Question

1. Eagle Corp. is a calendar-year corporation whose financial statements for 2019 and 2020 included errors as follows: Year Ending Inventory Depreciation Expense 2019 $36,000

1. Eagle Corp. is a calendar-year corporation whose financial statements for 2019 and 2020 included errors as follows:

| Year | Ending Inventory | Depreciation Expense | |

| 2019 | $36,000 overstated | $30,000 overstated | |

| 2020 | 12,000 understated | 10,000 understated |

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2019 or December 31, 2020. Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2021?

A) $4000 decrease

B) $8000 increase

C) $2000 increase

D) $32,000 increase

2.

3. The cash provided by (used in) financing activities for 2020 was (related to question above)

$(250,000). |

$12,500. |

$100,000. |

$(225,000). |

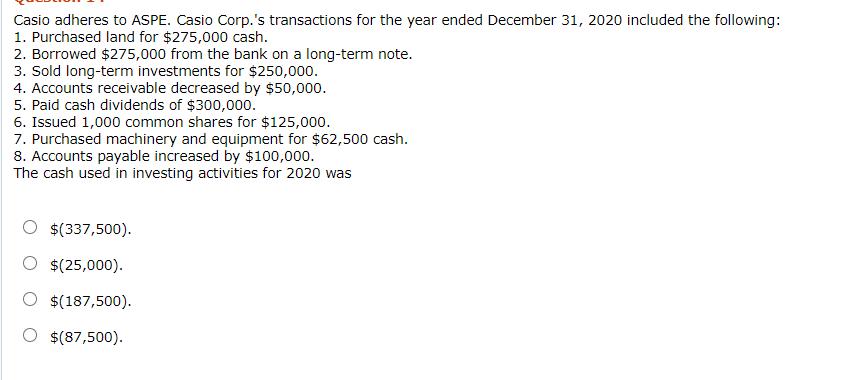

Casio adheres to ASPE. Casio Corp.'s transactions for the year ended December 31, 2020 included the following: 1. Purchased land for $275,000 cash. 2. Borrowed $275,000 from the bank on a long-term note. 3. Sold long-term investments for $250,000. 4. Accounts receivable decreased by $50,000. 5. Paid cash dividends of $300,000. 6. Issued 1,000 common shares for $125,000. 7. Purchased machinery and equipment for $62,500 cash. 8. Accounts payable increased by $100,000. The cash used in investing activities for 2020 was O $(337,500). $(25,000). O $(187,500). $(87,500).

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started