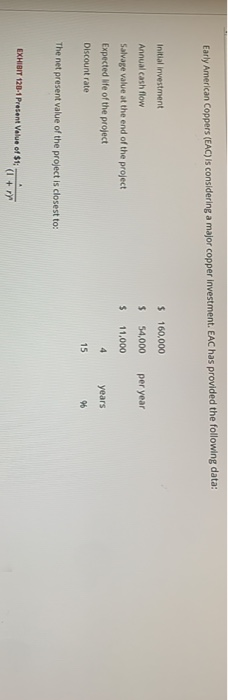

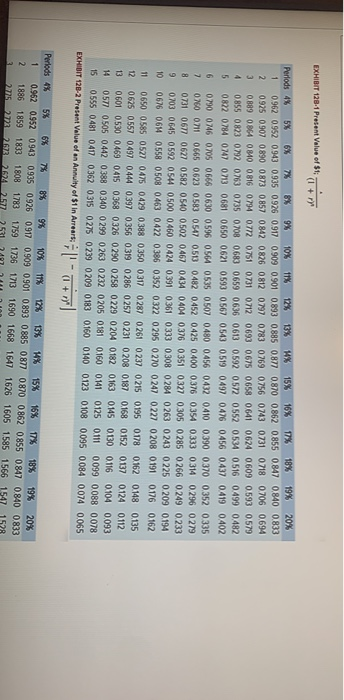

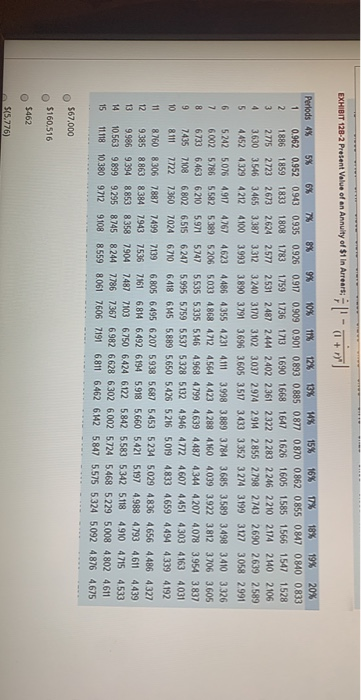

Early American Coppers (EAC) is considering a major copper investment. EAC has provided the following data: Initial investment $ 160,000 Annual cash flow 54,000 per year $ $ 11,000 Salvage value at the end of the project Expected We of the project Discount rate 4 years 15 06 The net present value of the project is closest to: EXHIT 120-1 Present Value of St + EXHIBIT 128:1 Present Value of $1; (1 + ry Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 9% 15% 16% 17% 18% 19% 20% 0962 0952 0943 0935 0.926 0917 0909 0901 0893 0885 0.877 0.870 0862 0855 0.847 0.840 0.833 2 0925 0.907 0890 0873 0857 0842 0.826 0.812 0797 0.783 0769 0.756 0743 0731 0718 0706 0.694 0.889 0964 080 0816 0794 072 0751 0731 0712 0.693 0.675 0.658 0641 0624 0.609 0.593 0.579 0855 0823 0792 0763 0735 0708 0683 0659 0636 0613 0.592 0572 0552 0534 0.516 0499 0.482 5 0822 0784 0747 0713 0681 0650 0621 0593 0567 0543 0.519 0497 0.476 0456 0437 0.419 0402 6 0790 076 0705 0666 0630 059 0564 053 0507 0480 0456 0432 0410 0.390 0.370 0352 0335 70360 071 0665 0623 0583 0547 0.50 0482 0.452 0425 0.400 0.376 0.354 0.333 0314 0.296 0 279 8 0731 06770627 05820540 0.502 0.467 0.434 0404 0376 0351 0327 0305 0285 0 266 0249 0233 07030645 0592 054 0500 0.460 0424 0391 0361 0333 0.308 0284 0263 0243 0225 0209 0.194 10 0676 064 0.558 0508 0463 0422 0386 0352 0322 0295 0 270 0247 0227 0208 0191 0176 0162 11 0650 0585 0527 0475 0429 0.388 0.350 0.317 0287 0.261 0237 0.215 0195 0178 0162 0.148 0.135 12 0625 0557 0.497 0.444 0.397 0356 0319 0286 0257 0231 0208 0.187 0168 0152 0.137 0124 0.112 13 0.601 0.530 0469 0415 0368 0326 0.290 0258 0229 0204 0182 0163 0.145 0130 0.116 0104 0.093 14 0571 0505 0442 0388 0340 0299 0263 0232 0205 0.181 0.160 0.11 0.125 0.111 0099 0.088 0.078 15 0555 0.481 0.417 0362 0.315 0275 0239 0209 0183 0160 0.140 0.123 0108 0.095 0.084 0.074 0.065 BHD 128-2 Present Value of an Annuity of $1 in Areers |-+| Perlods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% % 15% 16% 17% 18% 19% 20% 0.962 0.952 0943 0935 0926 0917 0.909 0901 0.893 0885 0877 0.870 0862 0855 0.847 0.840 0833 1886 1859 1833 1808 1783 1759 1736 173 1690 1668 1647 1626 1605 1585 1566 154 27725 277226722524277 2 EXHIBIT 128-2 Present Value of an Annuity of $1 in Arrears: **|- + 5 6 Periods 4% 5% 6% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 0.962 0.952 0943 0935 0.926 0917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0847 0.840 0.833 1886 1859 1833 1808 1783 1759 1736 1713 1690 1668 1647 1626 1605 1585 1566 1547 1528 3 2.775 2723 2673 2624 2577 2531 2487 2444 2402 2361 2322 2283 2246 2210 2174 210 2106 3.630 3.546 34653387 3312 3240 31703102 3037 2974 2914 2855 2798 2743 2690 2639 2589 4452 4329 422 4100 3993 3890 3791 3.696 3.605 3.517 3433 3352 3274 3199 3127 3.058 2.991 5242 5.076 4.917 4767 4623 4486 4355 4231 4111 3.998 3889 3.784 3685 3589 3.498 3410 3326 6.002 5786 5582 5389 5206 5.033 4868 4712 4564 4423 4288 4160 4039 3.922 3.812 37063605 8 6733 6.463 6210 5.971 57475.535 5335 5.16 4968 4799 4639 4487 4344 4207 4078 3.954 3837 7435 7108 6802 6.515 6247 5.995 5759 5.537 5328 5132 4946 4772 4607 4451 4303 4163 4031 10 8111 7722 7360 7024 6710 6.418 6145 5.889 5.650 5426 5216 5.019 4833 4659 4494 4339 4192 11 8760 8 306 7887 7499 7139 6.805 6.495 6207 5938 5.687 5453 5234 5.029 4836 4656 4.486 4327 12 93858.863 8 384 7943 7536 2161 6.814 6.492 6194 5918 5.660 5.421 5197 4988 4793 4.611 4439 13 9.986 9.394 8853 8358 7904 7487 7103 6.750 6.424 6122 5.842 5.583 5342 5118 4910 4715 4533 14 10.563 9899 9.295 8745 8244 7786 7367 6.982 6.628 632 6.002 5724 5.468 5229 5008 4.802 4611 15 11.118 10.3809712 9108 8559 8061 7606 7191 6811 6462 6.125.847 5575 5324 5.092 4876 4.675 9 567,000 $160,516 $462 $(5.776)