Question

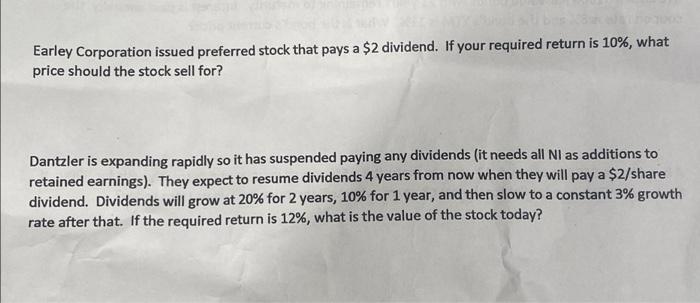

Earley Corporation issued preferred stock that pays a $2 dividend. If your required return is 10%, what price should the stock sell for? Dantzler

Earley Corporation issued preferred stock that pays a $2 dividend. If your required return is 10%, what price should the stock sell for? Dantzler is expanding rapidly so it has suspended paying any dividends (it needs all NI as additions to retained earnings). They expect to resume dividends 4 years from now when they will pay a $2/share dividend. Dividends will grow at 20% for 2 years, 10% for 1 year, and then slow to a constant 3% growth rate after that. If the required return is 12%, what is the value of the stock today?

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Dividend A dividend is a distribution of profits by a corporation t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

4th Edition

1439078084, 978-1439078082

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App