Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each year Briggs & Stratton (producer of gasoline engines) estimates its own company- wide weighted average cost of capital. In 2001, it based its

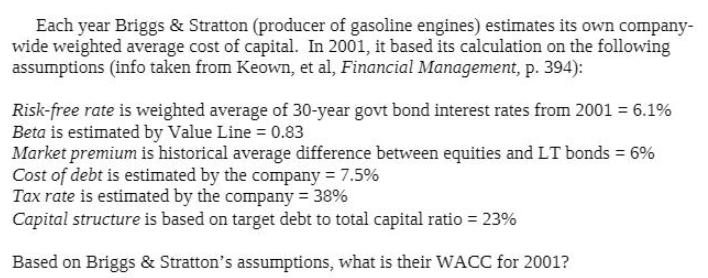

Each year Briggs & Stratton (producer of gasoline engines) estimates its own company- wide weighted average cost of capital. In 2001, it based its calculation on the following assumptions (info taken from Keown, et al, Financial Management, p. 394): Risk-free rate is weighted average of 30-year govt bond interest rates from 2001 = 6.1% Beta is estimated by Value Line = 0.83 Market premium is historical average difference between equities and LT bonds = 6% Cost of debt is estimated by the company = 7.5% Tax rate is estimated by the company = 38% Capital structure is based on target debt to total capital ratio = 23% Based on Briggs & Stratton's assumptions, what is their WACC for 2001?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here Risk free rate Rf 61 Beta of stock 083 Market risk premium MRp 6 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started