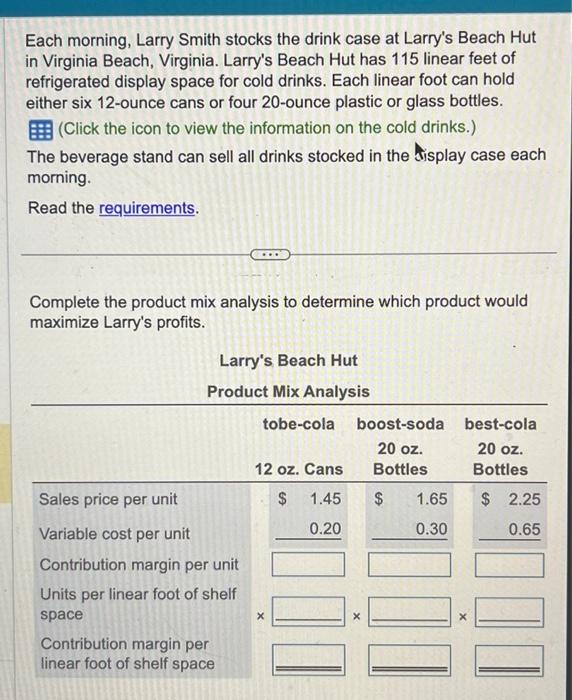

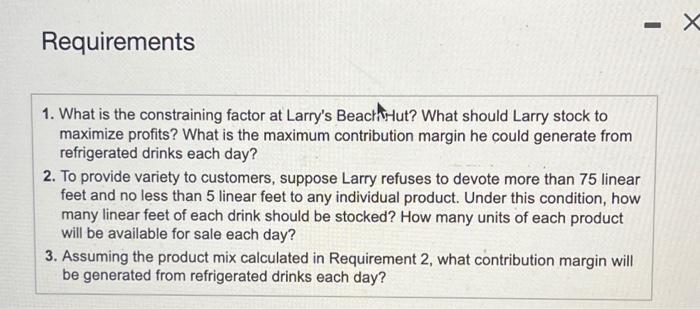

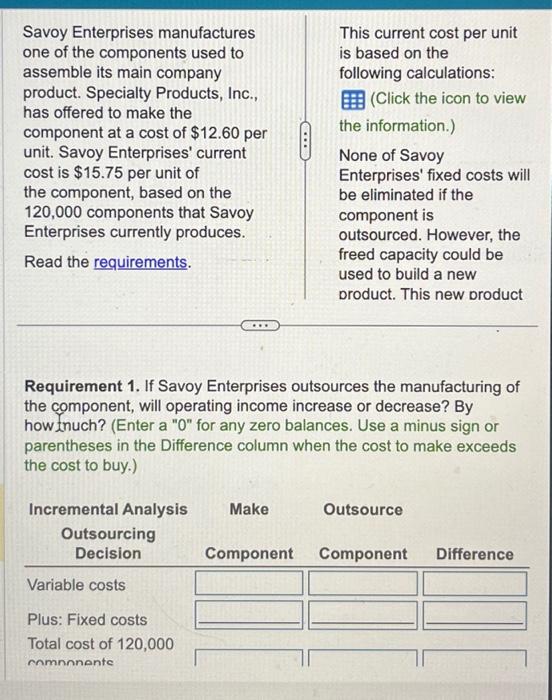

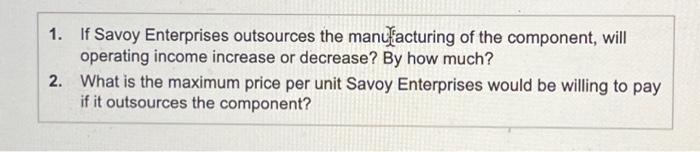

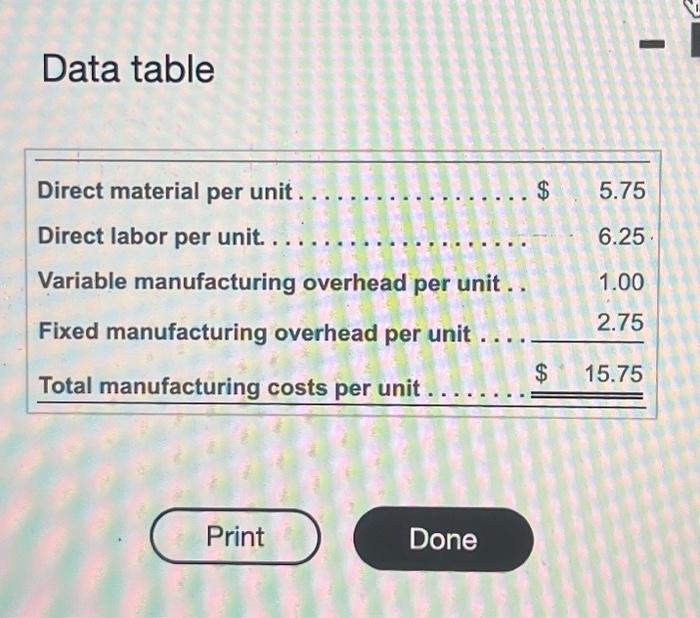

Each morning, Larry Smith stocks the drink case at Larry's Beach Hut in Virginia Beach, Virginia. Larry's Beach Hut has 115 linear feet of refrigerated display space for cold drinks. Each linear foot can hold either six 12-ounce cans or four 20-ounce plastic or glass bottles. (Click the icon to view the information on the cold drinks.) The beverage stand can sell all drinks stocked in the display case each morning. Read the requirements. Complete the product mix analysis to determine which product would maximize Larry's profits. Requirements 1. What is the constraining factor at Larry's BeachHut? What should Larry stock to maximize profits? What is the maximum contribution margin he could generate from refrigerated drinks each day? 2. To provide variety to customers, suppose Larry refuses to devote more than 75 linear feet and no less than 5 linear feet to any individual product. Under this condition, how many linear feet of each drink should be stocked? How many units of each product will be available for sale each day? 3. Assuming the product mix calculated in Requirement 2, what contribution margin will be generated from refrigerated drinks each day? Savoy Enterprises manufactures one of the components used to assemble its main company product. Specialty Products, Inc., has offered to make the component at a cost of $12.60 per unit. Savoy Enterprises' current cost is $15.75 per unit of the component, based on the 120,000 components that Savoy Enterprises currently produces. Read the requirements. This current cost per unit is based on the following calculations: (Click the icon to view the information.) None of Savoy Enterprises' fixed costs will be eliminated if the component is outsourced. However, the freed capacity could be used to build a new product. This new product Requirement 1. If Savoy Enterprises outsources the manufacturing of the component, will operating income increase or decrease? By how tnuch? (Enter a "0" for any zero balances. Use a minus sign or parentheses in the Difference column when the cost to make exceeds the cost to buy.) 1. If Savoy Enterprises outsources the manifacturing of the component, will operating income increase or decrease? By how much? 2. What is the maximum price per unit Savoy Enterprises would be willing to pay if it outsources the component? Data table