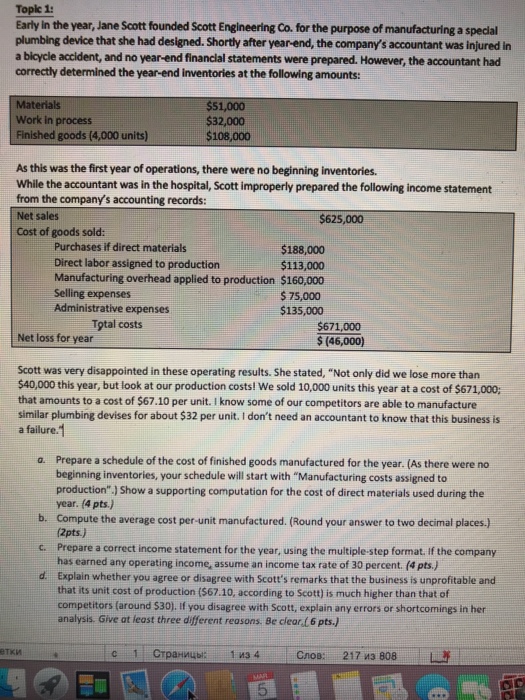

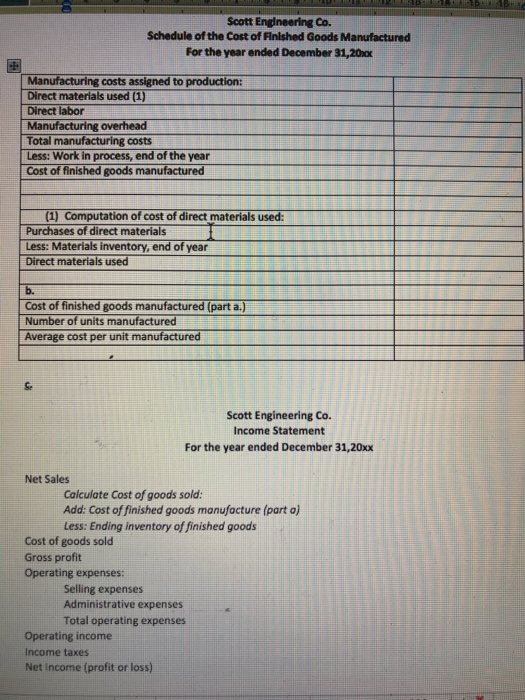

Early in the year, Jane Scott founded Scott Engineering Co. for the purpose of manufacturing a special plumbing device that she had designed. Shortly after year-end, the company's accountant was injured in a bioycle accident, and no year-end financial statements were prepared. However, the accountant had correctly determined the year-end inventories at the following amounts: terials Work in process Finished goods (4,000 units) $51,000 $32,000 $108,000 As this was the first year of operations, there were no beginning inventories. While the accountant was in the hospital, Scott improperly prepared the following income statement from the company's accounting records: Net sales Cost of goods sold: $625,000 Purchases if direct materials Direct labor assigned to production Manufacturing overhead applied to production Selling expenses Administrative expenses $188,000 $113,000 $160,000 $ 75,000 $135,000 Total costs $671,000 $(46,000) Net loss for year Scott was very disappointed in these operating results. She stated, "Not only did we lose more than $40,000 this year, but look at our production costs! We sold 10,000 units this year at a cost of $671,000 that amounts to a cost of $67.10 per unit. I know some of our competitors are able to manufacture similar plumbing devises for about $32 per unit. I don't need an accountant to know that this business is a failure.1 Prepare a schedule of the cost of finished goods manufactured for the year. (As there were no beginning inventories, your schedule will start with "Manufacturing costs assigned to production".] Show a supporting computation for the cost of direct materials used during the year. (4 pts) Compute the average cost per-unit manufactured. (Round your answer to two decimal places.) (2pts.) Prepare a correct income statement for the year, using the multiple-step format. if the company has earned any operating income, assume an income tax rate of 30 percent. (4 pts.) Explain whether you agree or disagree with Scott's remarks that the business is unprofitable and that its unit cost of production ($67.10, according to Scott) is much higher than that of competitors (around $30). If you disagree with Scott, explain any errors or shortcomings in her analysis. Give at least three different reasons. Be clear,L6 pts.) a. b. c. d