Answered step by step

Verified Expert Solution

Question

1 Approved Answer

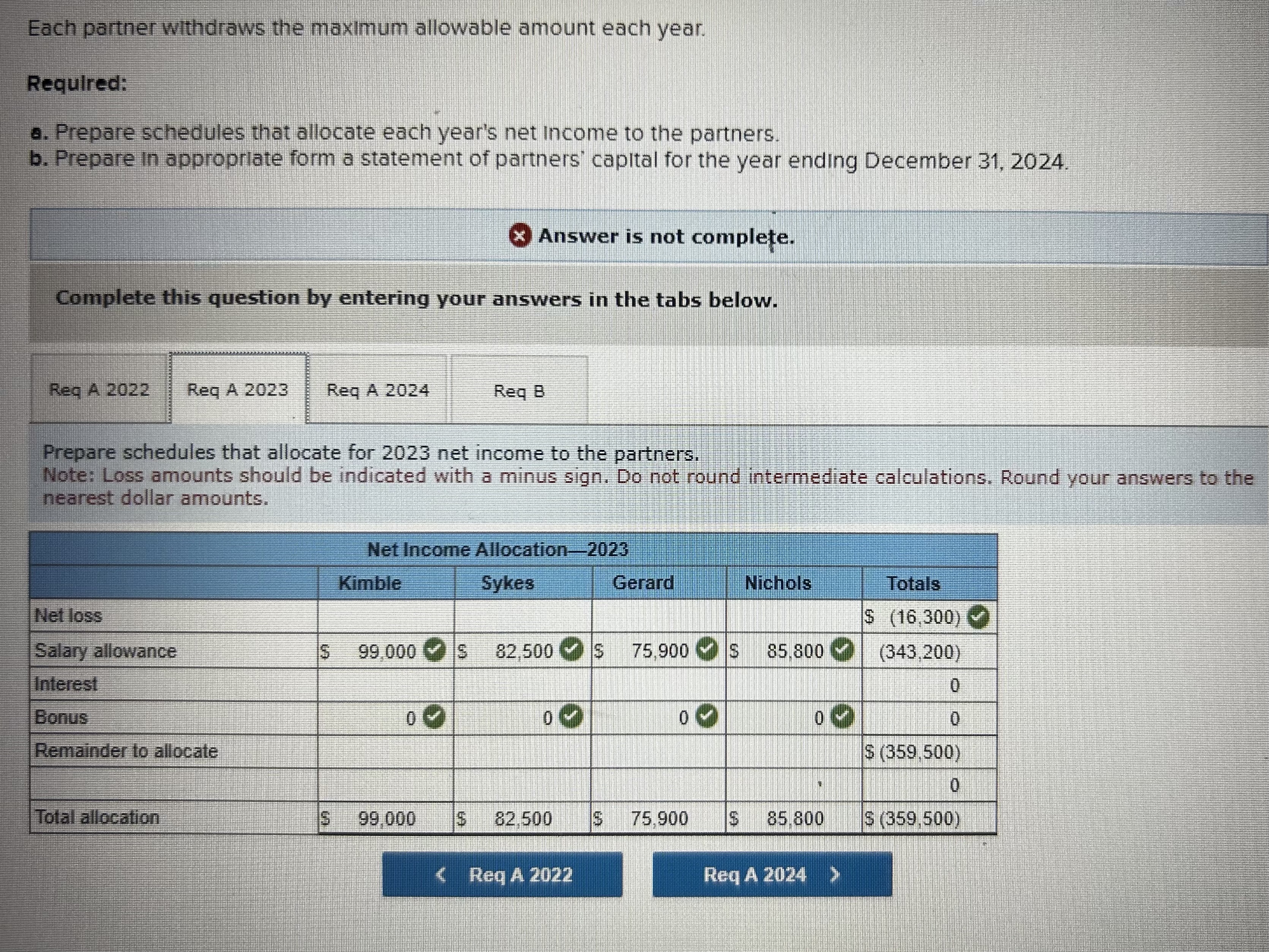

Each partner withdraws the maximum allowable amount each year. Required: a. Prepare schedules that allocate each year's net income to the partners. b. Prepare

Each partner withdraws the maximum allowable amount each year. Required: a. Prepare schedules that allocate each year's net income to the partners. b. Prepare in appropriate form a statement of partners' capital for the year ending December 31, 2024. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg A 2022 Req A 2023 Req A 2024 Req B Prepare schedules that allocate for 2023 net income to the partners. Note: Loss amounts should be indicated with a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar amounts. Net Income Allocation-2023 Kimble Sykes Gerard Nichols Totals Net loss Salary allowance S 99.000 S 82,500 s 75,900 S $ (16,300) 85,800 (343,200) Interest 0 Bonus 0 0 M 0 0 Remainder to allocate $ (359.500) N 0 Total allocation S 99,000 69 82.500 $ 75.900 $ 85.800 $ (359.500)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started