Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each Hot Wheels has the following 'per unit' costs associated with it (in no specific order): *Utilities Costs (Lighting/Heat/AC): *Selling: *Production Line Assemblers: *Plastic

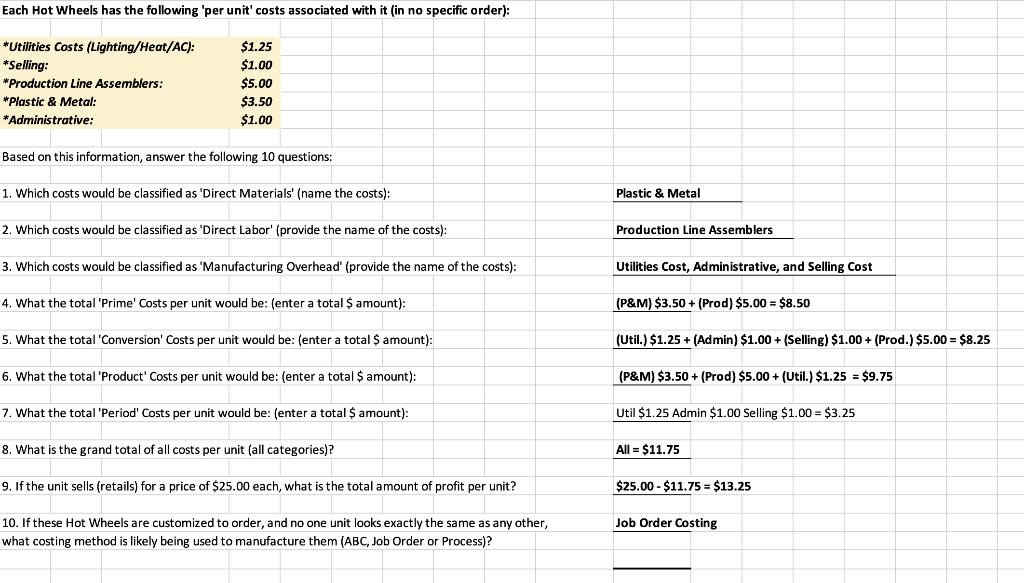

Each Hot Wheels has the following 'per unit' costs associated with it (in no specific order): *Utilities Costs (Lighting/Heat/AC): *Selling: *Production Line Assemblers: *Plastic & Metal: *Administrative: $1.25 $1.00 $5.00 $3.50 $1.00 Based on this information, answer the following 10 questions: 1. Which costs would be classified as 'Direct Materials' (name the costs): 2. Which costs would be classified as 'Direct Labor' (provide the name of the costs): 3. Which costs would be classified as 'Manufacturing Overhead' (provide the name of the costs): 4. What the total 'Prime' Costs per unit would be: (enter a total $ amount): 5. What the total 'Conversion' Costs per unit would be: (enter a total $ amount): 6. What the total 'Product' Costs per unit would be: (enter a total $ amount): 7. What the total 'Period' Costs per unit would be: (enter a total $ amount): 8. What is the grand total of all costs per unit (all categories)? 9. If the unit sells (retails) for a price of $25.00 each, what is the total amount of profit per unit? 10. If these Hot Wheels are customized to order, and no one unit looks exactly the same as any other, what costing method is likely being used to manufacture them (ABC, Job Order or Process)? Plastic & Metal Production Line Assemblers Utilities Cost, Administrative, and Selling Cost (P&M) $3.50+ (Prod) $5.00 - $8.50 (Util.) $1.25 + (Admin) $1.00+ (Selling) $1.00 + (Prod.) $5.00 = $8.25 (P&M) $3.50 + (Prod) $5.00+ (Util.) $1.25 = $9.75 Util $1.25 Admin $1.00 Selling $1.00 = $3.25 All = $11.75 $25.00 - $11.75 = $13.25 Job Order Costing

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Which costs would be classified as Direct Materials name the costs Direct materials refer to raw materials and components that are used to create a product In this case the direct materials cost wou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started