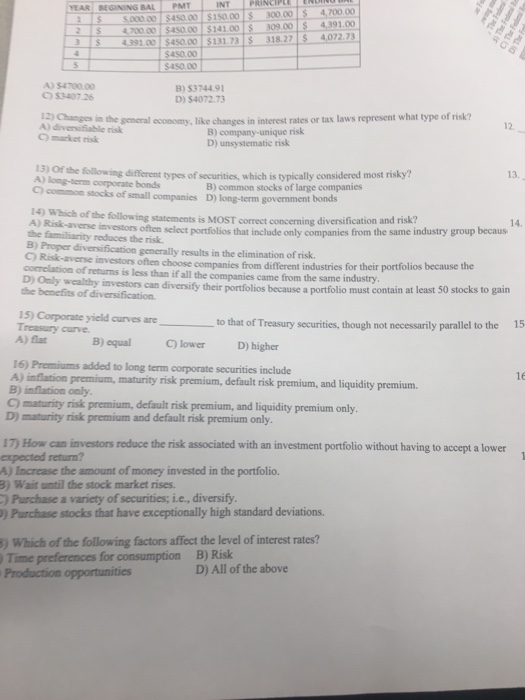

EAR BEGINING BALPMT INT PRINCIPED IB Soco.00:$45000|$150.cols300.00 ls47000015450001$ 14100Ls 309.001 -4,391.00 31$ 4391 00 l $45000 $131 73s-318.271. 407am $ 4,072.73 $450.00 $450.00 A) $4700.00 $3407.2 )$3744.91 D) $4072.73 2) Changes in the general economy A) divensifiable economy, like changes in interest rates or tax laws represent what type of risk? 12. A) diversifiable risk C) market risk B) company-unique risk D) unsystematic risk 13) Of the following different types of securities, which is typically considered most risky? 13, A) long-term corporate bonds C) common stocks of small companies D) long-term government B) common stocks of large companies 14) Which of the following statements is MOST A) Risi-averse investors often select portfiolios that include only companies from correct concerning diversification and risk? the familiarity reduces the risk the same industry group becaus B) Proper diversification generally results in the elimination of risk C) Risk-averse investors often choose companies from different industries correlation of returns is less than if all the companies came from the same industry. for their portfolios because the D) Obly wealthy investos can diversify their portfolios because a portfolio must contan the benefits of diversification at least 50 stocks to gain 15) Corporate yield curves are Treasury curve to that of Treasury securities, though not necessarily parallel to the 15 A) flat B) equalC) lower D) higher 16) Premiums added to long term corporate securities include A) inflation premium, maturity risk premium, default risk premium, and liquidity premium. B) inflation only C) maturity risk premium, default risk premium, and liquidity premium only 16 D) maturity risk premium and default risk premium only 17) How can investors reduce the risk associated with an investment portfolio without having to accept a lower expected return? 4) Increase the amount of money invested in the portfolio. 3) Wait until the stock market rises. Purchase a variety of securities; ie., diversify ) Purchase stocks that have exceptionally high standard deviations. ) Which of the following factors affect the level of interest rates? preferences for consumption B) Risk D) All of the above Time