journal entries to record the events of September I and November 1, 2021. AMD's accounting year ends December 31. b. Calculate the gross margin that is locked in with the put options. What is the actual reported gross margin? Why are the two amounts different?

Step by Step Solution

★★★★★

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

In the given question the company is buying a put option to protect against the fall in the price of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started