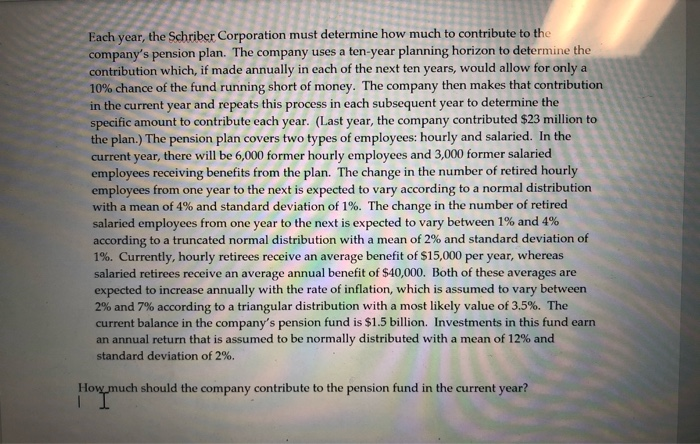

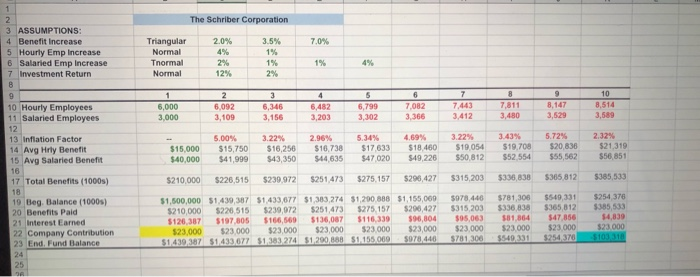

Each year, the Schriber Corporation must determine how much to contribute to the company's pension plan. The company uses a ten-year planning horizon to determine the contribution which, if made annually in each of the next ten years, would allow for only a 10% chance of the fund running short of money. The company then makes that contribution in the current year and repeats this process in each subsequent year to determine the specific amount to contribute each year. (Last year, the company contributed $23 million to the plan.) The pension plan covers two types of employees: hourly and salaried. In the current year, there will be 6,000 former hourly employees and 3,000 former salaried employees receiving benefits from the plan. The change in the number of retired hourly employees from one year to the next is expected to vary according to a normal distribution with a mean of 4% and standard deviation of 1%. The change in the number of retired salaried employees from one year to the next is expected to vary between 1% and 4% according to a truncated normal distribution with a mean of 2% and standard deviation of 1%. Currently, hourly retirees receive an average benefit of $15,000 per year, whereas salaried retirees receive an average annual benefit of $40,000. Both of these averages are expected to increase annually with the rate of inflation, which is assumed to vary between 2% and 7% according to a triangular distribution with a most likely value of 3.5%. The current balance in the company's pension fund is $1.5 billion. Investments in this fund earn an annual return that is assumed to be normally distributed with a mean of 12% and standard deviation of 2%. How much should the company contribute to the pension fund in the current year? The Schriber Corporation 20% 7.0% 3 ASSUMPTIONS: 4 Benefit increase 5 Hourly Emp Increase 6 Salaried Emp Increase 7 Investment Return Triangular Normal Tnormal Normal 12% 7 8 9 6 76082 10 Hourly Employees 11 Salaried Employees 6,000 3.000 6.092 3.109 6,346 3.156 5 6.799 3,302 6.482 3.203 10 8.514 3,589 5.00% 13 Inflation Factor 14 Avg Hrly Benefit 15 Avg Salaried Benefit 3.22% $16.250 $43,350 5.30% 2.96% $16.738 $44 635 5.34% $17.633 $47 020 $15.000 $40,000 4,80% $15.750 $41,999 4,69% $18.460 $49,226 3,32 10.70 3.43% $19.708 552 554 19 054 $50.812 5.72% $20.838 555,562 2.32% $21.319 $56.851 17 Total Benefits (1000) 5210,000 $226,515 $239,972 $251,473 $275,157 $296,427 $315,203 $330,830 $365,812 $385,533 19 Beg Balance (1000) 20 Benefits Paid 21 Interest Earned 22 Company Contribution 23 End Fund Balance $1,500,000 $1.439 387 51 433 677 $1383 274 $1,200 388 $210.000 5220 515 5239 072 $251.473 $275.157 5126 387 5197 505 5166,569 $136,087 $116.339 523000 23000 23000 23000 23000 514303871433 677 $1.383 274 $1.290 888 51,155 000 51,155,069 $200,427 596,804 23000 $078.440 5978 440 5781,300 $315 2035336 335 05 063 381 64 23000 23000 781 300 $540.331 $500 331 3365 812 