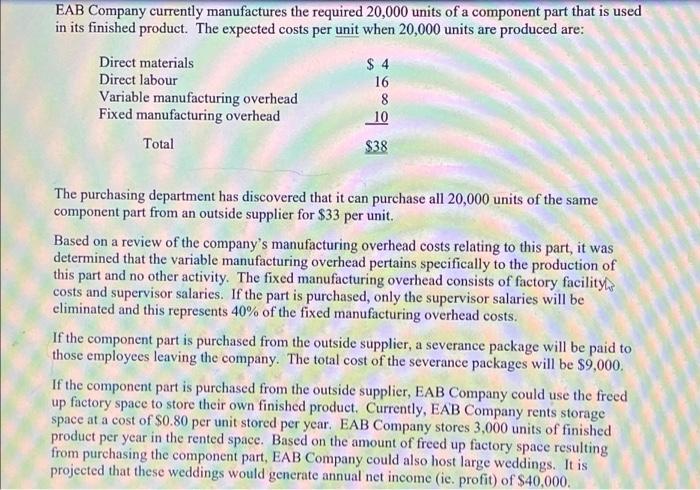

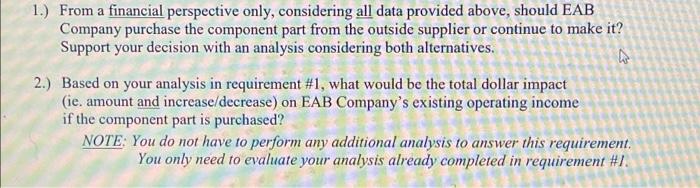

EAB Company currently manufactures the required 20,000 units of a component part that is used in its finished product. The expected costs per unit when 20,000 units are produced are: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Total $ 4 16 8 10 $38 The purchasing department has discovered that it can purchase all 20,000 units of the same component part from an outside supplier for $33 per unit. Based on a review of the company's manufacturing overhead costs relating to this part, it was determined that the variable manufacturing overhead pertains specifically to the production of this part and no other activity. The fixed manufacturing overhead consists of factory facility costs and supervisor salaries. If the part is purchased, only the supervisor salaries will be eliminated and this represents 40% of the fixed manufacturing overhead costs. If the component part is purchased from the outside supplier, a severance package will be paid to those employees leaving the company. The total cost of the severance packages will be $9,000. If the component part is purchased from the outside supplier, EAB Company could use the freed up factory space to store their own finished product. Currently, EAB Company rents storage space at a cost of $0.80 per unit stored per year. EAB Company stores 3,000 units of finished product per year in the rented space. Based on the amount of freed up factory space resulting from purchasing the component part, EAB Company could also host large weddings. It is projected that these weddings would generate annual net income (ie. profit) of $40,000. 1.) From a financial perspective only, considering all data provided above, should EAB Company purchase the component part from the outside supplier or continue to make it? Support your decision with an analysis considering both alternatives. w 2.) Based on your analysis in requirement #1, what would be the total dollar impact (ie, amount and increase/decrease) on EAB Company's existing operating income if the component part is purchased? NOTE: You do not have to perform any additional analysis to answer this requirement. You only need to evaluate your analysis already completed in requirement #1