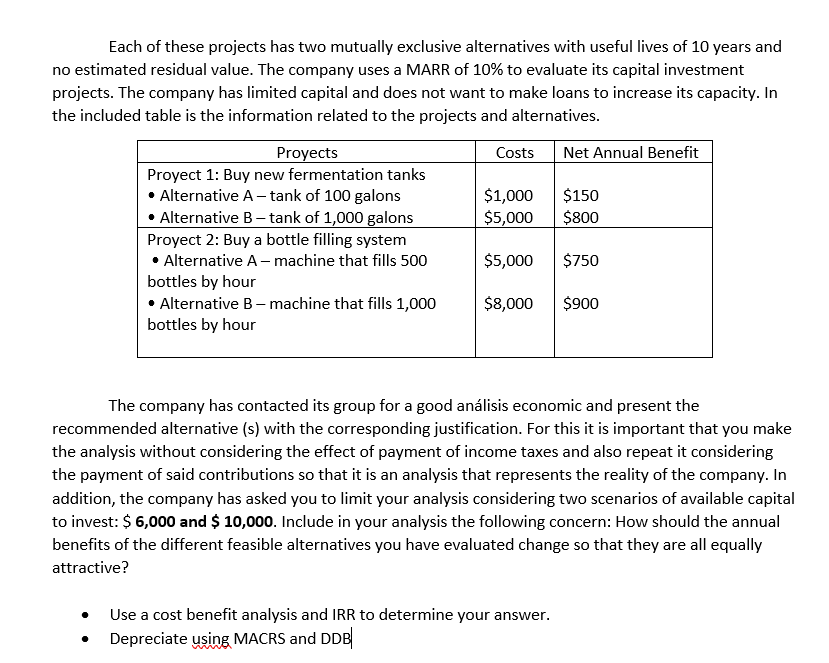

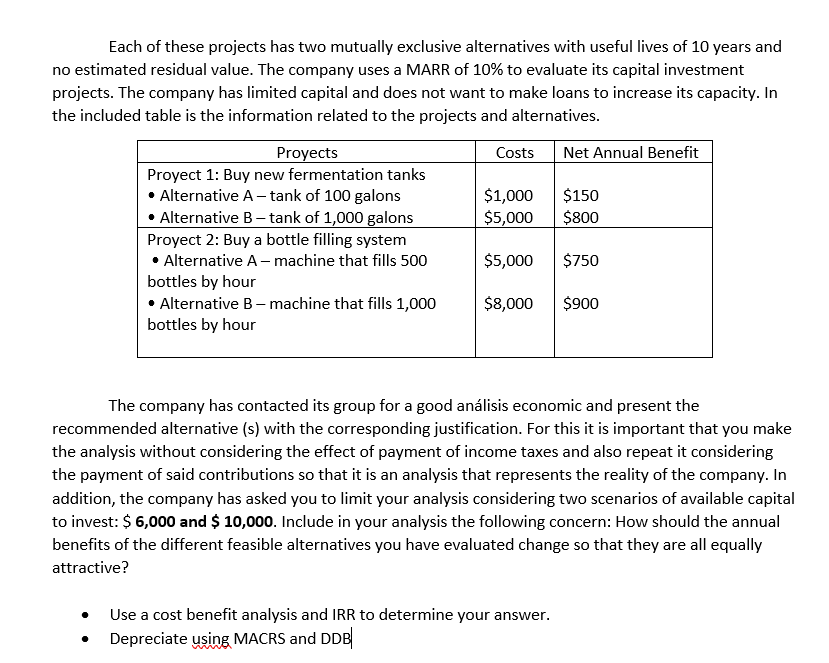

Each of these projects has two mutually exclusive alternatives with useful lives of 10 years and no estimated residual value. The company uses a MARR of 10% to evaluate its capital investment projects. The company has limited capital and does not want to make loans to increase its capacity. In the included table is the information related to the projects and alternatives. Proyects Costs Net Annual Benefit Proyect 1: Buy new fermentation tanks Alternative A-tank of 100 galons $1,000 $150 Alternative B-tank of 1,000 galons $5,000 $800 Proyect 2: Buy a bottle filling system Alternative A-machine that fills 500 $5,000 $750 bottles by hour Alternative B-machine that fills 1,000 $8,000 $900 bottles by hour The company has contacted its group for a good anlisis economic and present the recommended alternative (s) with the corresponding justification. For this it is important that you make the analysis without considering the effect of payment of income taxes and also repeat it considering the payment of said contributions so that it is an analysis that represents the reality of the company. In addition, the company has asked you to limit your analysis considering two scenarios of available capital to invest: $ 6,000 and $ 10,000. Include in your analysis the following concern: How should the annual benefits of the different feasible alternatives you have evaluated change so that they are all equally attractive? Use a cost benefit analysis and IRR to determine your answer. Depreciate using MACRS and DDB Each of these projects has two mutually exclusive alternatives with useful lives of 10 years and no estimated residual value. The company uses a MARR of 10% to evaluate its capital investment projects. The company has limited capital and does not want to make loans to increase its capacity. In the included table is the information related to the projects and alternatives. Proyects Costs Net Annual Benefit Proyect 1: Buy new fermentation tanks Alternative A-tank of 100 galons $1,000 $150 Alternative B-tank of 1,000 galons $5,000 $800 Proyect 2: Buy a bottle filling system Alternative A-machine that fills 500 $5,000 $750 bottles by hour Alternative B-machine that fills 1,000 $8,000 $900 bottles by hour The company has contacted its group for a good anlisis economic and present the recommended alternative (s) with the corresponding justification. For this it is important that you make the analysis without considering the effect of payment of income taxes and also repeat it considering the payment of said contributions so that it is an analysis that represents the reality of the company. In addition, the company has asked you to limit your analysis considering two scenarios of available capital to invest: $ 6,000 and $ 10,000. Include in your analysis the following concern: How should the annual benefits of the different feasible alternatives you have evaluated change so that they are all equally attractive? Use a cost benefit analysis and IRR to determine your answer. Depreciate using MACRS and DDB