47 856 23000 254.376 5254 378 15.513 14.839 Each year, the Schriber Corporation must determine how much to contribute to the company's pension plan. The company uses a ten-year planning horizon to determine the contribution which, if made annually in each of the next ten years, would allow for only a 10% chance of the fund running short of money. The company then makes that contribution in the current year and repeats this process in each subsequent year to determine the specific amount to contribute each year. (Last year, the company contributed $23 million to the plan.) The pension plan covers two types of employees: hourly and salaried. In the current year, there will be 6,000 former hourly employees and 3,000 former salaried employees receiving benefits from the plan. The change in the number of retired hourly employees from one year to the next is expected to vary according to a normal distribution with a mean of 4% and standard deviation of 1%. The change in the number of retired salaried employees from one year to the next is expected to vary between 1% and 4% according to a truncated normal distribution with a mean of 2% and standard deviation of 1%. Currently, hourly retirees receive an average benefit of $15,000 per year, whereas salaried retirees receive an average annual benefit of $40,000. Both of these averages are expected to increase annually with the rate of inflation, which is assumed to vary between 2% and 7% according to a triangular distribution with a most likely value of 3.5%. The current balance in the company's pension fund is $1.5 billion. Investments in this fund earn an annual return that is assumed to be normally distributed with a mean of 12% and standard deviation of 2%. How much should the company contribute to the pension fund in the current year? The Schriber Corporation 20% 7.0% 3 ASSUMPTIONS: 4 Benefit increase 5 Hourly Emp Increase 6 Salaried Emp Increase 7 Investment Return Triangular Normal Tnormal Normal 12% 7 8 9 6 76082 10 Hourly Employees 11 Salaried Employees 6,000 3.000 6.092 3.109 6,346 3.156 5 6.799 3,302 6.482 3.203 10 8.514 3,589 5.00% 13 Inflation Factor 14 Avg Hrly Benefit 15 Avg Salaried Benefit 3.22% $16.250 $43,350 5.30% 2.96% $16.738 $44 635 5.34% $17.633 $47 020 $15.000 $40,000 4,80% $15.750 $41,999 4,69% $18.460 $49,226 3,32 10.70 3.43% $19.708 552 554 19 054 $50.812 5.72% $20.838 555,562 2.32% $21.319 $56.851 17 Total Benefits (1000) 5210,000 $226,515 $239,972 $251,473 $275,157 $296,427 $315,203 $330,830 $365,812 $385,533 19 Beg Balance (1000) 20 Benefits Paid 21 Interest Earned 22 Company Contribution 23 End Fund Balance $1,500,000 $1.439 387 51 433 677 $1383 274 $1,200 388 $210.000 5220 515 5239 072 $251.473 $275.157 5126 387 5197 505 5166,569 $136,087 $116.339 523000 23000 23000 23000 23000 514303871433 677 $1.383 274 $1.290 888 51,155 000 51,155,069 $200,427 596,804 23000 $078.440 5978 440 5781,300 $315 2035336 335 05 063 381 64 23000 23000 781 300 $540.331 $500 331 3365 812 47 856 23000 254.376 5254 378 15.513 14.839