Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each question can have multiple answers 1. Which of the following statement(s) is(are) true regarding the replicating portfolio of a call stock option: a. For

Each question can have multiple answers

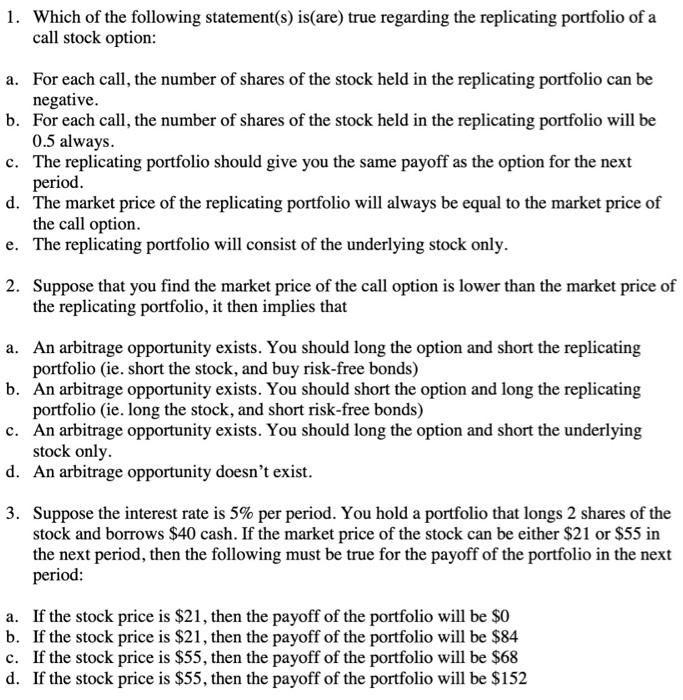

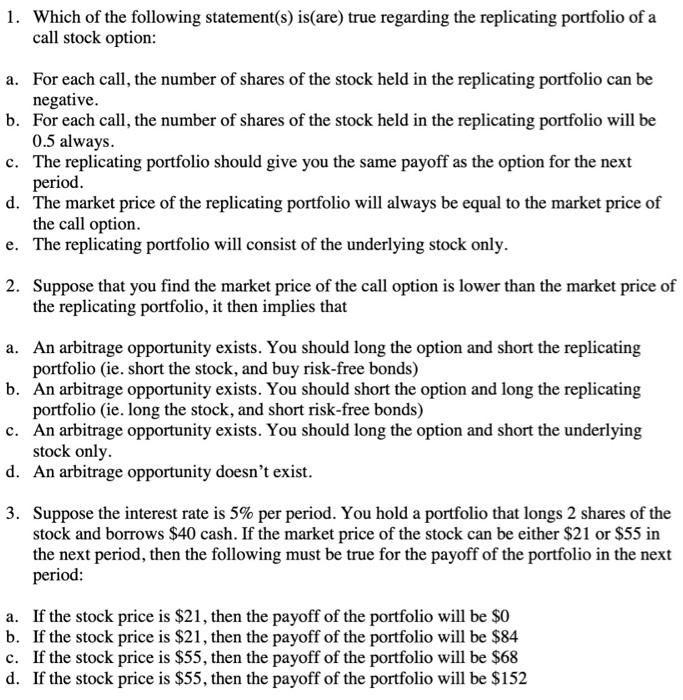

1. Which of the following statement(s) is(are) true regarding the replicating portfolio of a call stock option: a. For each call, the number of shares of the stock held in the replicating portfolio can be negative. b. For each call, the number of shares of the stock held in the replicating portfolio will be 0.5 always. c. The replicating portfolio should give you the same payoff as the option for the next period. d. The market price of the replicating portfolio will always be equal to the market price of the call option e. The replicating portfolio will consist of the underlying stock only. 2. Suppose that you find the market price of the call option is lower than the market price of the replicating portfolio, it then implies that a. An arbitrage opportunity exists. You should long the option and short the replicating portfolio (ie. short the stock, and buy risk-free bonds) b. An arbitrage opportunity exists. You should short the option and long the replicating portfolio (ie. long the stock, and short risk-free bonds) c. An arbitrage opportunity exists. You should long the option and short the underlying stock only. d. An arbitrage opportunity doesn't exist. 3. Suppose the interest rate is 5% per period. You hold a portfolio that longs 2 shares of the stock and borrows $40 cash. If the market price of the stock can be either $21 or $55 in the next period, then the following must be true for the payoff of the portfolio in the next period: a. If the stock price is $21, then the payoff of the portfolio will be $0 b. If the stock price is $21, then the payoff of the portfolio will be $84 c. If the stock price is $55, then the payoff of the portfolio will be $68 d. If the stock price is $55, then the payoff of the portfolio will be $152

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started