Question

Each question refers to the same initial data. Treat each question separately. Ignore income taxes. Assume no beginning or ending inventories. Calculations and backup should

Each question refers to the same initial data. Treat each question separately. Ignore income taxes. Assume no beginning or ending inventories. Calculations and backup should be completed and submitted in Excel. Use proper Contribution Income Statement formatting. Analysis can either be typed into cells in Excel (formatted to be easily legible) or typed into a text box in Excel.

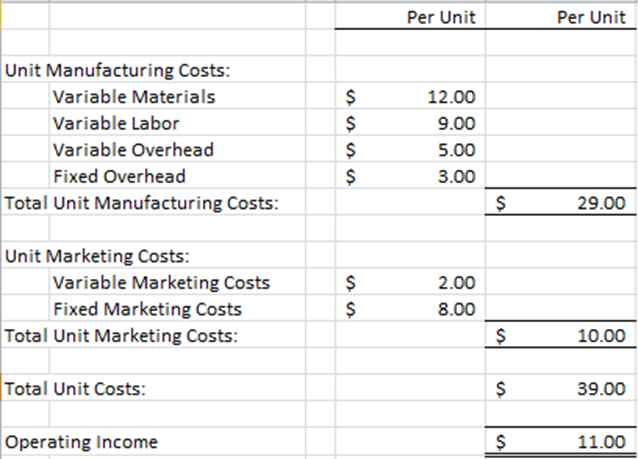

Data for all questions: Panalon produces cast iron dutch ovens (a deep pot with a lid that can be used on a stovetop or in the oven). Their pots are sold at many local department stores. The cost of manufacturing and marketing their pots, at their normal factory volume of 5,000 pots per month, is shown in the table below. These pots sell for $50 each. Panalon is making a small profit, but would prefer to increase profitability.

(Note: Fixed costs are shown on a per-unit basis in the table based on normal volume. However, fixed costs as a total do not change when volume changes, so you will need to determine total fixed costs first.)

Question 2: A kitchen-goods chain has offered to purchase 4,000 pots (one time in one month) if the sales price was lowered to $40 per pot. Panalons maximum capacity is 8,000 units. A) Based on the cost data provided, what would be the impact of the price decrease on sales, costs, and operating income if Panalon accepted this sale? Use a contribution margin income statement to show your results. B) Do you think Panalon should accept this sale? Support your decision with evidence and analysis.

Question 3: Market research has shown that enameled pans are selling well. Panalon would be able to produce an enameled dutch oven by putting a special coating on their existing pots. This would increase fixed overhead costs by $40,000 per month (still based on normal production volume of 5,000 units). The variable materials costs (only variable material costs not all variable costs) for the enameled pots would also be double the cost of the variable materials for the regular pots (to account for the coating). Maximum production for both types of pots together would still be 8,000 units because the same production lines would be used. The enameled pots would sell for $75 each. A) What would be the break-even point if Panalon only sold enameled pots? (In units and sales dollars) B) Create a contribution income statement for a month in which Panalon sold 2,500 regular pots, and 3,500 enameled pots. C) Explain, in your own words, how the changes to fixed and variable costs for the enameled pots impact profitability.

Per Unit Per Unit Unit Manufacturing Costs: Variable Materials Variable Labor Variable Overhead Fixed Overhead 12.00 9.00 5.00 3.00 Total Unit Manufacturing Costs 29.00 Unit Marketing Costs Variable Marketing Costs Fixed Marketing Costs 2.00 8.00 Total Unit Marketing Costs 10.00 Total Unit Costs: 39.00 Operating Income 11.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started