Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each year, the federal Finance Minister, currently James M. Flaherty presents the budget that carries Canadians into the new year. This following exercise is

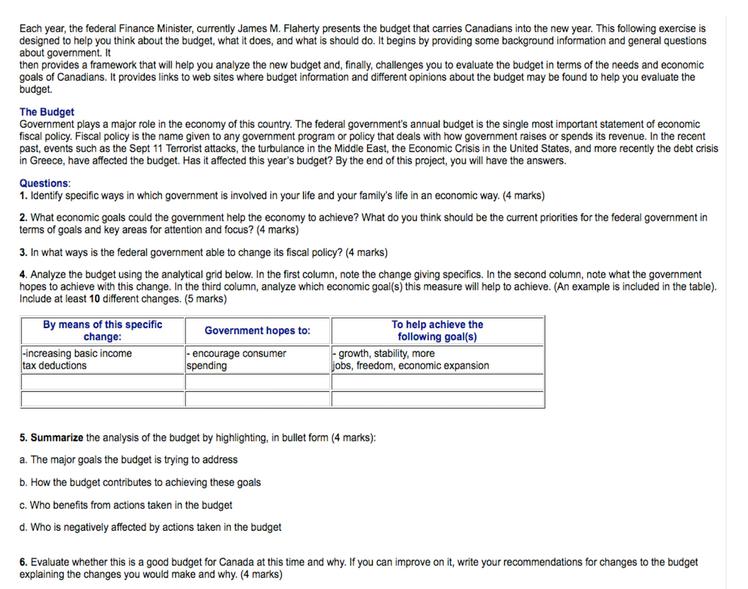

Each year, the federal Finance Minister, currently James M. Flaherty presents the budget that carries Canadians into the new year. This following exercise is designed to help you think about the budget, what it does, and what is should do. It begins by providing some background information and general questions about government. It then provides a framework that will help you analyze the new budget and, finally, challenges you to evaluate the budget in terms of the needs and economic goals of Canadians. It provides links to web sites where budget information and different opinions about the budget may be found to help you evaluate the budget. The Budget Government plays a major role in the economy of this country. The federal government's annual budget is the single most important statement of economic fiscal policy. Fiscal policy is the name given to any government program or policy that deals with how government raises or spends its revenue. In the recent past, events such as the Sept 11 Terrorist attacks, the turbulance in the Middle East, the Economic Crisis in the United States, and more recently the debt crisis in Greece, have affected the budget. Has it affected this year's budget? By the end of this project, you will have the answers. Questions: 1. Identify specific ways in which government is involved in your life and your family's life in an economic way. (4 marks) 2. What economic goals could the government help the economy to achieve? What do you think should be the current priorities for the federal government in terms of goals and key areas for attention and focus? (4 marks) 3. In what ways is the federal government able to change its fiscal policy? (4 marks) 4. Analyze the budget using the analytical grid below. In the first column, note the change giving specifics. In the second column, note what the government hopes to achieve with this change. In the third column, analyze which economic goal(s) this measure will help to achieve. (An example is included in the table). Include at least 10 different changes. (5 marks) By means of this specific change: -increasing basic income tax deductions Government hopes to: encourage consumer spending To help achieve the following goal(s) growth, stability, more jobs, freedom, economic expansion 5. Summarize the analysis of the budget by highlighting, in bullet form (4 marks): a. The major goals the budget is trying to address b. How the budget contributes to achieving these goals c. Who benefits from actions taken in the budget d. Who is negatively affected by actions taken in the budget 6. Evaluate whether this is a good budget for Canada at this time and why. If you can improve on it, write your recommendations for changes to the budget explaining the changes you would make and why. (4 marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Government involvement in economic aspects of life Provision of public education and healthcare services Implementation of tax policies affecting income and consumption Regulation of industries and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started