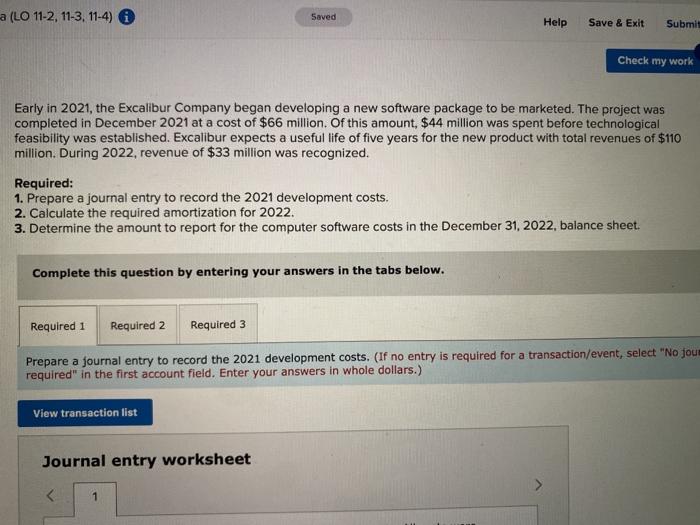

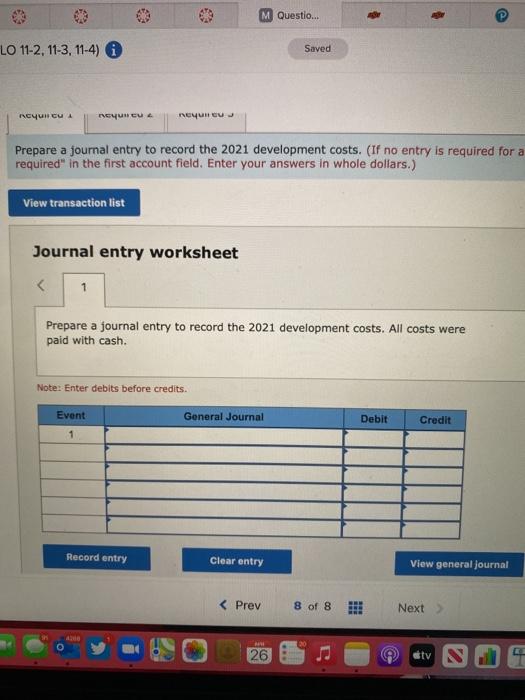

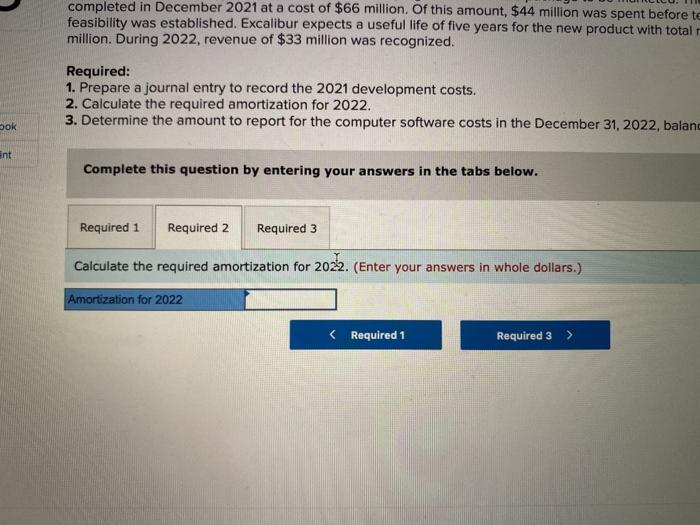

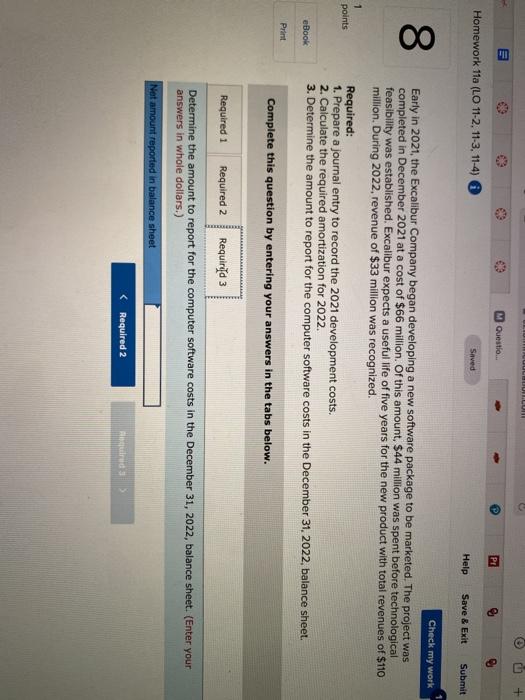

Early in 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $66 million. Of this amount, $44 million was spent before technological feasibility was established. Excalibur expects a useful life of five years for the new product with total revenues of $110 million. During 2022, revenue of $33 million was recognized.

Required: 1. Prepare a journal entry to record the 2021 development costs. 2. Calculate the required amortization for 2022. 3. Determine the amount to report for the computer software costs in the December 31, 2022, balance sheet.

a (LO 11-2, 11-3, 11-4) Saved Help Save & Exit Submit Check my work Early in 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $66 million. Of this amount, $44 million was spent before technological feasibility was established. Excalibur expects a useful life of five years for the new product with total revenues of $110 million. During 2022, revenue of $33 million was recognized. Required: 1. Prepare a journal entry to record the 2021 development costs. 2. Calculate the required amortization for 2022. 3. Determine the amount to report for the computer software costs in the December 31, 2022. balance sheet. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a journal entry to record the 2021 development costs. (If no entry is required for a transaction/event, select "No jou required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet 28 26 ev s completed in December 2021 at a cost of $66 million. Of this amount, $44 million was spent before te feasibility was established. Excalibur expects a useful life of five years for the new product with total million. During 2022, revenue of $33 million was recognized. Required: 1. Prepare a journal entry to record the 2021 development costs. 2. Calculate the required amortization for 2022. 3. Determine the amount to report for the computer software costs in the December 31, 2022, balanc Sok int Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the required amortization for 2022. (Enter your answers in whole dollars.) Amortization for 2022 HUILUN M Questio PE Homework 11a (LO 11-2, 11-3, 11-4) Saved Help Save & Exit Submit 8. Check my work Early in 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $66 million. Of this amount, $44 million was spent before technological feasibility was established. Excalibur expects a useful life of five years for the new product with total revenues of $110 million. During 2022, revenue of $33 million was recognized. Required: 1. Prepare a journal entry to record the 2021 development costs. 2. Calculate the required amortization for 2022. 3. Determine the amount to report for the computer software costs in the December 31, 2022, balance sheet. 1 points eBook Print Complete this question by entering your answers in the tabs below. Required 1 Required 2 Requirid 3 Determine the amount to report for the computer software costs in the December 31, 2022, balance sheet. (Enter your answers in whole dollars.) Net amount reported in balance sheet